Science is one of the greatest things about our country. The current administration’s attacks on science are attacks on who we are as a nation.

Science is one of the greatest things about our country. The current administration’s attacks on science are attacks on who we are as a nation.

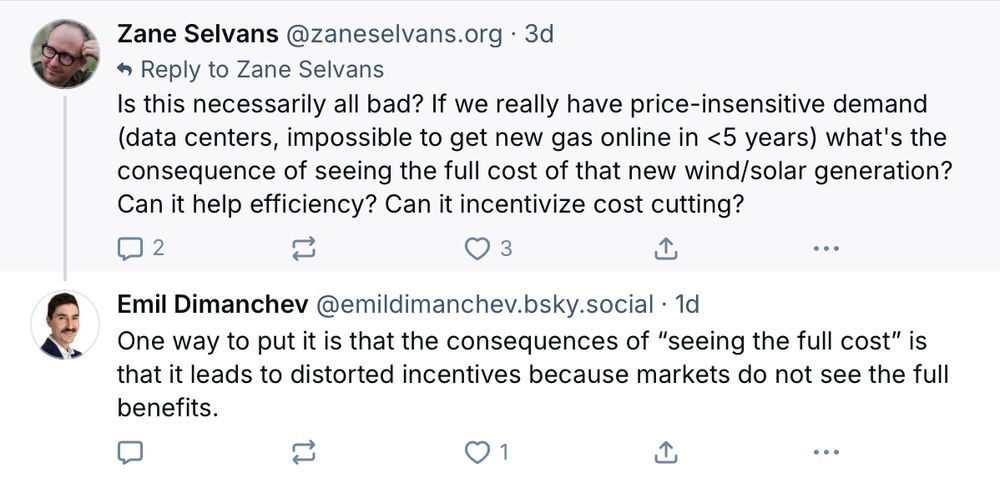

www.dr.dk/nyheder/vide... 🔌💡1/5

www.dr.dk/nyheder/vide... 🔌💡1/5

New report by Ecologic provides a good synthesis, and details ways to improve industrial policy in the EU. www.ecologic.eu/19908 #EnergySky #ClimateSky

New report by Ecologic provides a good synthesis, and details ways to improve industrial policy in the EU. www.ecologic.eu/19908 #EnergySky #ClimateSky

@donmackenzie.bsky.social would have insight to add here.

@donmackenzie.bsky.social would have insight to add here.