Covers: The Nation, Jacobin. Bylines: NYT, Nature, Bloomberg, BBC, Guardian, TIME, The Verge, Vox, Thomson Reuters Foundation, + others.

And if you made it this far, you should definitely subscribe to Obsolete, where I report on the economics+geopolitics of AI. (Been heads down on my book but will be back soon)

And if you made it this far, you should definitely subscribe to Obsolete, where I report on the economics+geopolitics of AI. (Been heads down on my book but will be back soon)

www.genaiforecon.org/ValueAGI.pdf

www.genaiforecon.org/ValueAGI.pdf

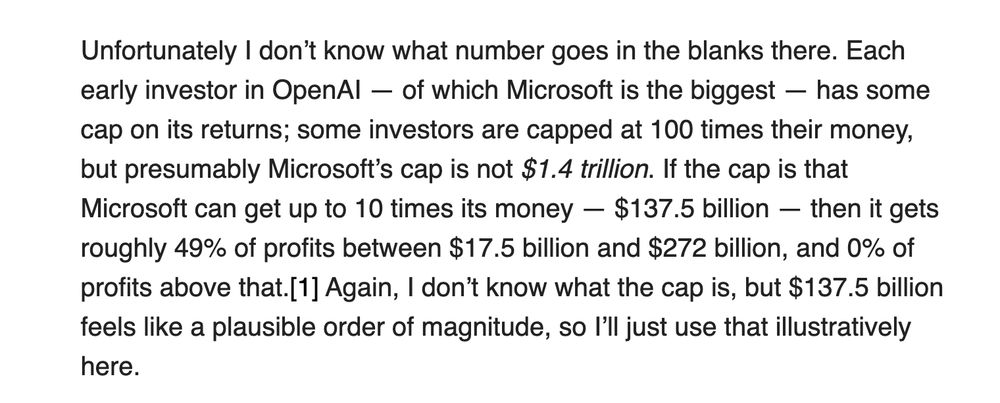

Obviously, this all depends on how well OAI actually does. But, the profit caps ONLY bite if OAI does very well.

Obviously, this all depends on how well OAI actually does. But, the profit caps ONLY bite if OAI does very well.

x.com/TheZvi/stat...

x.com/TheZvi/stat...

This is better than no profit caps and just the 26% stake, but still WAY worse than having the profit caps, at least in the worlds where OAI succeeds.

This is better than no profit caps and just the 26% stake, but still WAY worse than having the profit caps, at least in the worlds where OAI succeeds.

This plan does away with the caps.

This plan does away with the caps.

x.com/todor_m_mar...

x.com/todor_m_mar...

x.com/michaelhpag...

x.com/michaelhpag...