https://sites.utexas.edu/macro/

and even more details in the paper: academic.oup.com/restud/advan...

and even more details in the paper: academic.oup.com/restud/advan...

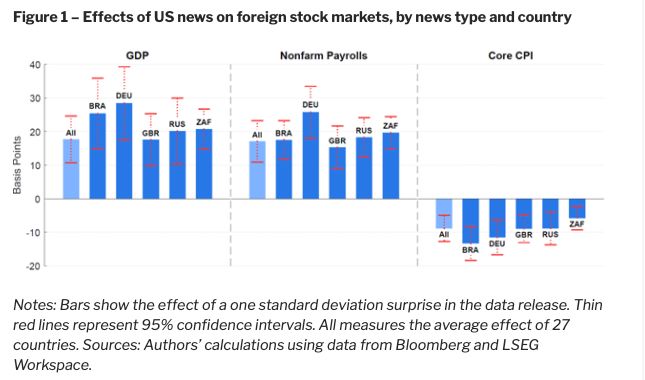

When bad news about the US economy becomes available, markets expect Fed to lower interest rates, which partially offsets the decline in stock markets and thus stabilizes asset markets and economy.

When bad news about the US economy becomes available, markets expect Fed to lower interest rates, which partially offsets the decline in stock markets and thus stabilizes asset markets and economy.

Flip side: bad news about the US economy can lead to a global stock market panic

Flip side: bad news about the US economy can lead to a global stock market panic

➡️ global stock prices rise after US macroeconomic news releases

➡️investors’ perceived risk and uncertainty falls

➡️ prices of relatively safe assets also fall

➡️ global stock prices rise after US macroeconomic news releases

➡️investors’ perceived risk and uncertainty falls

➡️ prices of relatively safe assets also fall

➡️ after US macroeconomic news releases, global stock prices respond immediately and in a synchronized way.

➡️ effects are large: Foreign countries’ stock prices respond with magnitudes similar to US stock market.

➡️ after US macroeconomic news releases, global stock prices respond immediately and in a synchronized way.

➡️ effects are large: Foreign countries’ stock prices respond with magnitudes similar to US stock market.

sites.utexas.edu/macro/2025/0...

Or in the full working paper: utexas.app.box.com/s/ht0ddytxfx...

Thank you for reading!

@utaustinecon.bsky.social

sites.utexas.edu/macro/2025/0...

Or in the full working paper: utexas.app.box.com/s/ht0ddytxfx...

Thank you for reading!

@utaustinecon.bsky.social