https://www.linkedin.com/in/econ-parker/

Thrilled to announce baby Logan has arrived!

Mom and baby are healthy and happy, and the big bros are over the moon!

Thrilled to announce baby Logan has arrived!

Mom and baby are healthy and happy, and the big bros are over the moon!

So even my earlier GDP contribution charts understate the true size of the AI investment boom.

So even my earlier GDP contribution charts understate the true size of the AI investment boom.

Both domestic and imported tech capex have surged in tandem.

Both domestic and imported tech capex have surged in tandem.

Computer & networking gear imports are surging,

While semiconductor imports have actually slumped.

That’s because high-end AI GPUs often get classified under “computers,” not chips...

So the AI boom can show up more prominently in segments outside of semiconductors.

Computer & networking gear imports are surging,

While semiconductor imports have actually slumped.

That’s because high-end AI GPUs often get classified under “computers,” not chips...

So the AI boom can show up more prominently in segments outside of semiconductors.

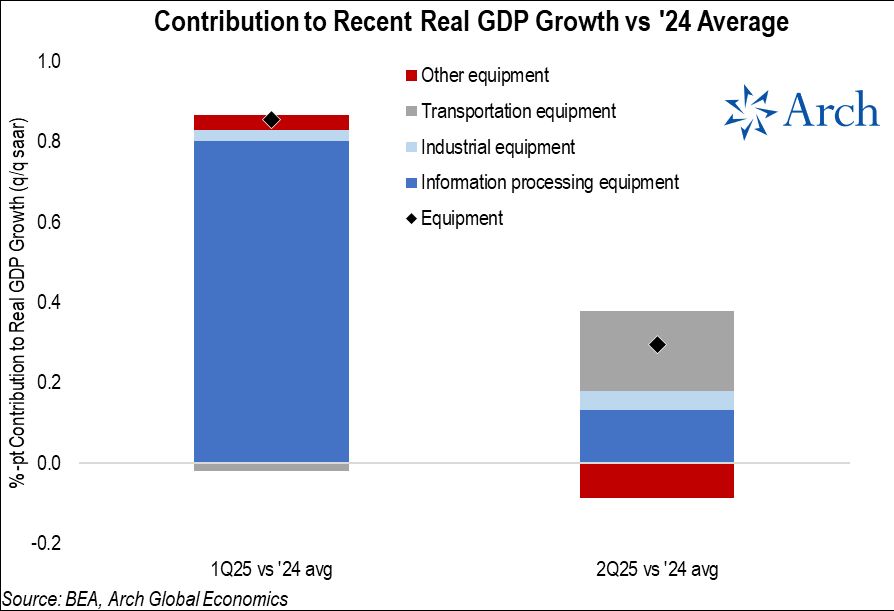

But here’s the catch: that capex contribution only captures the domestic slice of the boom.

Imports of Tech capex - up 90% in 2 years - tell the rest of the story.

More in 🧵

#EconThreads

But here’s the catch: that capex contribution only captures the domestic slice of the boom.

Imports of Tech capex - up 90% in 2 years - tell the rest of the story.

More in 🧵

#EconThreads

In terms of contribution to GDP, we've never seen a surge in tech & software investment of this scale.

For some perspective, here's the contribution to real GDP growth from businesses investing in software and technology since 1960.

#EconSky

In terms of contribution to GDP, we've never seen a surge in tech & software investment of this scale.

For some perspective, here's the contribution to real GDP growth from businesses investing in software and technology since 1960.

#EconSky

It hasn't been a massive surge in bulldozers and industrial equipment, but rather information processing equipment (again hello AI).

It hasn't been a massive surge in bulldozers and industrial equipment, but rather information processing equipment (again hello AI).

Mostly Intellectual Property Products and Equipment.

Structures have unsurprisingly been a drag (similar to residential investment).

Mostly Intellectual Property Products and Equipment.

Structures have unsurprisingly been a drag (similar to residential investment).

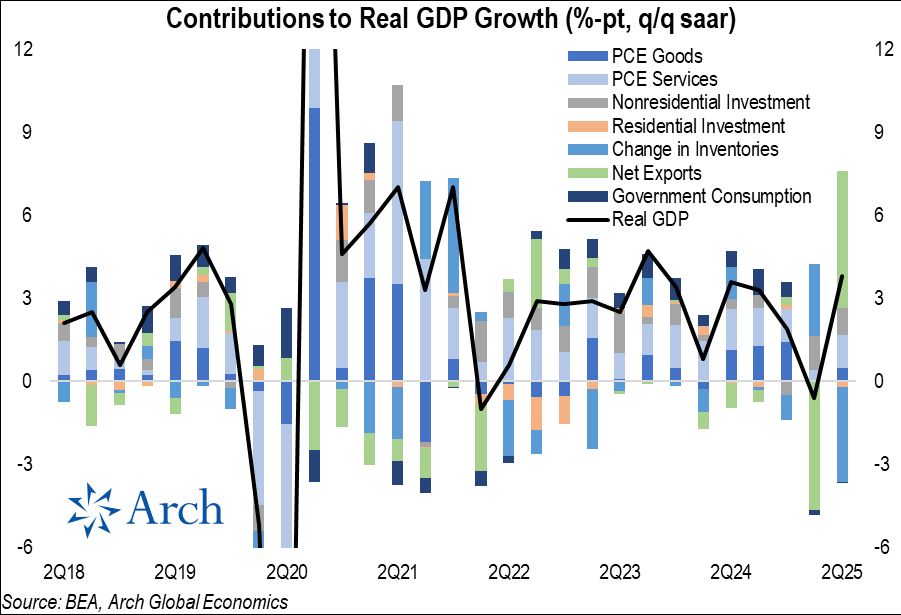

Again, we see the big swing in inventories and net exports.

Again, we see the big swing in inventories and net exports.

Again, now we see there was a modest dip in Q1, with Q2 back to the prior trend pace.

Again, now we see there was a modest dip in Q1, with Q2 back to the prior trend pace.

All of the upward revision was due to stronger than previously reported Consumer spending on of Services, Business Investment and a modest bump to Government consumption.

Details in 🧵

#EconSky

All of the upward revision was due to stronger than previously reported Consumer spending on of Services, Business Investment and a modest bump to Government consumption.

Details in 🧵

#EconSky

So, there's widespread softening, but it's not very rapid.

So, there's widespread softening, but it's not very rapid.

Right now, it's still a relatively small cohort rising at a notable pace.

Typically, insured unemployment is rising > 40bps y/y in ~20% of states at the onsets of recessions since 1990.

Right now we're at just 4%.

Right now, it's still a relatively small cohort rising at a notable pace.

Typically, insured unemployment is rising > 40bps y/y in ~20% of states at the onsets of recessions since 1990.

Right now we're at just 4%.

There we see a continued surge in workers receiving benefits.

There we see a continued surge in workers receiving benefits.