Focused on cross border grid infrastructure, energy markets, and the role of modelling in policymaking.

🇮🇪 Irish in Brussels 🇧🇪

Source: www.acer.europa.eu/monitoring/M...

Source: www.acer.europa.eu/monitoring/M...

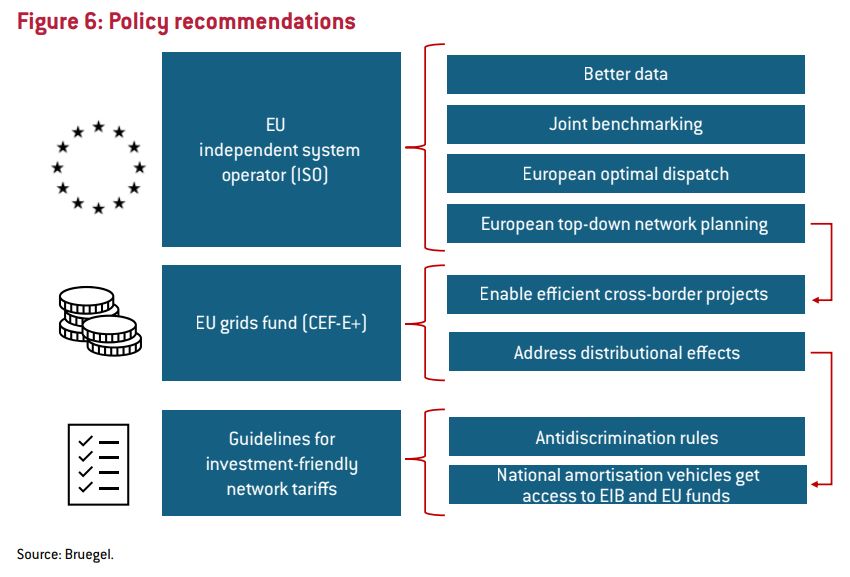

Full policy brief: www.bruegel.org/policy-brief...

Full policy brief: www.bruegel.org/policy-brief...

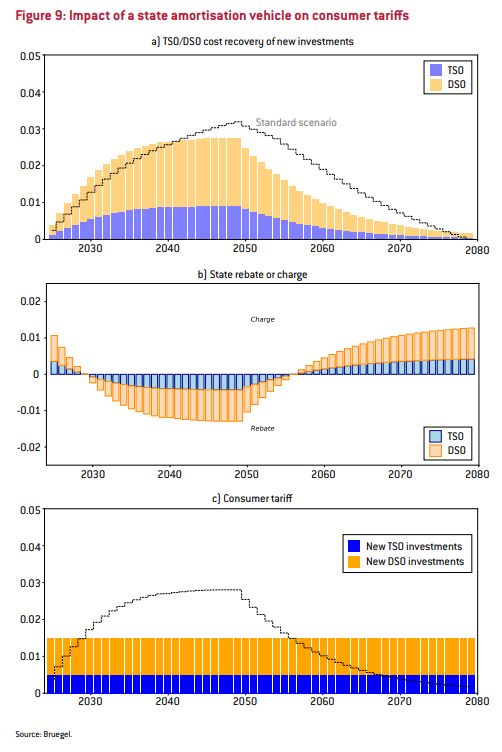

Electricity affordability is required to ensure public support. National funds could smooth cost recovery over time. However, common EU rules should be applied to avoid preferential treatment for national industries. See figure for a sketch of how such state funds could work.

Electricity affordability is required to ensure public support. National funds could smooth cost recovery over time. However, common EU rules should be applied to avoid preferential treatment for national industries. See figure for a sketch of how such state funds could work.

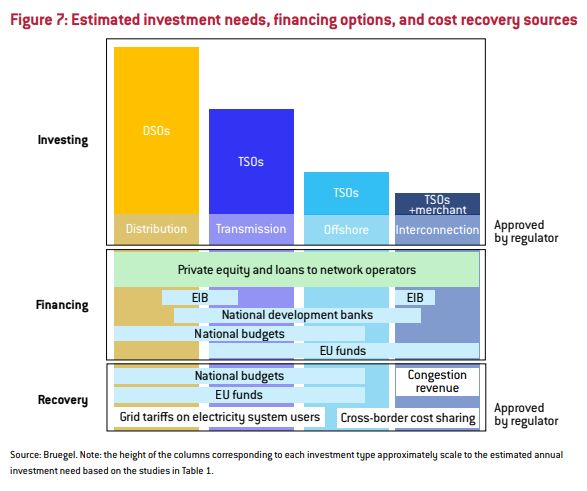

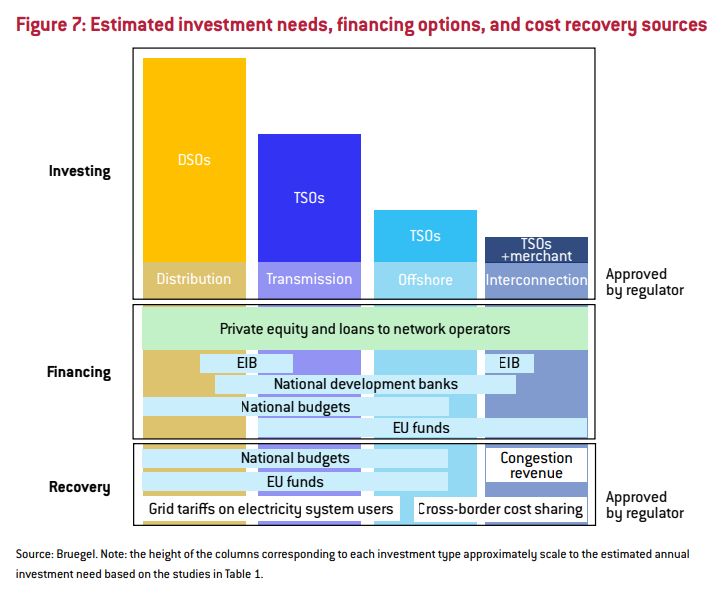

The majority of grid investment will happen at the distribution layer, although transmission, offshore and cross-border are still significant. Appropriate financing sources and cost recovery approaches depend on the network type.

The majority of grid investment will happen at the distribution layer, although transmission, offshore and cross-border are still significant. Appropriate financing sources and cost recovery approaches depend on the network type.

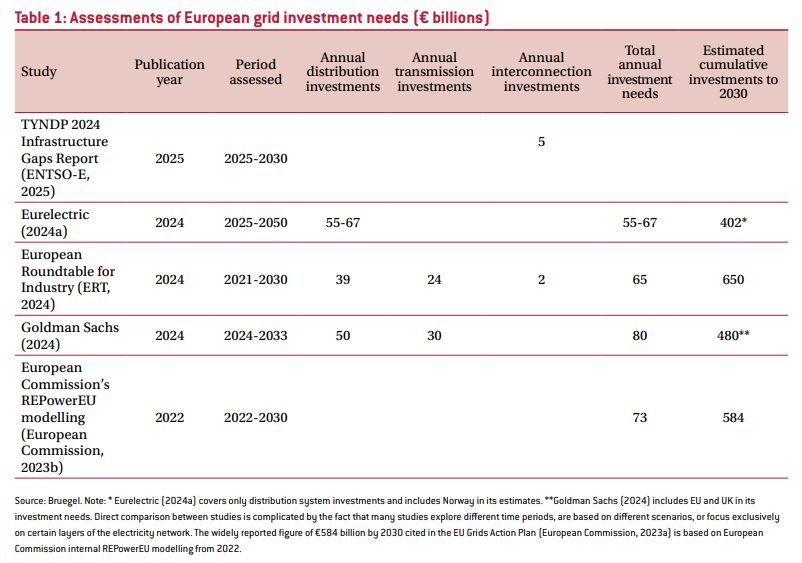

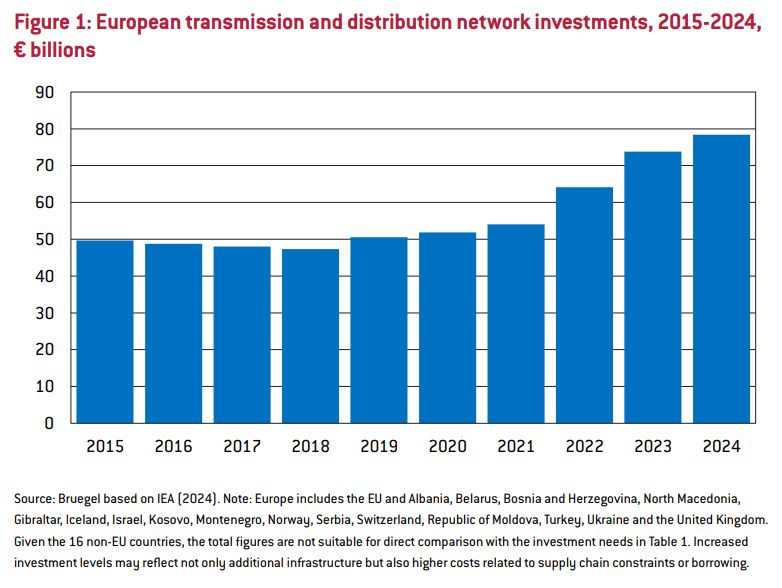

While huge grid investment over a sustained period is required, tens of billions of euros are flowing into electricity transmission and distribution in the EU and neighbouring countries.

While huge grid investment over a sustained period is required, tens of billions of euros are flowing into electricity transmission and distribution in the EU and neighbouring countries.

A few key messages:

- big share of investment needs at distribution level

- cost recovery of investments is as challenging as financing

- EU funds should further accelerate cross border inter connections

A few key messages:

- big share of investment needs at distribution level

- cost recovery of investments is as challenging as financing

- EU funds should further accelerate cross border inter connections

Can grids pay for themselves?

www.entsoe.eu/outlooks/tyn...

Can grids pay for themselves?

www.entsoe.eu/outlooks/tyn...

Full policy brief here: www.bruegel.org/policy-brief...

Full policy brief here: www.bruegel.org/policy-brief...

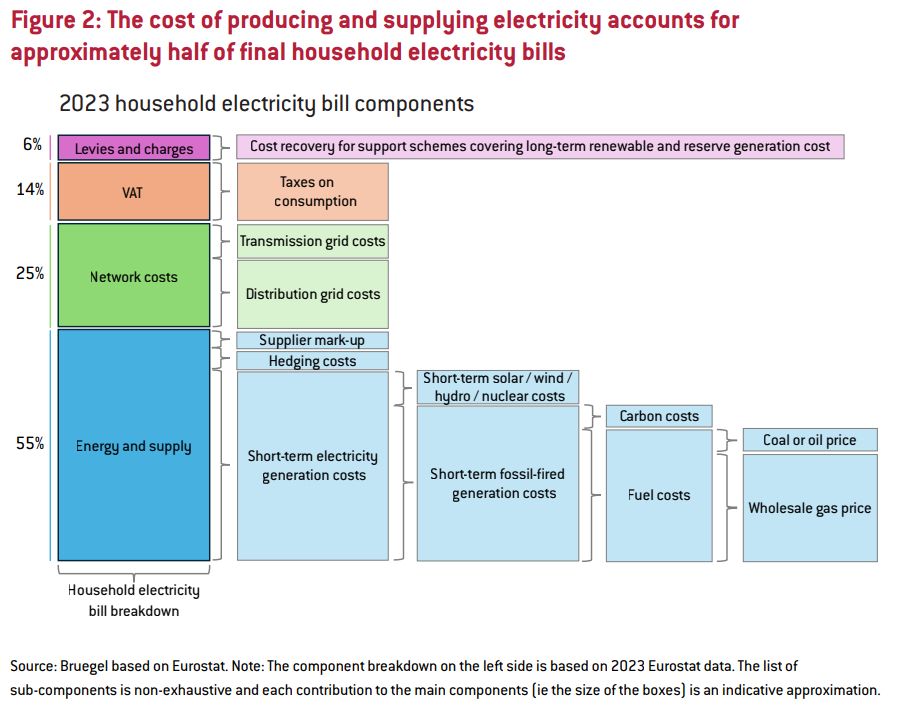

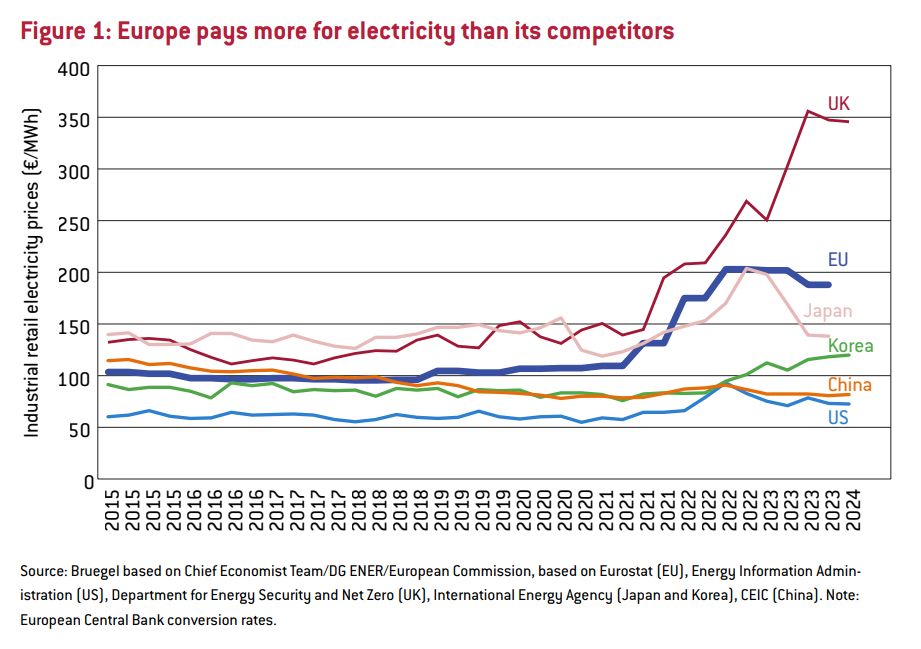

⚖️ The challenge is to balance industrial competitiveness with cost of living. Households already pay more per unit than industry—can we afford to shift the scales even further?

⚖️ The challenge is to balance industrial competitiveness with cost of living. Households already pay more per unit than industry—can we afford to shift the scales even further?

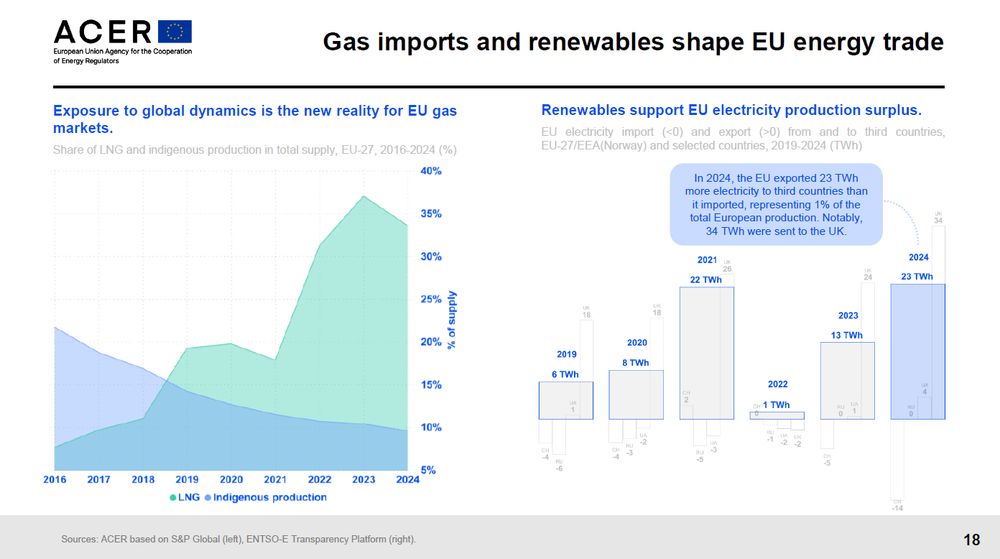

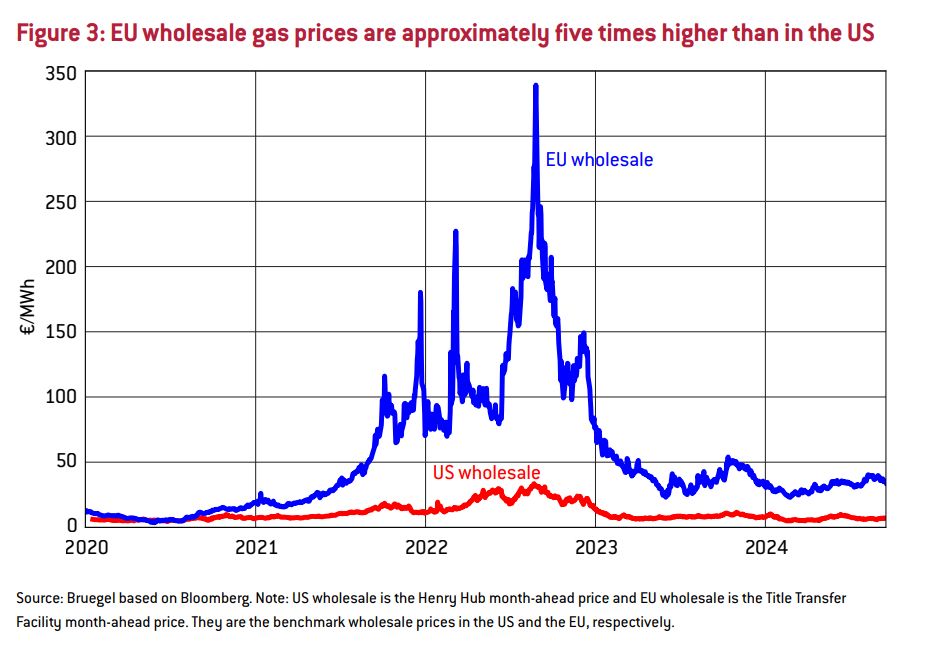

98% of natural gas is imported—much as LNG—costing 5x more than domestic US gas. This dependency drives high electricity prices, with fossil fuels still central to the power mix.

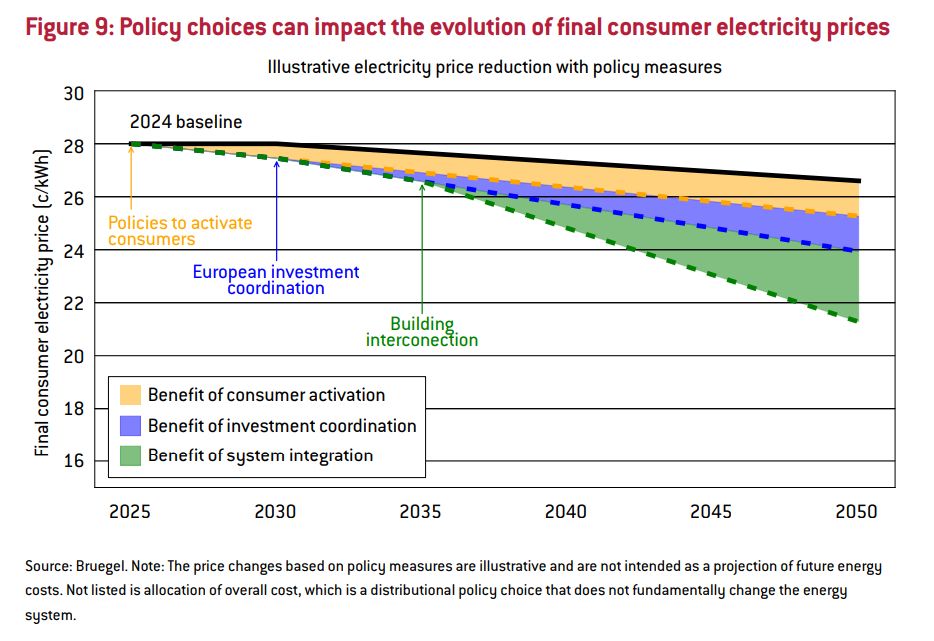

To make energy affordable, Europe must decarbonise. Here's four ways to reduce prices: 🧵

98% of natural gas is imported—much as LNG—costing 5x more than domestic US gas. This dependency drives high electricity prices, with fossil fuels still central to the power mix.

To make energy affordable, Europe must decarbonise. Here's four ways to reduce prices: 🧵

From the JRC's Clean Energy Technology Observatory: setis.ec.europa.eu/document/dow...

From the JRC's Clean Energy Technology Observatory: setis.ec.europa.eu/document/dow...