Property tax is devolved. As of right now, there's no mansion tax happening in Wales, Scotland, Northern Ireland.

Probably there will be, with each creating their own tax, potentially with different bands and rates...

Property tax is devolved. As of right now, there's no mansion tax happening in Wales, Scotland, Northern Ireland.

Probably there will be, with each creating their own tax, potentially with different bands and rates...

The exit tax leaks were really unfortunate. It would be a very good idea for Ms Reeves to clearly rule out any future exit tax.

The exit tax leaks were really unfortunate. It would be a very good idea for Ms Reeves to clearly rule out any future exit tax.

You can see who's paying - which constituency, which postcode - and how many "mansions" are near you.

Full interactive map here 👇

You can see who's paying - which constituency, which postcode - and how many "mansions" are near you.

Full interactive map here 👇

The council tax surcharge is a good policy. Very compromised/imperfect, but still good policy.

This is why:

The council tax surcharge is a good policy. Very compromised/imperfect, but still good policy.

This is why:

Hugely damaging to the UK. The exit tax rumours in particular. The uncertainty didn't end with the Budget - I expect an ongoing impact on business confidence and domestic/foreign investment.

Indefensible.

Hugely damaging to the UK. The exit tax rumours in particular. The uncertainty didn't end with the Budget - I expect an ongoing impact on business confidence and domestic/foreign investment.

Indefensible.

Why hasn't the SRA stopped him? Because he's conducted an extraordinary campaign against the SRA. 180 complaints. Two judicial reviews.

More here: buff.ly/LmLVegM

Why hasn't the SRA stopped him? Because he's conducted an extraordinary campaign against the SRA. 180 complaints. Two judicial reviews.

More here: buff.ly/LmLVegM

Why?

Why?

The consultation opens today, and closes last March.

The consultation opens today, and closes last March.

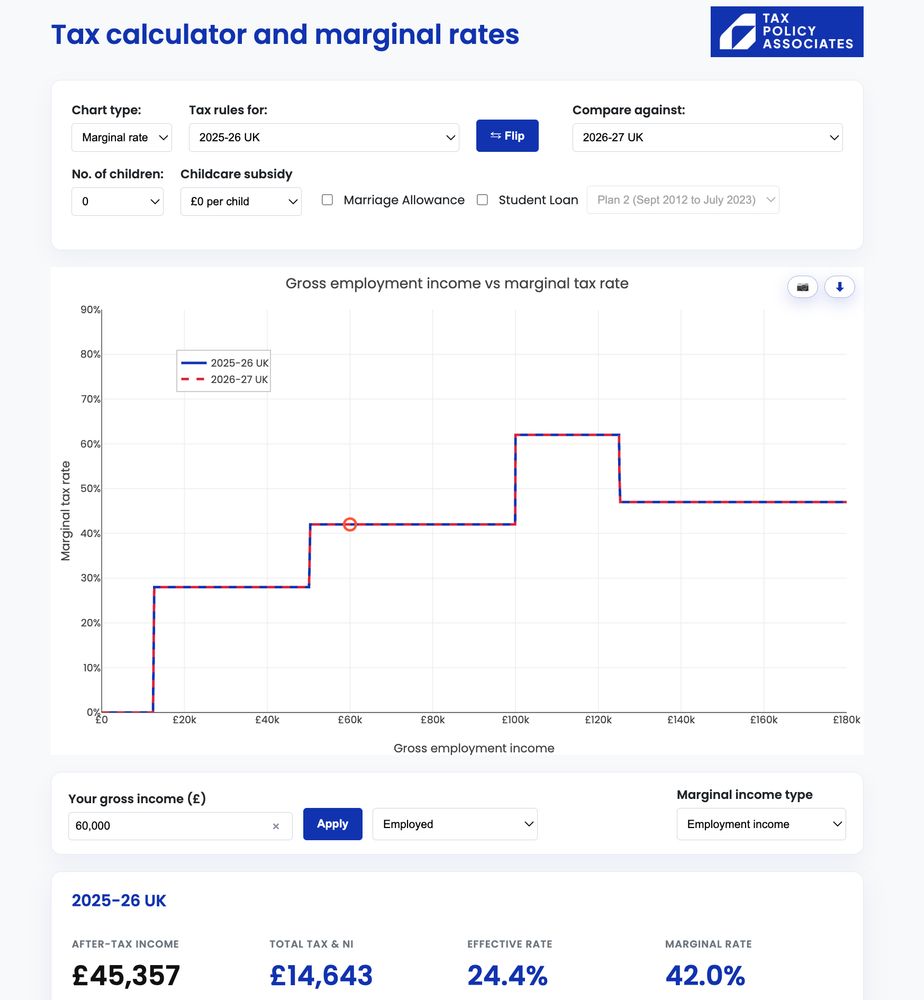

You'll see no change in the tax you pay in 2026/27 unless you're a landlord or receive interest/dividend income.

You'll see no change in the tax you pay in 2026/27 unless you're a landlord or receive interest/dividend income.

I expect we'd see: less tax on median earner. More tax on top decile. More welfare and benefit-in-kind at the higher deciles.

I expect we'd see: less tax on median earner. More tax on top decile. More welfare and benefit-in-kind at the higher deciles.

The bad: the Budget contained no significant tax reforms, and almost nothing in the way of pro-growth measures. The capital allowance change will reduce business investment - it's positively anti-growth.

The bad: the Budget contained no significant tax reforms, and almost nothing in the way of pro-growth measures. The capital allowance change will reduce business investment - it's positively anti-growth.

Probably somewhere between £150k and £375k.

So if you own a £5m house, you just lost money.

If you were planning to buy one, you haven't (because you'll pay the tax, but save on the purchase)

Probably somewhere between £150k and £375k.

So if you own a £5m house, you just lost money.

If you were planning to buy one, you haven't (because you'll pay the tax, but save on the purchase)

(It has to be renewed each year or it ceases to apply. Because it's a temporary tax, introduced to fund the Napoleonic wars)

(It has to be renewed each year or it ceases to apply. Because it's a temporary tax, introduced to fund the Napoleonic wars)

Some quick thoughts: buff.ly/1dW05S4

Some quick thoughts: buff.ly/1dW05S4

We'll be watching for these six:

We'll be watching for these six: