-wsj @ennovance

-wsj @ennovance

Regulators are calling it “pump → dump → disappear.”

Since 2023, Nasdaq has listed 230+ IPOs under $15M.

👇 @barronsonline

x.com/mohossain/st...

Regulators are calling it “pump → dump → disappear.”

Since 2023, Nasdaq has listed 230+ IPOs under $15M.

👇 @barronsonline

x.com/mohossain/st...

• China is now a net drag on global growth

• EV + manufacturing overcapacity exporting deflation worldwide

Winners: U.S./MX reshoring, commodity exporters to China

Losers: EU & East Asian

x.com/mohossain/st...

www.wsj.com/economy/trad...

• China is now a net drag on global growth

• EV + manufacturing overcapacity exporting deflation worldwide

Winners: U.S./MX reshoring, commodity exporters to China

Losers: EU & East Asian

x.com/mohossain/st...

www.wsj.com/economy/trad...

Top firms are unlocking new capital through creative structures ..bonds, MSOs, Arizona’s alt models.

Law partners now earn $9M/year, …turning partnership equity into liquid wealth to fund AI ..$2,500/hr

www.ft.com/content/612d...

x.com/mohossain/st...

Top firms are unlocking new capital through creative structures ..bonds, MSOs, Arizona’s alt models.

Law partners now earn $9M/year, …turning partnership equity into liquid wealth to fund AI ..$2,500/hr

www.ft.com/content/612d...

x.com/mohossain/st...

📉 Defaults down.

📈 Earnings up.

🚀 GDP tracking 3.8% vs 2% trend.

High‑profile defaults ≠ systemic stress.

Growth + earnings momentum = US economy remains incredibly resilient.

@ennovance

📉 Defaults down.

📈 Earnings up.

🚀 GDP tracking 3.8% vs 2% trend.

High‑profile defaults ≠ systemic stress.

Growth + earnings momentum = US economy remains incredibly resilient.

@ennovance

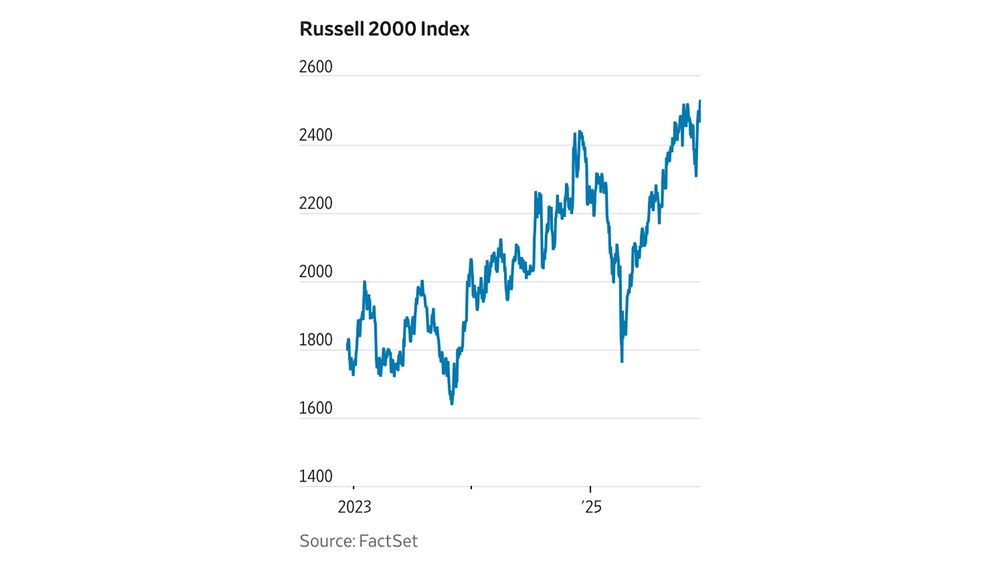

Valuations high but not 1999-high. Excess CAPE yield: 1.7%

10Y yields down → equities more attractive.

Earnings outlook solid, holiday spending strong.

Not just meg7: R2K + SPX equal-weight near ATHs.

Breakevens ⚓️ → inflation fears fading

www.wsj.com/finance/inve...

Valuations high but not 1999-high. Excess CAPE yield: 1.7%

10Y yields down → equities more attractive.

Earnings outlook solid, holiday spending strong.

Not just meg7: R2K + SPX equal-weight near ATHs.

Breakevens ⚓️ → inflation fears fading

www.wsj.com/finance/inve...

📊 Dallas Fed shows its supply‑driven: tighter #immigration, higher H‑1B fees.

🟢 Evidence: low jobless claims + rising job openings.

📰Bottom line → labor supply, not demand, is the constraint.

www.dallasfed.org/research/eco...

#labor

x.com/mohossain/st...

📊 Dallas Fed shows its supply‑driven: tighter #immigration, higher H‑1B fees.

🟢 Evidence: low jobless claims + rising job openings.

📰Bottom line → labor supply, not demand, is the constraint.

www.dallasfed.org/research/eco...

#labor

x.com/mohossain/st...

📉 Defaults down.

📈 Earnings up.

🚀 GDP tracking 3.8% vs 2% trend.

High‑profile defaults ≠ systemic stress.

Growth + earnings momentum = US economy remains incredibly resilient.

@ennovance

📉 Defaults down.

📈 Earnings up.

🚀 GDP tracking 3.8% vs 2% trend.

High‑profile defaults ≠ systemic stress.

Growth + earnings momentum = US economy remains incredibly resilient.

@ennovance

Top firms are unlocking new capital through creative structures ..bonds, MSOs, Arizona’s alt models.

Law partners now earn $9M/year, …turning partnership equity into liquid wealth to fund AI ..$2,500/hr

www.ft.com/content/612d...

x.com/mohossain/st...

Top firms are unlocking new capital through creative structures ..bonds, MSOs, Arizona’s alt models.

Law partners now earn $9M/year, …turning partnership equity into liquid wealth to fund AI ..$2,500/hr

www.ft.com/content/612d...

x.com/mohossain/st...

Court win ✓ In-house chips ✓ Gemini 3 ✓ 90% search dominance ✓ = $3.8T market cap

Up 16% while rivals tank. The secret? Vertical integration + spending smarter

Alphabet looks less like an AI bubble, more like the AI backbone.

x.com/mohossain/st...

Court win ✓ In-house chips ✓ Gemini 3 ✓ 90% search dominance ✓ = $3.8T market cap

Up 16% while rivals tank. The secret? Vertical integration + spending smarter

Alphabet looks less like an AI bubble, more like the AI backbone.

x.com/mohossain/st...

SF Fed decomposition shows price growth fueled by strong activity, not supply shocks. As long as demand‑pull keeps inflation >2%, the Fed must lean on restrictive policy

The source of inflation dictates the path of rates

#m2

x.com/mohossain/st...

SF Fed decomposition shows price growth fueled by strong activity, not supply shocks. As long as demand‑pull keeps inflation >2%, the Fed must lean on restrictive policy

The source of inflation dictates the path of rates

#m2

x.com/mohossain/st...

Dividend recap loans have hit $28.7B YTD—on pace to surpass 2021. With IPOs and M&A stalled, sponsors are layering leverage to appease cash‑flow negative LPs. .... credit risks.

⬇️

x.com/mohossain/st...

Dividend recap loans have hit $28.7B YTD—on pace to surpass 2021. With IPOs and M&A stalled, sponsors are layering leverage to appease cash‑flow negative LPs. .... credit risks.

⬇️

x.com/mohossain/st...

For the first time since 1970, new single-family homes are cheaper than existing ones.

Builders are downsizing and offering incentives.

Sellers are sitting tight with low-rate mortgages.

Affordability is reshaping the housing market. 🏠📉

x.com/mohossain/st...

For the first time since 1970, new single-family homes are cheaper than existing ones.

Builders are downsizing and offering incentives.

Sellers are sitting tight with low-rate mortgages.

Affordability is reshaping the housing market. 🏠📉

x.com/mohossain/st...

AI capex: $3T through 2028. Big tech will cash-flow only ~50%. The rest = debt, private credit, securitizations

⬇️

Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy - WSJ

www.wsj.com/finance/inve...

#ennovance

x.com/mohossain/st...

AI capex: $3T through 2028. Big tech will cash-flow only ~50%. The rest = debt, private credit, securitizations

⬇️

Wall Street Blows Past Bubble Worries to Supercharge AI Spending Frenzy - WSJ

www.wsj.com/finance/inve...

#ennovance

x.com/mohossain/st...

From Peak Pain to Quiet Progress

In 2010, 14% of Americans had third-party collections. Today? Just 5%.

The average balance is ~$1,600—still real, but fewer are stuck. 🇺🇸Resilience isn’t loud. It’s steady.

x.com/mohossain/st...

From Peak Pain to Quiet Progress

In 2010, 14% of Americans had third-party collections. Today? Just 5%.

The average balance is ~$1,600—still real, but fewer are stuck. 🇺🇸Resilience isn’t loud. It’s steady.

x.com/mohossain/st...

Prices go up, consumers scream “inflation!”

Inflation cools, prices stay high—still the government’s fault.

It’s not Econ 101, it’s Blame 101.

Culprits: vibes, supply chains, and whoever’s in office.

🇺🇸https://x.com/mohossain/status/1545482174807384069?s=46

Prices go up, consumers scream “inflation!”

Inflation cools, prices stay high—still the government’s fault.

It’s not Econ 101, it’s Blame 101.

Culprits: vibes, supply chains, and whoever’s in office.

🇺🇸https://x.com/mohossain/status/1545482174807384069?s=46

Unlike 1969, when Buffett shut down his hedge fund amid frothy valuations…

𝑀𝑎𝑟𝑘𝑒𝑡 𝑐𝑜𝑛𝑐𝑒𝑛𝑡𝑟𝑎𝑡𝑖𝑜𝑛 𝑖𝑠 𝑡ℎ𝑒 𝑛𝑒𝑤 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑚𝑜𝑑𝑒𝑙—“𝑤𝑖𝑛𝑛𝑒𝑟 𝑡𝑎𝑘𝑒𝑠 𝑎𝑙𝑙, 𝑐𝑜𝑚𝑝𝑒𝑡𝑖𝑡𝑜𝑟𝑠 𝑗𝑢𝑠𝑡 𝑑𝑒𝑐𝑜𝑟”?

x.com/mohossain/st...

Unlike 1969, when Buffett shut down his hedge fund amid frothy valuations…

𝑀𝑎𝑟𝑘𝑒𝑡 𝑐𝑜𝑛𝑐𝑒𝑛𝑡𝑟𝑎𝑡𝑖𝑜𝑛 𝑖𝑠 𝑡ℎ𝑒 𝑛𝑒𝑤 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑚𝑜𝑑𝑒𝑙—“𝑤𝑖𝑛𝑛𝑒𝑟 𝑡𝑎𝑘𝑒𝑠 𝑎𝑙𝑙, 𝑐𝑜𝑚𝑝𝑒𝑡𝑖𝑡𝑜𝑟𝑠 𝑗𝑢𝑠𝑡 𝑑𝑒𝑐𝑜𝑟”?

x.com/mohossain/st...

—LPs retreat as capital returned fails to materialize, and PE faces a growing backlog of aging assets.

Real assets, with tangible income and “political sizzle,” are the only strategy outperforming their long-term IRRs?

x.com/mohossain/st...

—LPs retreat as capital returned fails to materialize, and PE faces a growing backlog of aging assets.

Real assets, with tangible income and “political sizzle,” are the only strategy outperforming their long-term IRRs?

x.com/mohossain/st...

• 6.65% of subprime borrowers are 60+ days late — highest since 1994

• Subprime share of consumers up to 14.4%

• 28% of trade‑ins carry negative equity, avg new car price >$50K.

x.com/mohossain/st...

• 6.65% of subprime borrowers are 60+ days late — highest since 1994

• Subprime share of consumers up to 14.4%

• 28% of trade‑ins carry negative equity, avg new car price >$50K.

x.com/mohossain/st...

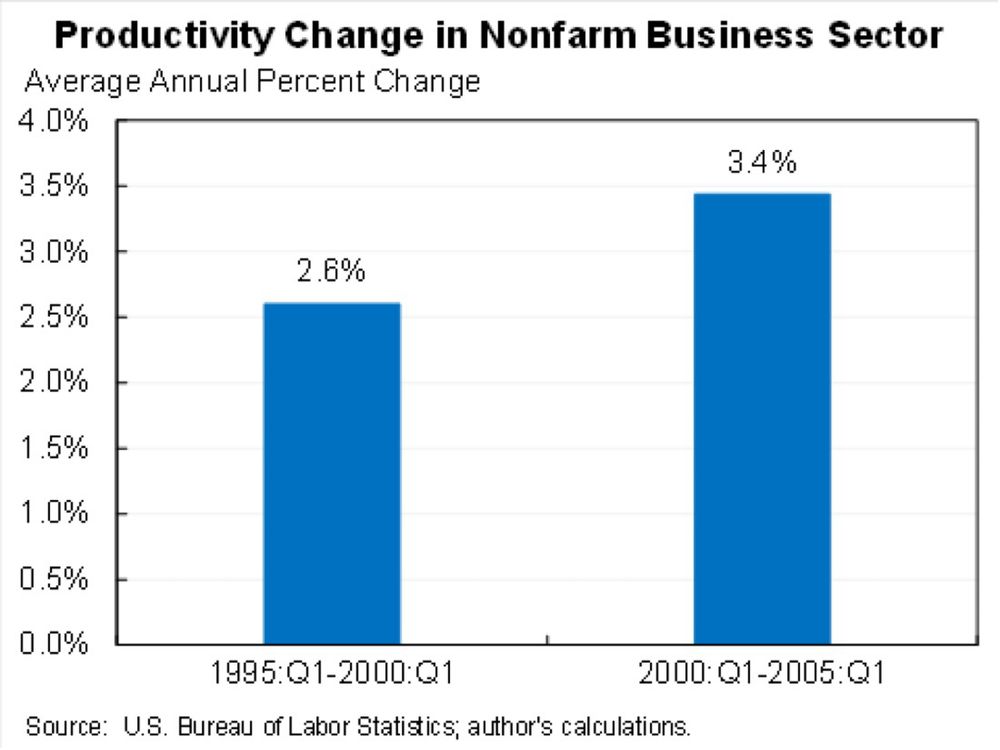

🚂📞🛢️🤖 … 𝑀𝑎𝑛𝑖𝑎 𝑖𝑠 𝑎 𝑓𝑒𝑎𝑡𝑢𝑟𝑒, 𝑛𝑜𝑡 𝑎 𝑏𝑢𝑔.

Every tech boom rides in with productivity gains and capital euphoria—then leaves investors holding the bubble bag.

From railways to AI: +600% up, then reality.

So what’s your edge ..?

x.com/mohossain/st...

🚂📞🛢️🤖 … 𝑀𝑎𝑛𝑖𝑎 𝑖𝑠 𝑎 𝑓𝑒𝑎𝑡𝑢𝑟𝑒, 𝑛𝑜𝑡 𝑎 𝑏𝑢𝑔.

Every tech boom rides in with productivity gains and capital euphoria—then leaves investors holding the bubble bag.

From railways to AI: +600% up, then reality.

So what’s your edge ..?

x.com/mohossain/st...

90‑day correlation between US IG spreads & S&P is rising — rare territory.

Only 5 times in the past decade we’ve seen less‑negative readings

Now? Mini‑decoupling driven by:

• AI issuance wave

• Hidden risk jitters

Credit isn’t just following equities anymore…

90‑day correlation between US IG spreads & S&P is rising — rare territory.

Only 5 times in the past decade we’ve seen less‑negative readings

Now? Mini‑decoupling driven by:

• AI issuance wave

• Hidden risk jitters

Credit isn’t just following equities anymore…

🐸 Renovo’s 💯‑to‑zero overnight

From Zips Car Wash to Tricolor Auto, everyone fears the boiling frog — but in this market, you don’t simmer. You splat.

x.com/mohossain/st...

🐸 Renovo’s 💯‑to‑zero overnight

From Zips Car Wash to Tricolor Auto, everyone fears the boiling frog — but in this market, you don’t simmer. You splat.

x.com/mohossain/st...

Deals: $30B @ 6.58% | $38B @ 6.40% | $12–20B @ 10.50%

Capital costs rise, structures get complex. Yield for credit investors, risk for equity holders?

x.com/mohossain/st... #privatedebt

x.com/mohossain/st...

Deals: $30B @ 6.58% | $38B @ 6.40% | $12–20B @ 10.50%

Capital costs rise, structures get complex. Yield for credit investors, risk for equity holders?

x.com/mohossain/st... #privatedebt

x.com/mohossain/st...