This story highlights an early response to that stress test: involuntary, 4-month reassignments of HR/IT staff to taxpayer services.

buff.ly/52RfQeA

This story highlights an early response to that stress test: involuntary, 4-month reassignments of HR/IT staff to taxpayer services.

buff.ly/52RfQeA

buff.ly/52RfQeA

We have some broad thoughts on how lawmakers should be thinking about de minimis, mining/staking, and more:

bipartisanpolicy.org/issue-brief/...

We have some broad thoughts on how lawmakers should be thinking about de minimis, mining/staking, and more:

bipartisanpolicy.org/issue-brief/...

Setting aside the notion CBO does projections based on the party in power (they don't), growth has been on a clear downward trend for decades.

Setting aside the notion CBO does projections based on the party in power (they don't), growth has been on a clear downward trend for decades.

www.wnyc.org/story/salt-c...

www.wnyc.org/story/salt-c...

- @andrewlautz.bsky.social on raising the SALT deductions cap,

- Envisioning 'good government' in NYC with @citizensunionny.bsky.social,

- @contrapoints.bsky.social on conspiracy theories,

- Listeners, what would YOU wait on line for?

Live at 10 on 93.9 FM, AM820 or @wnyc.org

- @andrewlautz.bsky.social on raising the SALT deductions cap,

- Envisioning 'good government' in NYC with @citizensunionny.bsky.social,

- @contrapoints.bsky.social on conspiracy theories,

- Listeners, what would YOU wait on line for?

Live at 10 on 93.9 FM, AM820 or @wnyc.org

But it won't get close to pre-TCJA levels, @kylepomerleau.bsky.social and @andrewlautz.bsky.social say.

buff.ly/Ak16FNg

But it won't get close to pre-TCJA levels, @kylepomerleau.bsky.social and @andrewlautz.bsky.social say.

buff.ly/Ak16FNg

🔗https://bit.ly/4lhqOK9

🔗https://bit.ly/4lhqOK9

JCT finds that extension costs $4.1 trillion over 10 years, and $700 billion more tacked on due to the extra interest payments we'll have to make on our debt.

punchbowl.news/wyden_merkle...

JCT finds that extension costs $4.1 trillion over 10 years, and $700 billion more tacked on due to the extra interest payments we'll have to make on our debt.

punchbowl.news/wyden_merkle...

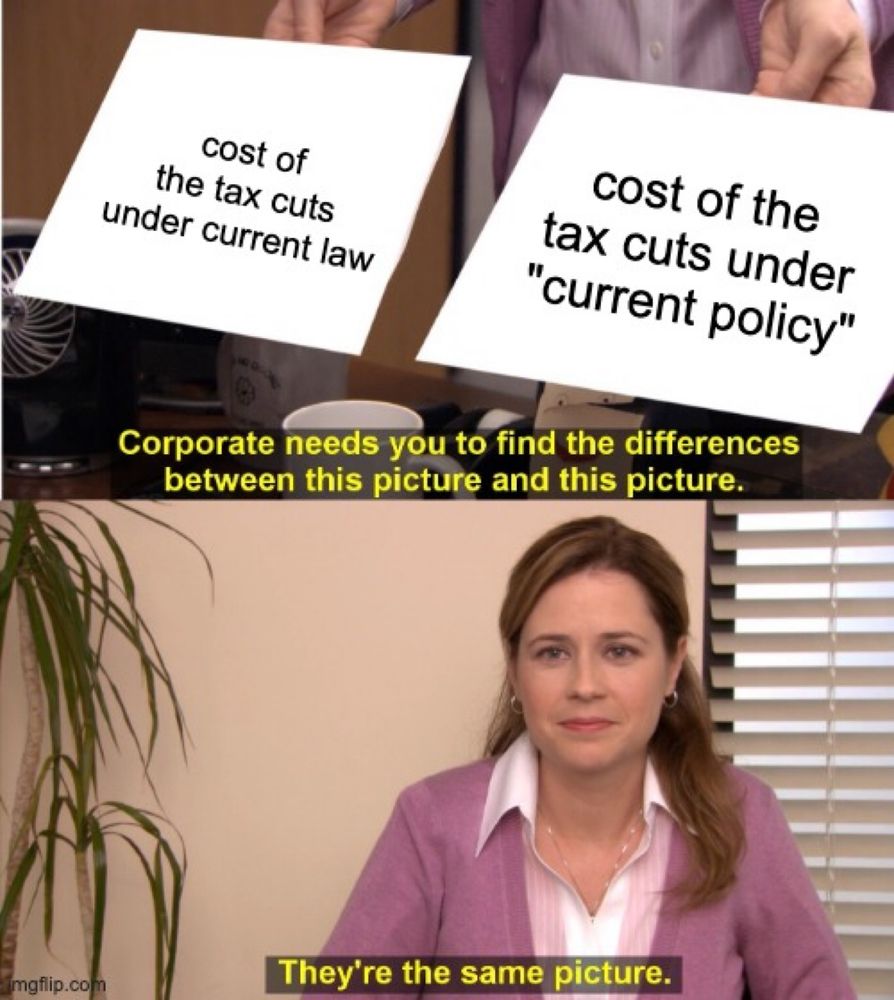

What’s in the Senate GOP budget?

💸 1) up to $5.7 TRILLION in higher deficits/debt

🫣 2) an attempt to obscure a huge portion of that behind a "current policy" baseline that says tax cuts are free.

Read more:

bipartisanpolicy.org/explainer/wh...

What’s in the Senate GOP budget?

💸 1) up to $5.7 TRILLION in higher deficits/debt

🫣 2) an attempt to obscure a huge portion of that behind a "current policy" baseline that says tax cuts are free.

Read more:

bipartisanpolicy.org/explainer/wh...

Current policy just obscures the cost from the public and breaks decades of precedent.

Current policy just obscures the cost from the public and breaks decades of precedent.

The baseline is a political choice, but it doesn't change that extending the tax cuts w/o paying for them adds trillions to debt.

www.cbo.gov/publication/...

The baseline is a political choice, but it doesn't change that extending the tax cuts w/o paying for them adds trillions to debt.

www.cbo.gov/publication/...

What it doesn't change is that extending the 2017 tax cuts costs $4 trillion over a decade.

Some friends here do a great job of explaining this for folks who aren't enmeshed in nerdy budget battles.

What it doesn't change is that extending the 2017 tax cuts costs $4 trillion over a decade.

Some friends here do a great job of explaining this for folks who aren't enmeshed in nerdy budget battles.

Sound ridiculous?

This is the "current policy" gimmick some Republicans are mulling for tax cuts.

Great metaphors here:

www.nytimes.com/interactive/...

Sound ridiculous?

This is the "current policy" gimmick some Republicans are mulling for tax cuts.

Great metaphors here:

www.nytimes.com/interactive/...

Currently, the agenda may exceed $7 trillion over 10 years before offsets.

Lawmakers need to pay for new tax cuts/spending to avoid increasing deficits by a third.

bipartisanpolicy.org/tcja-offsets/

Currently, the agenda may exceed $7 trillion over 10 years before offsets.

Lawmakers need to pay for new tax cuts/spending to avoid increasing deficits by a third.

bipartisanpolicy.org/tcja-offsets/

At Bipartisan Policy Center we have a new resource with options to pay for $4 trillion in expiring tax cuts.

One set of options out today. More next week.

bipartisanpolicy.org/tcja-offsets/

At Bipartisan Policy Center we have a new resource with options to pay for $4 trillion in expiring tax cuts.

One set of options out today. More next week.

bipartisanpolicy.org/tcja-offsets/

Of the overall $79.6 billion to the IRS, a larger portion remains ($27.1 billion or 34%).

Of the overall $79.6 billion to the IRS, a larger portion remains ($27.1 billion or 34%).

Created a Tax Starter Pack for other tax folks coming here -- policy wonks, reporters, etc. -- but let me know if I missed you!

go.bsky.app/9pFtGbx

Created a Tax Starter Pack for other tax folks coming here -- policy wonks, reporters, etc. -- but let me know if I missed you!

go.bsky.app/9pFtGbx