2. The Fed has been hated for 110 years

3. High probabilities do not imply certainty

4. It can always be different this time

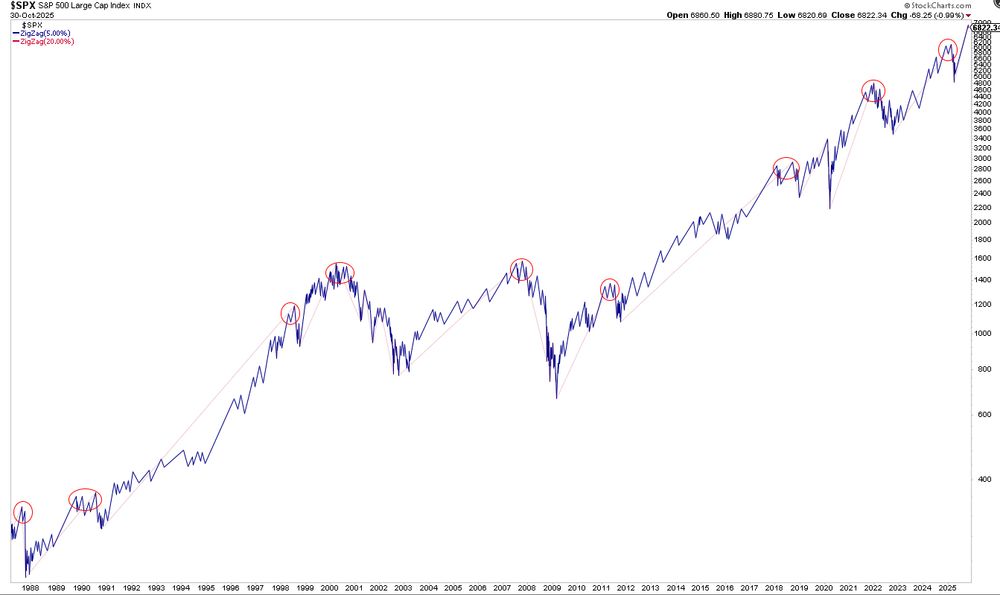

5. Things go up over time

6. We’re not all going to agree

bsky.app/profile/carl...

I found the December column interesting …”

- B of A desk

bsky.app/profile/carl...

Investing go.bsky.app/Qn6r8WD

Econ go.bsky.app/Q3Vt4ef

Ritholtz All Stars go.bsky.app/K7pijeB

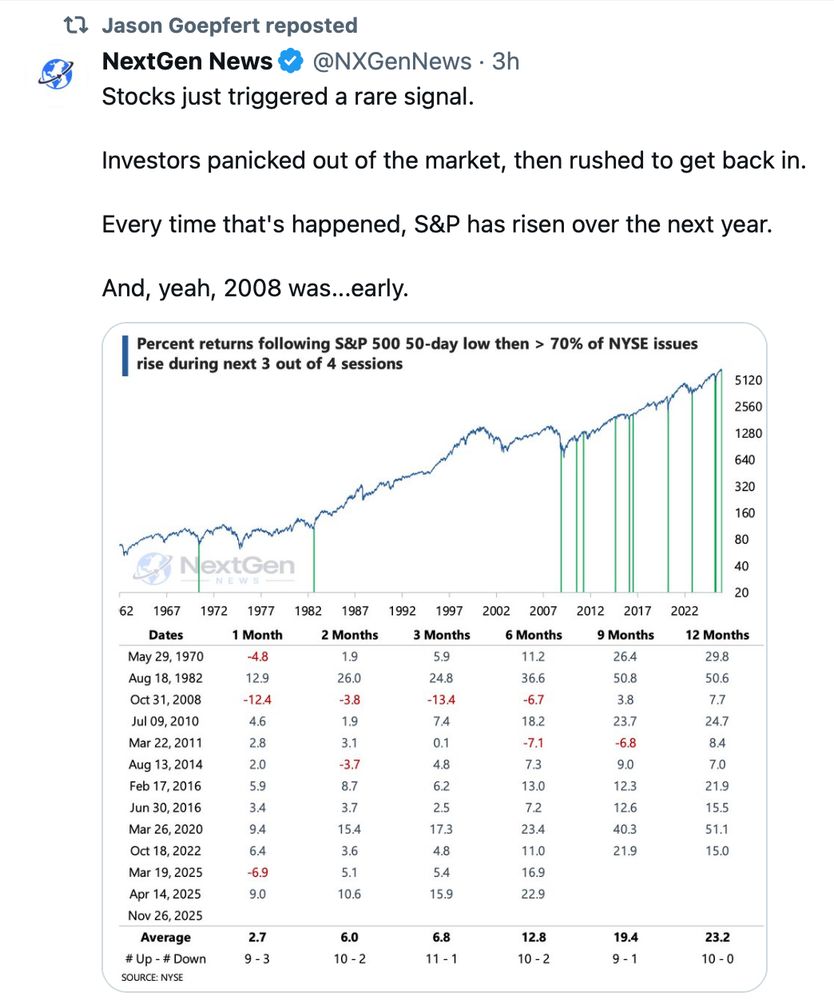

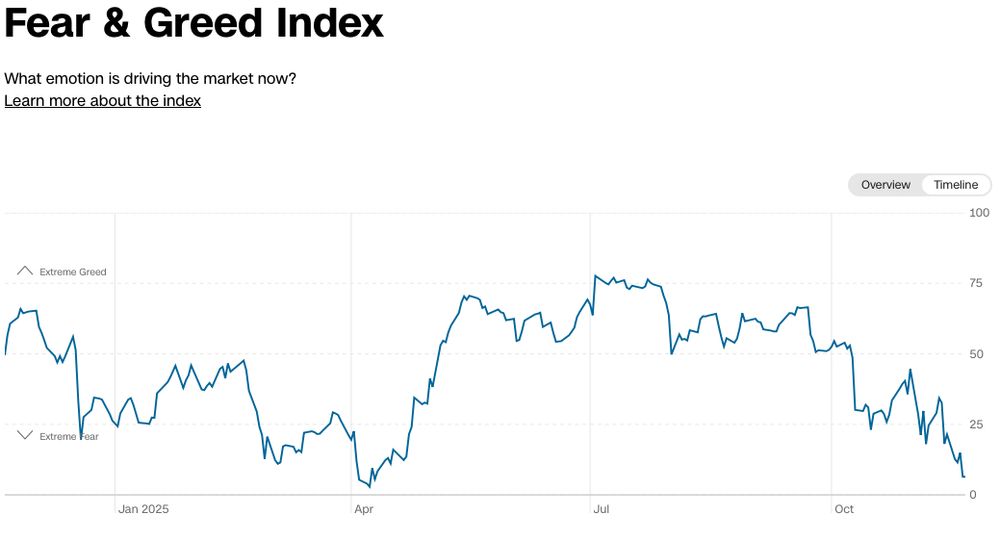

Sentiment buy signals are solid because investors panic all at once. Assuming a tidy symmetry with sentiment sell signals doesn't work

Sentiment buy signals are solid because investors panic all at once. Assuming a tidy symmetry with sentiment sell signals doesn't work

bsky.app/profile/carl...

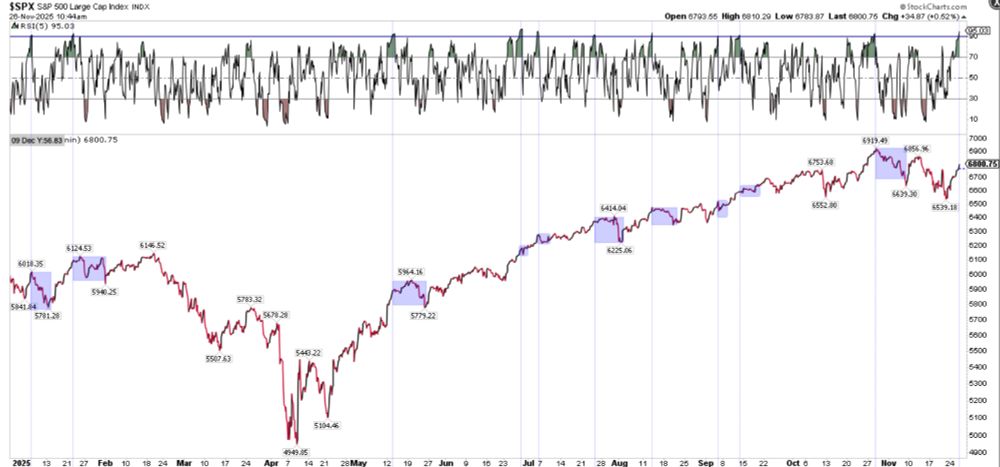

$SPX