CaixaBank Research

@caixabankresearch.bsky.social

www.caixabankresearch.com

Canal de información económica del Servicio de Estudios de CaixaBank | Canal d'informació econòmica del Servei d'Estudis de CaixaBank | Economic Research & Analysis

Canal de información económica del Servicio de Estudios de CaixaBank | Canal d'informació econòmica del Servei d'Estudis de CaixaBank | Economic Research & Analysis

🔵📈 #FinancialMarketsDailyReport Sep 12 |

Markets were mixed in yesterday's session. Global stock markets advanced and U.S. sovereign yields nudged down as the U.S. CPI report did not depress investor expectations about Fed cuts. ⤵️

Markets were mixed in yesterday's session. Global stock markets advanced and U.S. sovereign yields nudged down as the U.S. CPI report did not depress investor expectations about Fed cuts. ⤵️

September 12, 2025 at 8:14 AM

🔵📈 #FinancialMarketsDailyReport Sep 12 |

Markets were mixed in yesterday's session. Global stock markets advanced and U.S. sovereign yields nudged down as the U.S. CPI report did not depress investor expectations about Fed cuts. ⤵️

Markets were mixed in yesterday's session. Global stock markets advanced and U.S. sovereign yields nudged down as the U.S. CPI report did not depress investor expectations about Fed cuts. ⤵️

🔵📈 #FinancialMarketsDailyReport Sep 10 | Investors seemingly recovered some appetite for risk in yesterday's session. Stock markets rose moderately across advanced economies and sovereign yields increased both in the US and Europe. ⤵️

September 10, 2025 at 8:28 AM

🔵📈 #FinancialMarketsDailyReport Sep 10 | Investors seemingly recovered some appetite for risk in yesterday's session. Stock markets rose moderately across advanced economies and sovereign yields increased both in the US and Europe. ⤵️

📚 #InformeMensual 09/2025 📚

Empezamos el curso con nuestro análisis mensual de la situación y los temas clave de la economía y los mercados financieros, y con un nuevo e interesante 📌Dossier: "Desafíos y políticas en la era de la longevidad".

Léelo aquí 👇🔗

www.caixabankresearch.com/es/informe-m...

Empezamos el curso con nuestro análisis mensual de la situación y los temas clave de la economía y los mercados financieros, y con un nuevo e interesante 📌Dossier: "Desafíos y políticas en la era de la longevidad".

Léelo aquí 👇🔗

www.caixabankresearch.com/es/informe-m...

September 9, 2025 at 1:27 PM

📚 #InformeMensual 09/2025 📚

Empezamos el curso con nuestro análisis mensual de la situación y los temas clave de la economía y los mercados financieros, y con un nuevo e interesante 📌Dossier: "Desafíos y políticas en la era de la longevidad".

Léelo aquí 👇🔗

www.caixabankresearch.com/es/informe-m...

Empezamos el curso con nuestro análisis mensual de la situación y los temas clave de la economía y los mercados financieros, y con un nuevo e interesante 📌Dossier: "Desafíos y políticas en la era de la longevidad".

Léelo aquí 👇🔗

www.caixabankresearch.com/es/informe-m...

🔵📈 Global stocks rebounded and sovereign yields continued to decline as investors cemented their expectations for rate cuts ahead of the Fed's next week meeting. The USD weakened moderately across other major currencies and gold prices continued to surge. ⤵️

September 9, 2025 at 8:26 AM

🔵📈 Global stocks rebounded and sovereign yields continued to decline as investors cemented their expectations for rate cuts ahead of the Fed's next week meeting. The USD weakened moderately across other major currencies and gold prices continued to surge. ⤵️

🔵📈 #FinancialMarketsDailyReport Sep. 8 |

Risk-off sentiment drove markets after a weaker-than-expected U.S. labor market report (nonfarm payrolls +22k in August, and June-July revised down to a cumulative +66k [prior: +87k]). ⤵️

Risk-off sentiment drove markets after a weaker-than-expected U.S. labor market report (nonfarm payrolls +22k in August, and June-July revised down to a cumulative +66k [prior: +87k]). ⤵️

September 8, 2025 at 8:08 AM

🔵📈 #FinancialMarketsDailyReport Sep. 8 |

Risk-off sentiment drove markets after a weaker-than-expected U.S. labor market report (nonfarm payrolls +22k in August, and June-July revised down to a cumulative +66k [prior: +87k]). ⤵️

Risk-off sentiment drove markets after a weaker-than-expected U.S. labor market report (nonfarm payrolls +22k in August, and June-July revised down to a cumulative +66k [prior: +87k]). ⤵️

🔵🏦 #Observatorio #BCE | Todo sugiere que en su reunión del próximo 11 de septiembre el BCE mantendrá los tipos en los niveles actuales (depo en el 2,00%). ⤵️

September 5, 2025 at 10:08 AM

🔵🏦 #Observatorio #BCE | Todo sugiere que en su reunión del próximo 11 de septiembre el BCE mantendrá los tipos en los niveles actuales (depo en el 2,00%). ⤵️

🔵📈 #FinancialMarketsDailyReport Sep 5 |

Data released yesterday, which continued to point to a cooling US labor market, including higher-than-expected unemployment benefit claims and slower private job creation, reinforced expectations of a Fed cut later this month. ⤵️

Data released yesterday, which continued to point to a cooling US labor market, including higher-than-expected unemployment benefit claims and slower private job creation, reinforced expectations of a Fed cut later this month. ⤵️

September 5, 2025 at 9:41 AM

🔵📈 #FinancialMarketsDailyReport Sep 5 |

Data released yesterday, which continued to point to a cooling US labor market, including higher-than-expected unemployment benefit claims and slower private job creation, reinforced expectations of a Fed cut later this month. ⤵️

Data released yesterday, which continued to point to a cooling US labor market, including higher-than-expected unemployment benefit claims and slower private job creation, reinforced expectations of a Fed cut later this month. ⤵️

🔵📈 #FinancialMarketsDailyReport Sep 4th |

Dovish remarks from Fed Governor Chris Waller and a JOLTS job report that showed US job openings fell in July to the lowest in 10 months, reniforced market expectations of a Fed rate cut in its September meeting. ⤵️

Dovish remarks from Fed Governor Chris Waller and a JOLTS job report that showed US job openings fell in July to the lowest in 10 months, reniforced market expectations of a Fed rate cut in its September meeting. ⤵️

September 4, 2025 at 7:57 AM

🔵📈 #FinancialMarketsDailyReport Sep 4th |

Dovish remarks from Fed Governor Chris Waller and a JOLTS job report that showed US job openings fell in July to the lowest in 10 months, reniforced market expectations of a Fed rate cut in its September meeting. ⤵️

Dovish remarks from Fed Governor Chris Waller and a JOLTS job report that showed US job openings fell in July to the lowest in 10 months, reniforced market expectations of a Fed rate cut in its September meeting. ⤵️

🔵📈 #FinancialMarketsDailyReport Sep 3 |

Renewed fears about inflation and fiscal discipline prompted a broad sovereign bond sell-off. The Japanese 20-year bond yield reached levels not seen since 1999, the 30-year UK yield touched highs from 1998... ⤵️

Renewed fears about inflation and fiscal discipline prompted a broad sovereign bond sell-off. The Japanese 20-year bond yield reached levels not seen since 1999, the 30-year UK yield touched highs from 1998... ⤵️

September 3, 2025 at 7:35 AM

🔵📈 #FinancialMarketsDailyReport Sep 3 |

Renewed fears about inflation and fiscal discipline prompted a broad sovereign bond sell-off. The Japanese 20-year bond yield reached levels not seen since 1999, the 30-year UK yield touched highs from 1998... ⤵️

Renewed fears about inflation and fiscal discipline prompted a broad sovereign bond sell-off. The Japanese 20-year bond yield reached levels not seen since 1999, the 30-year UK yield touched highs from 1998... ⤵️

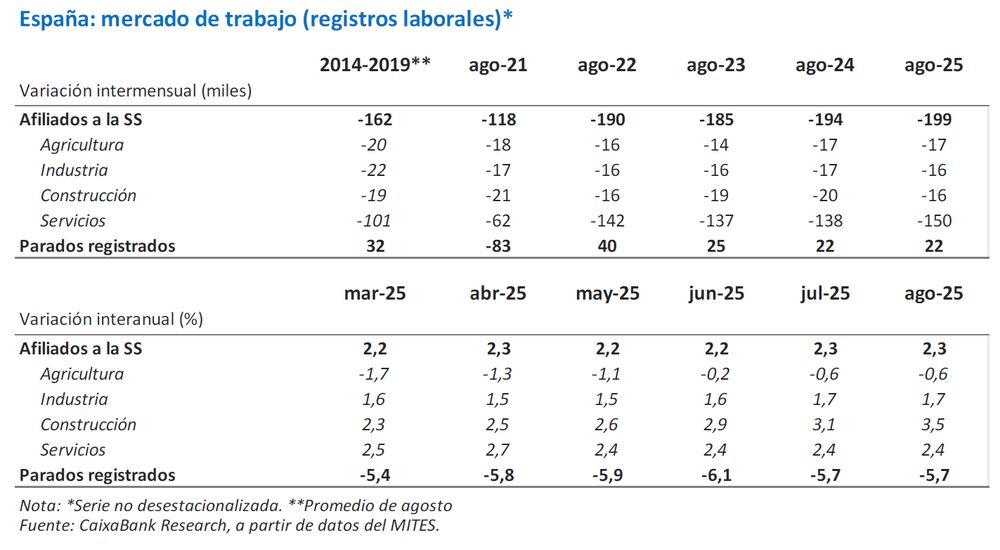

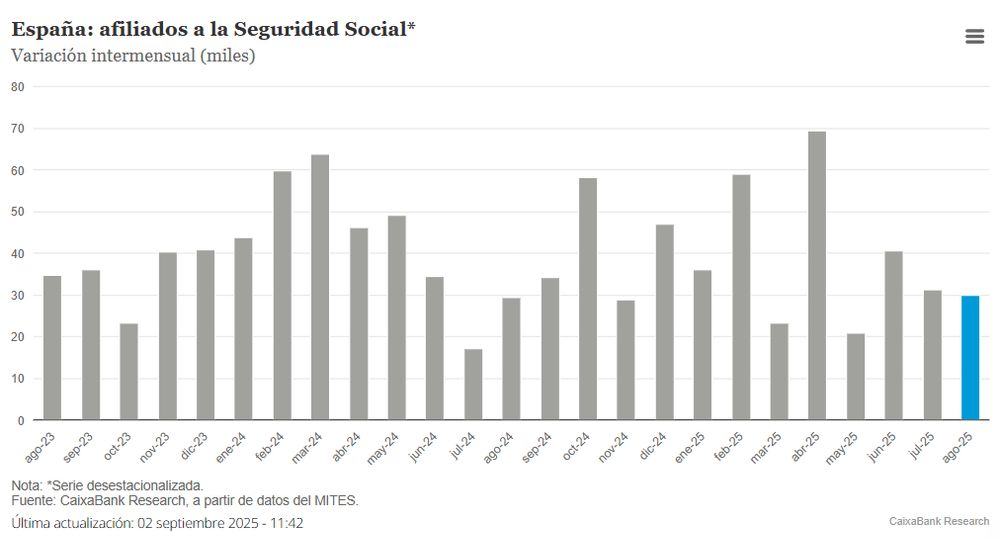

🔵👷♀️ Tónica positiva del mercado laboral español pese a la estacionalidad adversa del fin del verano: el dato de afiliación a la Seguridad Social de agosto no da sorpresas y mantiene un notable ritmo de crecimiento interanual del 2,3%.

September 2, 2025 at 1:07 PM

🔵👷♀️ Tónica positiva del mercado laboral español pese a la estacionalidad adversa del fin del verano: el dato de afiliación a la Seguridad Social de agosto no da sorpresas y mantiene un notable ritmo de crecimiento interanual del 2,3%.

🔵🛒 La #inflación general de la #eurozona fue del 2,1% yoy en agosto, y la núcleo se mantuvo en el 2,3% por cuarto mes consecutivo. Los datos fueron acordes con lo esperado y reflejan una inflación virtualmente en el objetivo ⤵️

September 2, 2025 at 11:42 AM

🔵🛒 La #inflación general de la #eurozona fue del 2,1% yoy en agosto, y la núcleo se mantuvo en el 2,3% por cuarto mes consecutivo. Los datos fueron acordes con lo esperado y reflejan una inflación virtualmente en el objetivo ⤵️

🔵📈 #FinancialMarkets #DailyReport Sep. 2nd |

Markets had a muted reaction to a U.S. federal appeals court which ruled 7–4 that tariffs imposed under the IEEPA exceed congressional authority, affecting general bilateral tariffs but not sector-specific ones. ⤵️

Markets had a muted reaction to a U.S. federal appeals court which ruled 7–4 that tariffs imposed under the IEEPA exceed congressional authority, affecting general bilateral tariffs but not sector-specific ones. ⤵️

September 2, 2025 at 9:17 AM

🔵📈 #FinancialMarkets #DailyReport Sep. 2nd |

Markets had a muted reaction to a U.S. federal appeals court which ruled 7–4 that tariffs imposed under the IEEPA exceed congressional authority, affecting general bilateral tariffs but not sector-specific ones. ⤵️

Markets had a muted reaction to a U.S. federal appeals court which ruled 7–4 that tariffs imposed under the IEEPA exceed congressional authority, affecting general bilateral tariffs but not sector-specific ones. ⤵️

🔵📈 #FinancialMarketsDailyReport Sep 1st |

Investors ended August with a mixed session as markets remained focused primarily on inflation data and monetary policy expectations (for a quick review of last month’s financial market developments, see our take here). ⤵️

Investors ended August with a mixed session as markets remained focused primarily on inflation data and monetary policy expectations (for a quick review of last month’s financial market developments, see our take here). ⤵️

September 1, 2025 at 8:03 AM

🔵📈 #FinancialMarketsDailyReport Sep 1st |

Investors ended August with a mixed session as markets remained focused primarily on inflation data and monetary policy expectations (for a quick review of last month’s financial market developments, see our take here). ⤵️

Investors ended August with a mixed session as markets remained focused primarily on inflation data and monetary policy expectations (for a quick review of last month’s financial market developments, see our take here). ⤵️

🔵🛒 La inflación en España se mantiene en el 2,7% en agosto gracias a la moderación de los precios de los alimentos y de la electricidad 👇

www.caixabankresearch.com/es/publicaci...

www.caixabankresearch.com/es/publicaci...

www.caixabankresearch.com

August 29, 2025 at 10:53 AM

🔵🛒 La inflación en España se mantiene en el 2,7% en agosto gracias a la moderación de los precios de los alimentos y de la electricidad 👇

www.caixabankresearch.com/es/publicaci...

www.caixabankresearch.com/es/publicaci...

🩴 Nuestras publicaciones se toman un descanso por vacaciones: volveremos a finales de agosto con más informes y análisis económicos. ¡Muchas gracias por leernos!

#BonEstiu #FelizVerano #HappySummer

#BonEstiu #FelizVerano #HappySummer

August 4, 2025 at 9:39 AM

🩴 Nuestras publicaciones se toman un descanso por vacaciones: volveremos a finales de agosto con más informes y análisis económicos. ¡Muchas gracias por leernos!

#BonEstiu #FelizVerano #HappySummer

#BonEstiu #FelizVerano #HappySummer

🔵🏦 La #Fed pausa y apuesta a que el verano traerá claridad |En una decisión ampliamente descontada por los mercados financieros, la Reserva Federal mantuvo tipos en el rango de 4,25%-4,50%, prolongando por quinta vez consecutiva la pausa que inició este año. ⤵️

July 31, 2025 at 12:09 PM

🔵🏦 La #Fed pausa y apuesta a que el verano traerá claridad |En una decisión ampliamente descontada por los mercados financieros, la Reserva Federal mantuvo tipos en el rango de 4,25%-4,50%, prolongando por quinta vez consecutiva la pausa que inició este año. ⤵️

🔵📈 #FinancialMarketsDaily July 31 |

The Federal Reserve held the federal funds rate at 4,25%-4,50%, citing solid labor market conditions and above-target inflation. Financial markets made a hawkish reading of the Fed's accompanying statement... ⤵️

The Federal Reserve held the federal funds rate at 4,25%-4,50%, citing solid labor market conditions and above-target inflation. Financial markets made a hawkish reading of the Fed's accompanying statement... ⤵️

July 31, 2025 at 8:00 AM

🔵📈 #FinancialMarketsDaily July 31 |

The Federal Reserve held the federal funds rate at 4,25%-4,50%, citing solid labor market conditions and above-target inflation. Financial markets made a hawkish reading of the Fed's accompanying statement... ⤵️

The Federal Reserve held the federal funds rate at 4,25%-4,50%, citing solid labor market conditions and above-target inflation. Financial markets made a hawkish reading of the Fed's accompanying statement... ⤵️

🔵🛒 La energía vuelve impulsar la #inflación al alza en julio | La inflación general aumentó en #España 4 décimas hasta el 2,7%, y la inflación subyacente subió 1 décima hasta el 2,3%, según el indicador adelantado del IPC publicado por el INE. ⤵️

July 30, 2025 at 11:10 AM

🔵🛒 La energía vuelve impulsar la #inflación al alza en julio | La inflación general aumentó en #España 4 décimas hasta el 2,7%, y la inflación subyacente subió 1 décima hasta el 2,3%, según el indicador adelantado del IPC publicado por el INE. ⤵️

🔵📈 #FinancialMarkets #DailyReport July 30 |

Euro area investor sentiment recovered following the EU-US trade deal, sending stocks higher across the region. ⤵️

Euro area investor sentiment recovered following the EU-US trade deal, sending stocks higher across the region. ⤵️

July 30, 2025 at 7:52 AM

🔵📈 #FinancialMarkets #DailyReport July 30 |

Euro area investor sentiment recovered following the EU-US trade deal, sending stocks higher across the region. ⤵️

Euro area investor sentiment recovered following the EU-US trade deal, sending stocks higher across the region. ⤵️

🔵📊 Sorpresa positiva del crecimiento en España |

El PIB del 2T crece un 0,7% t/t (2,8% a/a), 1 décima más que el trimestre anterior y 2 décimas por encima de nuestra previsión. ⤵️

El PIB del 2T crece un 0,7% t/t (2,8% a/a), 1 décima más que el trimestre anterior y 2 décimas por encima de nuestra previsión. ⤵️

July 29, 2025 at 1:17 PM

🔵📊 Sorpresa positiva del crecimiento en España |

El PIB del 2T crece un 0,7% t/t (2,8% a/a), 1 décima más que el trimestre anterior y 2 décimas por encima de nuestra previsión. ⤵️

El PIB del 2T crece un 0,7% t/t (2,8% a/a), 1 décima más que el trimestre anterior y 2 décimas por encima de nuestra previsión. ⤵️

🔵📈 #FinancialMarkets #DailyReport July 29 | Initial optimism over the EU-U.S. trade deal, which had boosted European stocks early in the trading session, soon faded and the region's main indices closed lower with losses led by German stocks ( 1%). ⤵️

July 29, 2025 at 6:34 AM

🔵📈 #FinancialMarkets #DailyReport July 29 | Initial optimism over the EU-U.S. trade deal, which had boosted European stocks early in the trading session, soon faded and the region's main indices closed lower with losses led by German stocks ( 1%). ⤵️

🔵📈 #FinancialMarketsDaily July, 28 |

Markets ended the week with a mixed session. Optimism over trade deals continued to support U.S. equity markets, sending the S&P 500 and the Nasdaq to new record highs... ⤵️

Markets ended the week with a mixed session. Optimism over trade deals continued to support U.S. equity markets, sending the S&P 500 and the Nasdaq to new record highs... ⤵️

July 28, 2025 at 7:00 AM

🔵📈 #FinancialMarketsDaily July, 28 |

Markets ended the week with a mixed session. Optimism over trade deals continued to support U.S. equity markets, sending the S&P 500 and the Nasdaq to new record highs... ⤵️

Markets ended the week with a mixed session. Optimism over trade deals continued to support U.S. equity markets, sending the S&P 500 and the Nasdaq to new record highs... ⤵️

🔵🏦 Anticipamos que la Fed dejará nuevamente sin cambios los tipos de interés (fed funds en el 4,25%-4,50%), sin unanimidad ⤵️

July 25, 2025 at 12:41 PM

🔵🏦 Anticipamos que la Fed dejará nuevamente sin cambios los tipos de interés (fed funds en el 4,25%-4,50%), sin unanimidad ⤵️