Yes in my… basement? Near it, at least.

Yes in my… basement? Near it, at least.

The challenges? Completion risk, affordability anxiety, and demand uncertainty (from data centers!). We can't build new nuclear without addressing those.

The challenges? Completion risk, affordability anxiety, and demand uncertainty (from data centers!). We can't build new nuclear without addressing those.

www.theverge.com/ai-artificia...

www.theverge.com/ai-artificia...

www.cnbc.com/2025/11/14/a...

www.cnbc.com/2025/11/14/a...

ethanding.substack.com/p/ai-subscri...

ethanding.substack.com/p/ai-subscri...

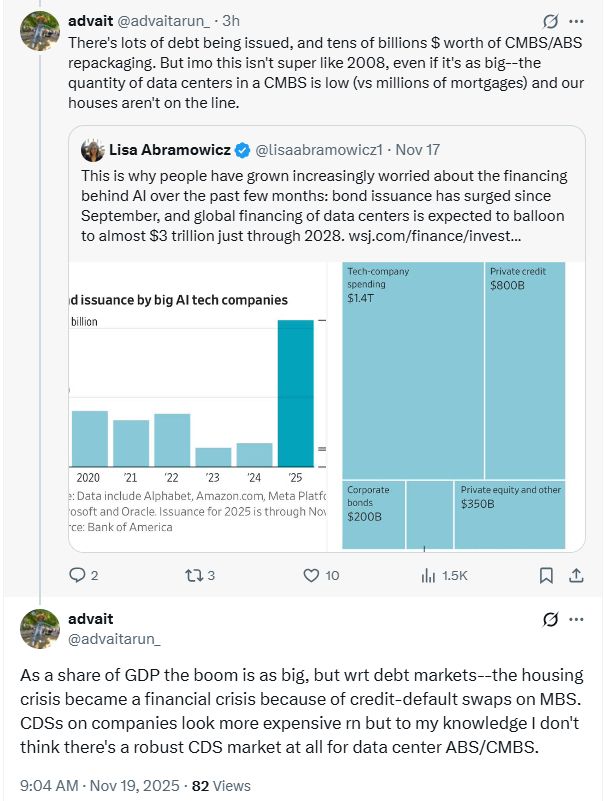

The implication: The U.S.'s sole growth sector is stuck between a prisoner's dilemma in pricing and a collateral crunch.

bsky.app/profile/adva...

The implication: The U.S.'s sole growth sector is stuck between a prisoner's dilemma in pricing and a collateral crunch.

bsky.app/profile/adva...

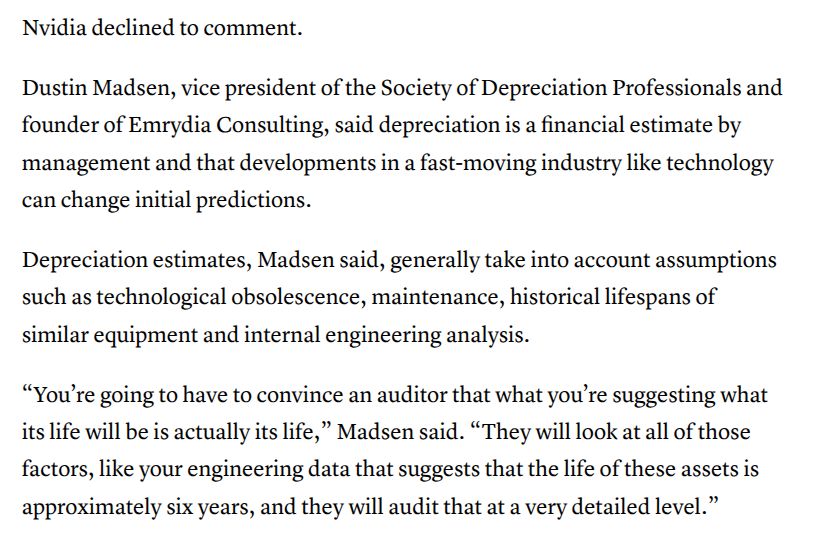

Counterintuitively, a GPU loan guarantee is a boon to NVIDIA (and a tax credit might not be so easy to monetize...)

Counterintuitively, a GPU loan guarantee is a boon to NVIDIA (and a tax credit might not be so easy to monetize...)

You've probably heard of some of them. But here's the analysis of how they connect.

You've probably heard of some of them. But here's the analysis of how they connect.