Tweets not investment advice

Berlin has signalled to Paris it will no longer block French efforts to ensure nuclear power is treated on par with renewable energy in EU legislation

This is a massively positive development for nuclear power in Europe and #uranium 🇪🇺

Brownfield restarts are the proverbial low hanging fruit as prices go up. What do you think happens to greenfield #uranium pounds?

Brownfield restarts are the proverbial low hanging fruit as prices go up. What do you think happens to greenfield #uranium pounds?

As has the trade news between the US and China. I discuss all this in a 4-page update that's available for everyone on: patreon.com/contrariancodex

As has the trade news between the US and China. I discuss all this in a 4-page update that's available for everyone on: patreon.com/contrariancodex

For all those who were hoping that those pounds would be released, tough luck.

www.globenewswire.com/news-release...

For all those who were hoping that those pounds would be released, tough luck.

www.globenewswire.com/news-release...

Meanwhile, the supply side has faced one headwind after another. From the largest producers (as below) in the world to smaller developers, supply disruptions remain widespread.

inbusiness.kz/ru/news/krup...

Meanwhile, the supply side has faced one headwind after another. From the largest producers (as below) in the world to smaller developers, supply disruptions remain widespread.

inbusiness.kz/ru/news/krup...

"The Trump administration is considering several executive orders aimed at speeding up the construction of nuclear power plants to help meet rising electricity demand"

www.nytimes.com/2025/05/09/c...

"The Trump administration is considering several executive orders aimed at speeding up the construction of nuclear power plants to help meet rising electricity demand"

www.nytimes.com/2025/05/09/c...

That and much more in this week's newsletter report, including two new portfolio positions

That and much more in this week's newsletter report, including two new portfolio positions

"I have no idea where all the pounds we need are going to come from, for the first tike after ~50 years in the business, I simply have no idea"

Prices will go higher

"I have no idea where all the pounds we need are going to come from, for the first tike after ~50 years in the business, I simply have no idea"

Prices will go higher

Cameco is leading the way and they could stand to benefit greatly from an AP-1000 buildout program in the country.

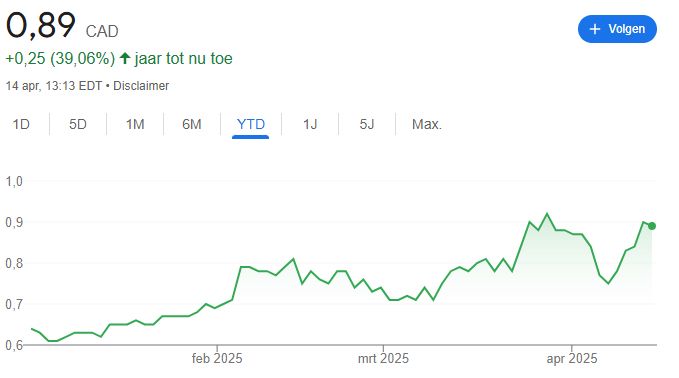

The call options we bought on the Codex in Q1 have more than doubled 📈 (link in my bio)

Cameco is leading the way and they could stand to benefit greatly from an AP-1000 buildout program in the country.

The call options we bought on the Codex in Q1 have more than doubled 📈 (link in my bio)

But what about all the 150 pound chimps? Smaller projects that are seeing delays and cost overruns. All that is really starting to add up.

But what about all the 150 pound chimps? Smaller projects that are seeing delays and cost overruns. All that is really starting to add up.

It's available for everyone right here ⤵️

www.patreon.com/posts/127972...

It's available for everyone right here ⤵️

www.patreon.com/posts/127972...

The long term trajectory remains firmly upward and to the right

The long term trajectory remains firmly upward and to the right

No good terms, no new production.

No good terms, no new production.

That's not the case in the presentation today and it's clear that the current pricing environment is 'not good enough' for those tier 2 assets. This rings true for other companies as well, which mutes supply.

That's not the case in the presentation today and it's clear that the current pricing environment is 'not good enough' for those tier 2 assets. This rings true for other companies as well, which mutes supply.

www.cameco.com/media/news/c...

www.cameco.com/media/news/c...

www.japantimes.co.jp/news/2025/04...

www.japantimes.co.jp/news/2025/04...

They are failing to deliver. Producing #uranium is hard and the marginal pound will not be sold until much higher prices.

They are failing to deliver. Producing #uranium is hard and the marginal pound will not be sold until much higher prices.

"There may not be enough guaranteed supply for everyone"

"There may not be enough guaranteed supply for everyone"

#Gold and #silver have been doing very well however and have carried the Codex portfolio YTD. We had some big winners, including 130% profit on AG calls. Link in bio ⤵️

www.patreon.com/posts/126123...

www.patreon.com/posts/126123...

A new 40 page report is now ready on the Codex which discusses all that and much more ⤵️

www.patreon.com/posts/124700...

A new 40 page report is now ready on the Codex which discusses all that and much more ⤵️

www.patreon.com/posts/124700...

"Major tech companies such as Amazon and Google today signed a pledge to support the goal of at least tripling the world's nuclear energy capacity by 2050"

#uranium

www.reuters.com/business/ene...

"Major tech companies such as Amazon and Google today signed a pledge to support the goal of at least tripling the world's nuclear energy capacity by 2050"

#uranium

www.reuters.com/business/ene...

www.patreon.com/posts/124114...

www.patreon.com/posts/124114...