Follow us on all socials to boost tax fairness ➡️ @4taxfairness

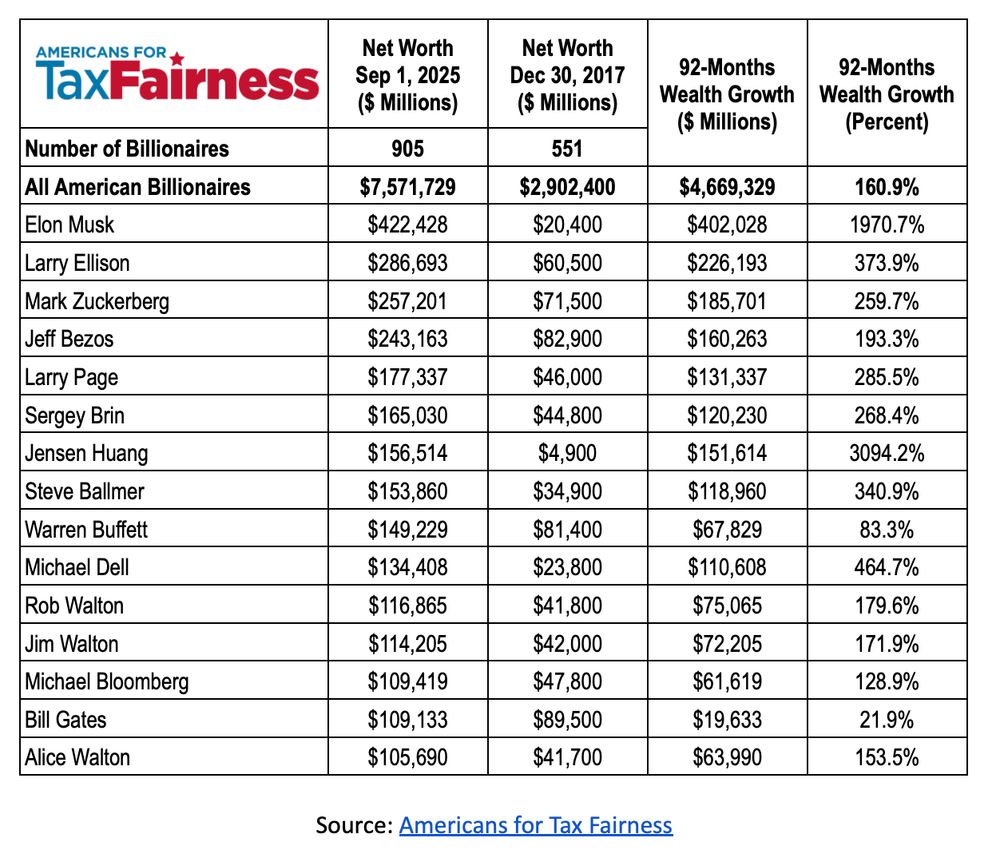

That's a $4.7 TRILLION increase since the last Trump tax scam.

Yes, wealth increase is a form of INCOME. And most of that income will never be taxed.

This is why we need a Billionaires Income Tax.

And 5 million people are about to lose their healthcare coverage next year.

This economy is being rigged on purpose.

And 5 million people are about to lose their healthcare coverage next year.

This economy is being rigged on purpose.

Healthcare patients are paying higher prices than ever.

When will we stop enriching those at the top at the expense of the people?

Healthcare patients are paying higher prices than ever.

When will we stop enriching those at the top at the expense of the people?

This will result in MILLIONS losing healthcare.

The same Republican-led Senate gave out multi billion-dollar tax cuts to the rich earlier this summer.

Our system is so upside-down.

This will result in MILLIONS losing healthcare.

The same Republican-led Senate gave out multi billion-dollar tax cuts to the rich earlier this summer.

Our system is so upside-down.

How many times do we have to see this happen until we invest in us over CEOs?

How many times do we have to see this happen until we invest in us over CEOs?

The Affordable Care Act's tax credits will expire at the end of this year.

Republicans could have extended them in their budget bill this summer.

They didn't.

Instead, they gave Big Pharma and insurance companies a tax break.

The Affordable Care Act's tax credits will expire at the end of this year.

Republicans could have extended them in their budget bill this summer.

They didn't.

Instead, they gave Big Pharma and insurance companies a tax break.

But don't worry—that money is going to billionaire tax breaks instead, so I'm sure everything will work out fine.

But don't worry—that money is going to billionaire tax breaks instead, so I'm sure everything will work out fine.

We could stop it from happening, but Republicans in Congress are refusing to act.

You know what not enough people realize about all of this?

Those same Republicans JUST gave Big Pharma and insurance companies a huge tax break.

We could stop it from happening, but Republicans in Congress are refusing to act.

You know what not enough people realize about all of this?

Those same Republicans JUST gave Big Pharma and insurance companies a huge tax break.

That's a direct consequence of the United States cutting international development funding.

Never, ever forget that that money was spent on billionaire tax breaks instead.

Horrible.

That's a direct consequence of the United States cutting international development funding.

Never, ever forget that that money was spent on billionaire tax breaks instead.

Horrible.

It'll probably cost us $362.7 BILLION over ten years.

This isn't going to lower prices.

It's not going to create jobs.

It's just going to make corporations and their CEOs richer.

It'll probably cost us $362.7 BILLION over ten years.

This isn't going to lower prices.

It's not going to create jobs.

It's just going to make corporations and their CEOs richer.

They then spent $3.9 billion on stock buybacks and $2.6 billion on dividend payouts to further enrich their wealthy CEOs and shareholders.

Tax cuts for rich corporations never trickle down.

They then spent $3.9 billion on stock buybacks and $2.6 billion on dividend payouts to further enrich their wealthy CEOs and shareholders.

Tax cuts for rich corporations never trickle down.

Regular, working families are going to have to pay hundreds more in premiums next year.

Just months ago we decided to spend trillions giving billionaires tax breaks.

None of this makes any sense.

Regular, working families are going to have to pay hundreds more in premiums next year.

Just months ago we decided to spend trillions giving billionaires tax breaks.

None of this makes any sense.

But get this—

The tax break is allegedly meant to "incentivize" investment.

But that $16 billion writeoff is coming from investments they've ALREADY MADE.

We are being scammed, people.

But get this—

The tax break is allegedly meant to "incentivize" investment.

But that $16 billion writeoff is coming from investments they've ALREADY MADE.

We are being scammed, people.

That's what's going to happen if Republicans in Congress don't act.

But don't worry, billionaires got their tax breaks and I'm sure that'll trickle down soon.

That's what's going to happen if Republicans in Congress don't act.

But don't worry, billionaires got their tax breaks and I'm sure that'll trickle down soon.

The fact the filthy rich fight us on this is just another example of their out-of-control greed.

The fact the filthy rich fight us on this is just another example of their out-of-control greed.

That's a $1,016 average hike.

The only people who can afford a $1,000 price hike in this economy are millionaires and billionaires.

And we just cut healthcare to give them tax breaks.

Really.

That's a $1,016 average hike.

The only people who can afford a $1,000 price hike in this economy are millionaires and billionaires.

And we just cut healthcare to give them tax breaks.

Really.

Really?

Because we've been cutting taxes for the rich for forty years.

And now three guys own as much as the bottom 50% of Americans and the economy sucks for working people.

Really?

Because we've been cutting taxes for the rich for forty years.

And now three guys own as much as the bottom 50% of Americans and the economy sucks for working people.

All these billion-dollar tax cuts are going straight to lining the pockets of the CEOs.

All these billion-dollar tax cuts are going straight to lining the pockets of the CEOs.

Our salaries aren't going as far as they used to.

We're taking on debt and working multiple jobs.

And corporations are expecting to claim $16 BILLION from just one new tax break this year.

When was the last time your wallet got a boost like that?

Our salaries aren't going as far as they used to.

We're taking on debt and working multiple jobs.

And corporations are expecting to claim $16 BILLION from just one new tax break this year.

When was the last time your wallet got a boost like that?

Counting only Delta, Southwest and United—the collective tax rate declines to 4%.

The tax code is rigged.

Counting only Delta, Southwest and United—the collective tax rate declines to 4%.

The tax code is rigged.