Teymour Bourial

@teymour.me

210 followers

190 following

120 posts

I write about energy and circularity.

Partner at ExoPeak.

Based in Paris.

Posts

Media

Videos

Starter Packs

Teymour Bourial

@teymour.me

· 10d

Teymour Bourial

@teymour.me

· 11d

Teymour Bourial

@teymour.me

· 11d

Teymour Bourial

@teymour.me

· Sep 3

Solar by the Numbers: Midong Is China's Latest Mega-Marvel

A solar power project in the Gobi Desert has moved the needle on the size and scope of global photovoltaic installations, aided by innovation in equipment and construction. The numbers tell much of th...

www.powermag.com

Teymour Bourial

@teymour.me

· Jul 22

Teymour Bourial

@teymour.me

· Jul 22

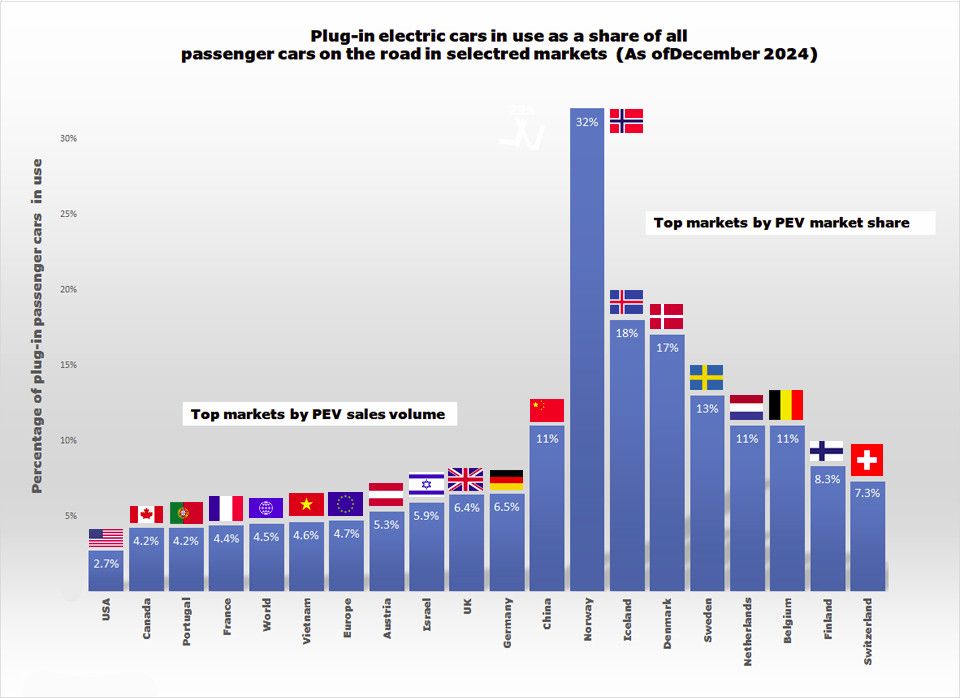

While all eyes were watching BYD overtake Tesla, a set of smaller Chinese EV makers quietly slipped into the global top 10. Chinese automakers now control 70% of global EV production.

Our latest story: restofworld.org/2025/chinese...

Our latest story: restofworld.org/2025/chinese...

Teymour Bourial

@teymour.me

· Jul 11

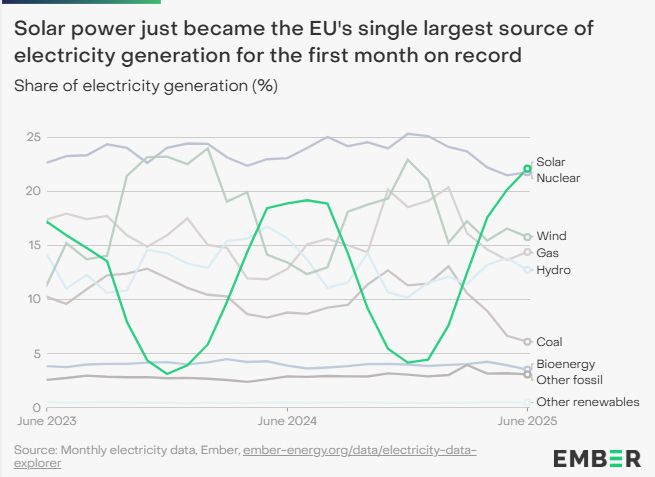

Nuclear☢️ has been consistently the EU's biggest source of electricity for around a decade..

That changed in June, as solar became the #1 source of EU electricity.

Sure, it's summer, but this is a big milestone for just how far solar has come, pushing coal to an all-time low💪

That changed in June, as solar became the #1 source of EU electricity.

Sure, it's summer, but this is a big milestone for just how far solar has come, pushing coal to an all-time low💪

Teymour Bourial

@teymour.me

· Jun 13

Teymour Bourial

@teymour.me

· Jun 12

Teymour Bourial

@teymour.me

· Jun 12

Trump Has an Electricity Price Problem #Climate

Trump Has an Electricity Price Problem

heatmap.news