NEF's senior economist @jayasood.bsky.social on @lbc.co.uk.

NEF's senior economist @jayasood.bsky.social on @lbc.co.uk.

bit.ly/4oaCGhM

bit.ly/4oaCGhM

@jayasood.bsky.social on the upcoming autumn budget in @politicshome.bsky.social

www.politicshome.com/news/article...

@jayasood.bsky.social on the upcoming autumn budget in @politicshome.bsky.social

www.politicshome.com/news/article...

www.theguardian.com/business/202...

www.theguardian.com/business/202...

That's more than the entire budget of the Department for Transport.

And where does this money ultimately end up? Lining the pockets of commercial banks.

That's more than the entire budget of the Department for Transport.

And where does this money ultimately end up? Lining the pockets of commercial banks.

…but Rachel Reeves & Keir Starmer are refusing to get out of bed with the banks and make it happen❗

Tell them to #TaxTheBanks today: bit.ly/TaxTheBanks

@jayasood.bsky.social responds to today's GDP figures.

@jayasood.bsky.social responds to today's GDP figures.

Our governing economic institutions, that set the tone for how our economy functions, are failing. They need a serious re-think 1/5

bit.ly/3V1JZeO

Our governing economic institutions, that set the tone for how our economy functions, are failing. They need a serious re-think 1/5

bit.ly/3V1JZeO

Here he addresses the question "How does the level of British public investment compare to other peer nations?"

Listen in full: www.parliamentlive.tv/Event/Index/...

Here he addresses the question "How does the level of British public investment compare to other peer nations?"

Listen in full: www.parliamentlive.tv/Event/Index/...

@survation.bsky.social reveals a majority of Labour MPs want the Chancellor to change course on fiscal policy.

1/8 thetimes.com/article/6448...

@survation.bsky.social reveals a majority of Labour MPs want the Chancellor to change course on fiscal policy.

1/8 thetimes.com/article/6448...

obr.uk

obr.uk

@jayasood.bsky.social , senior economist @neweconomics.bsky.social , makes the case for renewed public financing for mature tech like wind and solar:

@jayasood.bsky.social , senior economist @neweconomics.bsky.social , makes the case for renewed public financing for mature tech like wind and solar:

@jayasood.bsky.social explains why holding interest rates in response to today's inflation stats would be bad for people and the economy

@jayasood.bsky.social explains why holding interest rates in response to today's inflation stats would be bad for people and the economy

We're want:

💷 Decent pensions for all.

☀️ A just transition to a thriving low-carbon economy.

🚫 A phase-out of funding for fossil fuels, deforestation and other harmful industries.

Sign now: to.350.org/pensions

We're want:

💷 Decent pensions for all.

☀️ A just transition to a thriving low-carbon economy.

🚫 A phase-out of funding for fossil fuels, deforestation and other harmful industries.

Sign now: to.350.org/pensions

The good news is we have the tools to navigate this -- NEF's monetary- fiscal coordination framework explains how 👇🏽👇🏽

Wrote about this with Dom: neweconomics.org/2025/04/when...

The good news is we have the tools to navigate this -- NEF's monetary- fiscal coordination framework explains how 👇🏽👇🏽

Wrote about this with Dom: neweconomics.org/2025/04/when...

My new Op Ed in NZI:

www.netzeroinvestor.net/news-and-vie...

@jayasood.bsky.social

My new Op Ed in NZI:

www.netzeroinvestor.net/news-and-vie...

@jayasood.bsky.social

Our paper categorises different policy tools for different inflation scenarios

Our paper categorises different policy tools for different inflation scenarios

@theoharris.bsky.social & argue that Labour must position the NWF as a proactive, market-leading institution, with enough financial firepower to have impact.

@theoharris.bsky.social & argue that Labour must position the NWF as a proactive, market-leading institution, with enough financial firepower to have impact.

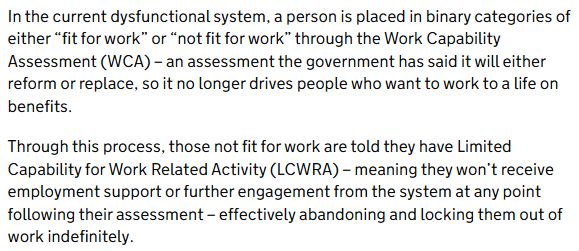

In two short paragraphs it peddles multiple falsehoods about the current system that will be used to justify upcoming cuts & changes

Here's what MPs & journalists should be challenging... 🧵

In two short paragraphs it peddles multiple falsehoods about the current system that will be used to justify upcoming cuts & changes

Here's what MPs & journalists should be challenging... 🧵