@americanprogress.bsky.social

Big cuts for the poor paid for big tax cuts for the rich, which outnumber the tax cuts for everyone else

Big cuts for the poor paid for big tax cuts for the rich, which outnumber the tax cuts for everyone else

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

In 2029 everyone is in the negative

In 2029 everyone is in the negative

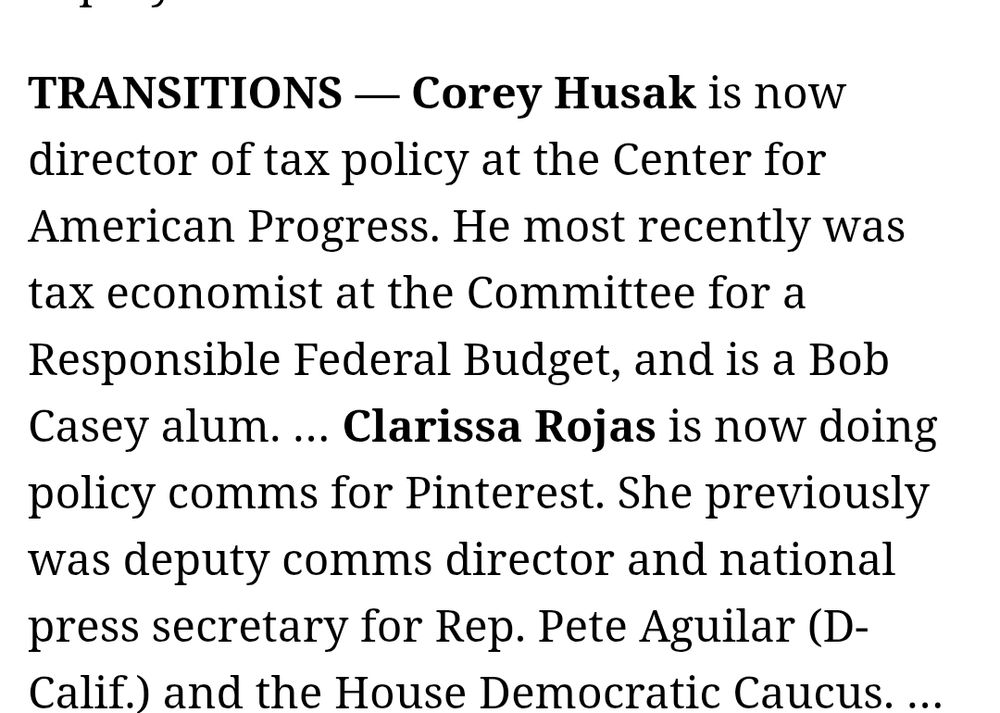

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

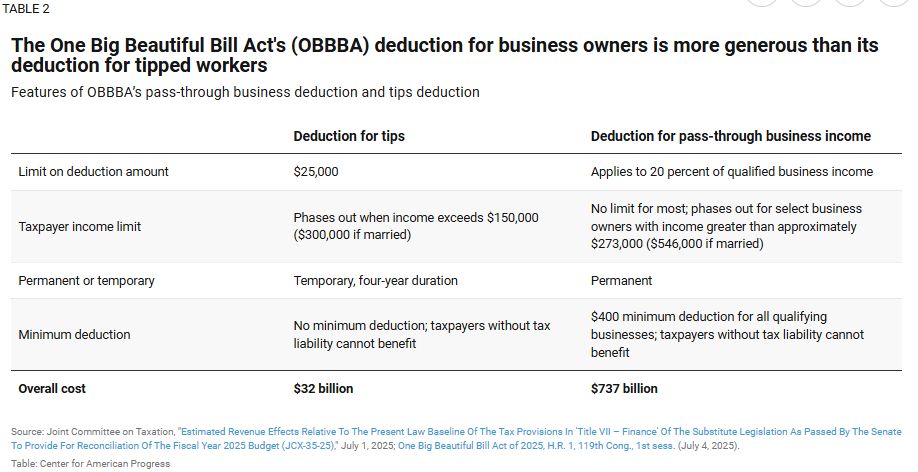

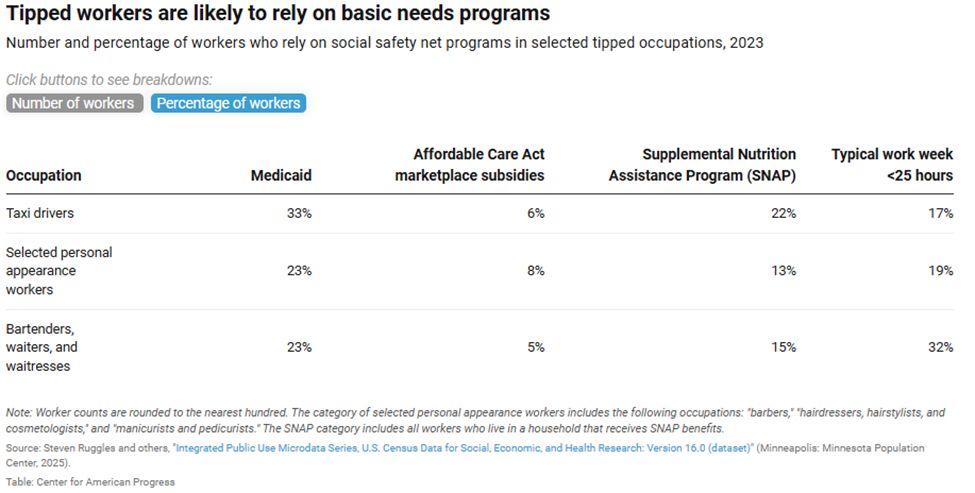

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

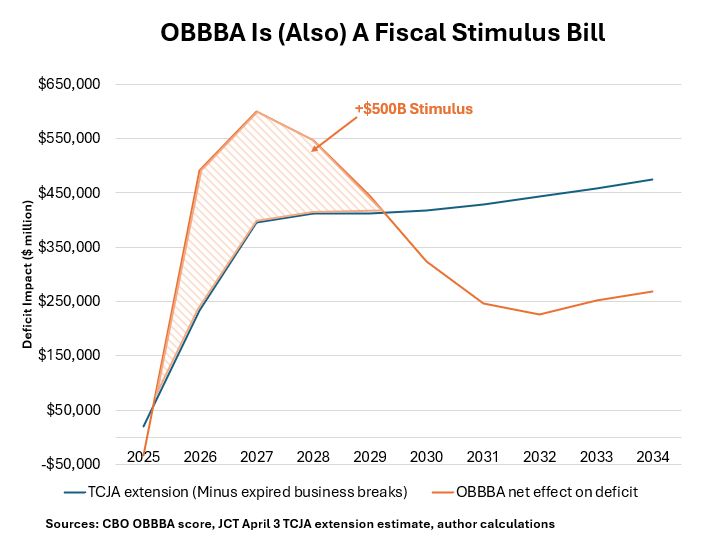

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

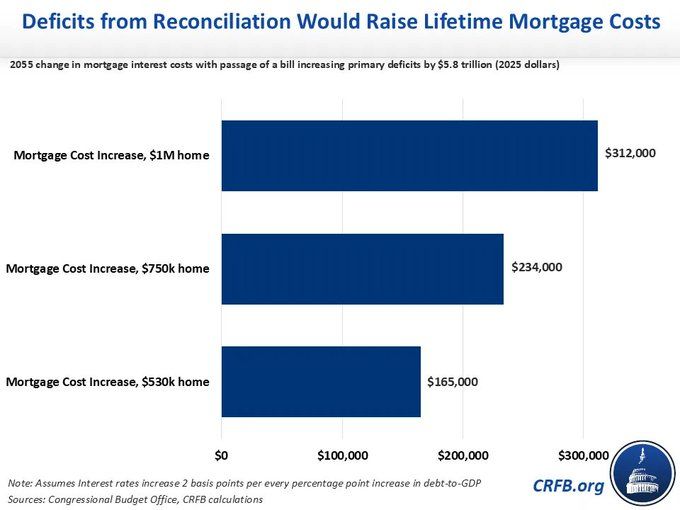

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

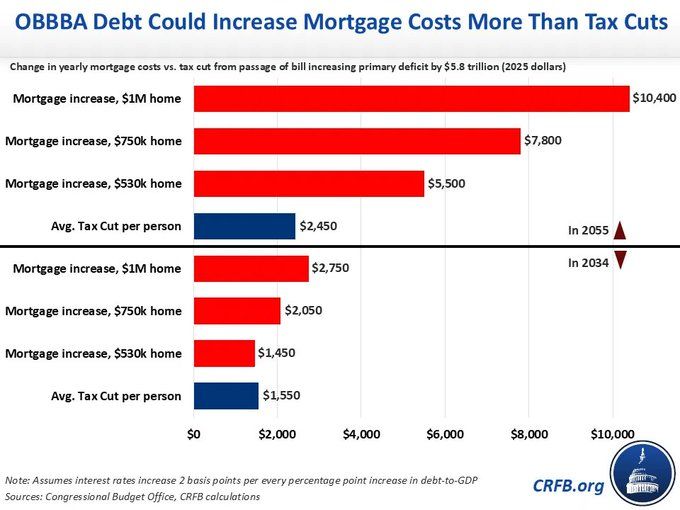

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back