Martin Sartorius

@martinsartorius.bsky.social

410 followers

730 following

38 posts

Principal Economist at the CBI. Views are my own

Posts

Media

Videos

Starter Packs

Reposted by Martin Sartorius

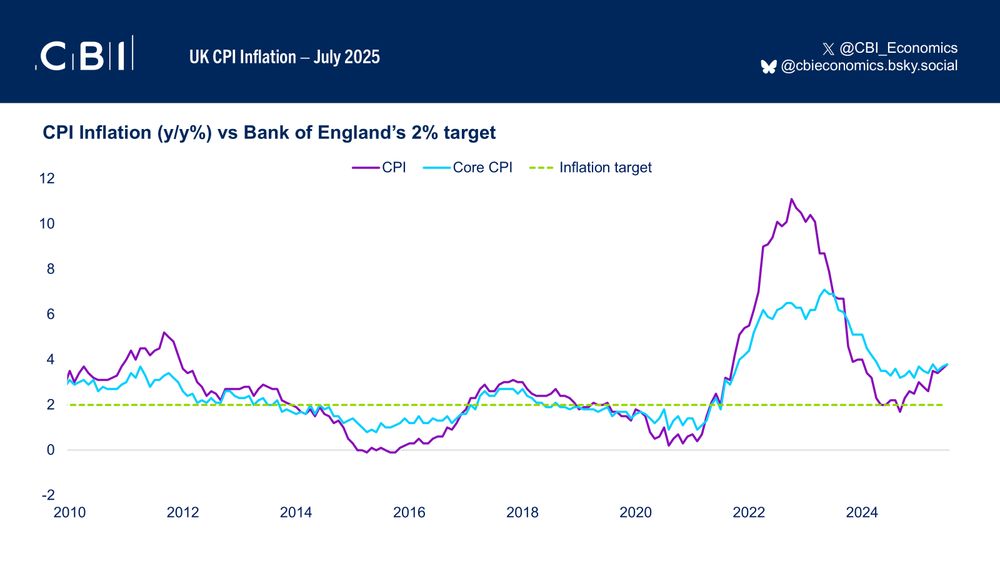

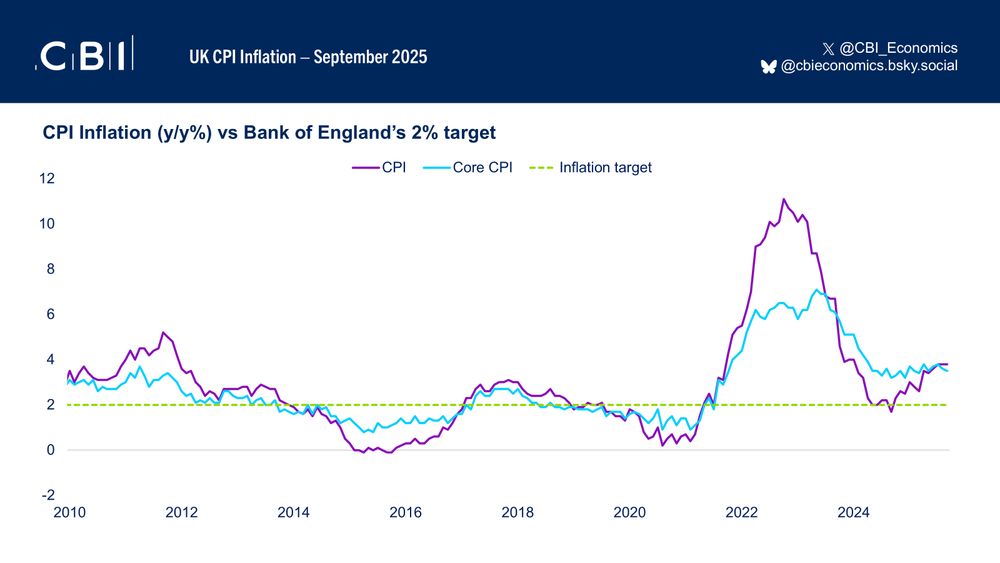

UK #CPI inflation held steady at 3.8% in the year to September, undershooting consensus expectations (of 4.0%). Core CPI inflation (excl. energy, food, alcohol, and tobacco) eased slightly to 3.5% (from 3.6% in August)

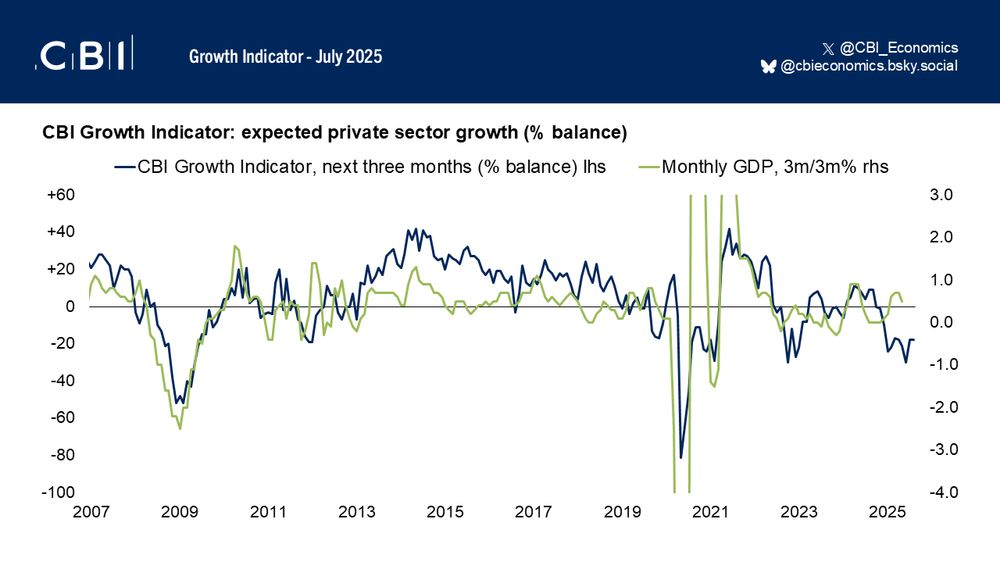

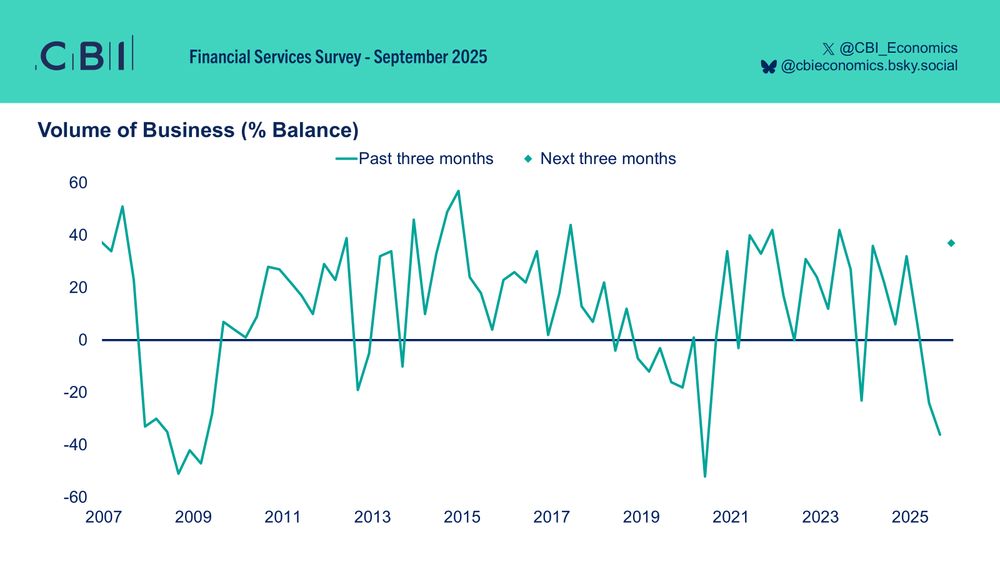

Business volumes in the financial services sector fell at the fastest rate since June 2020 in Q3 2025. However, firms expect volumes growth to make a strong recovery next quarter, according to the latest CBI Financial Services Survey.

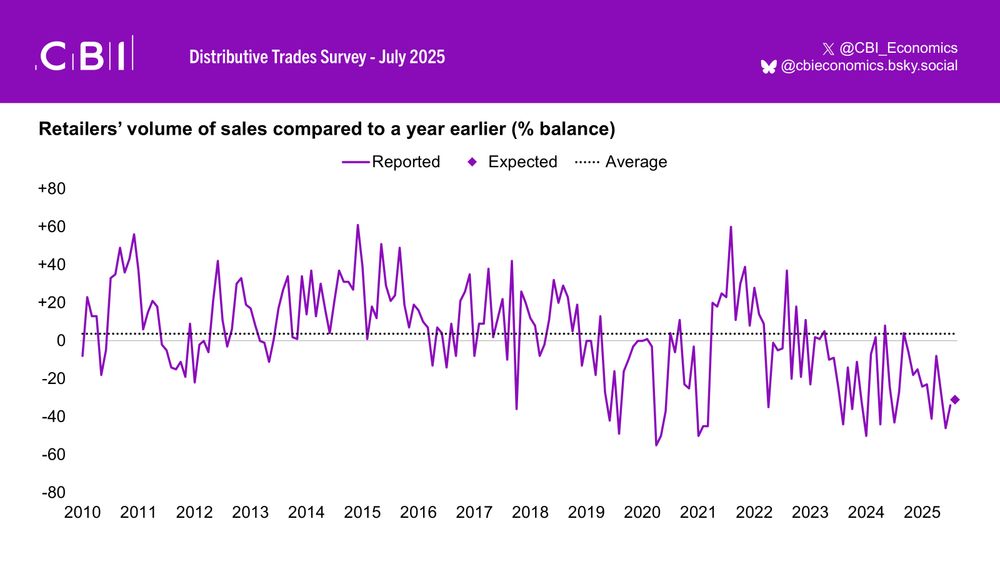

#Retail sales volumes fell year-on-year for the 12th month in a row in September, highlighting persistently weak demand conditions in the sector, according to the latest CBI DTS. Sales are expected to decline at a slightly faster rate next month.

Reposted by Martin Sartorius

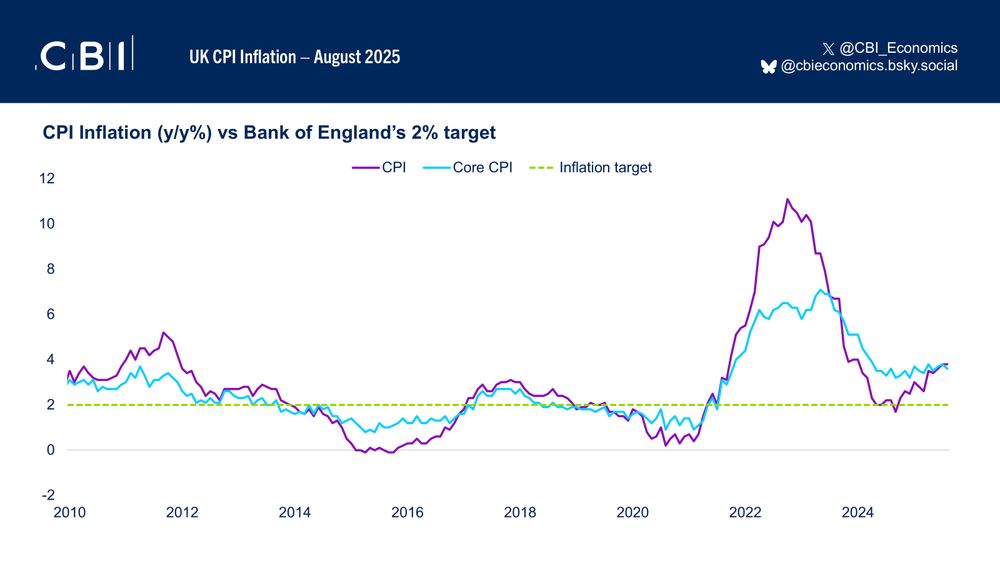

UK CPI #inflation remained steady at 3.8% in the year to August (unchanged from July), in line with consensus expectations. Core CPI inflation (excl. energy, food, alcohol, and tobacco) rose by 3.6% (down from 3.8% in July)

Reposted by Martin Sartorius

Reposted by Martin Sartorius

Reposted by Martin Sartorius

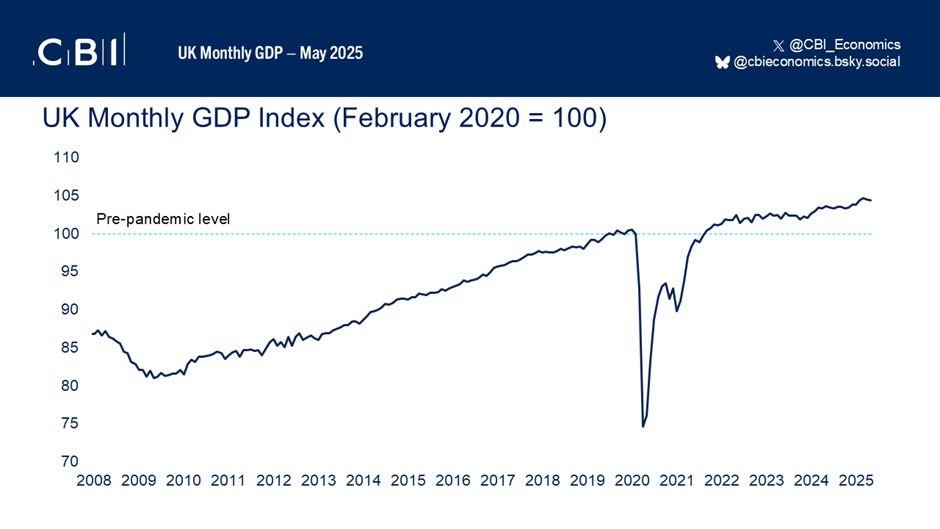

UK GDP grew by 0.3% q/q in Q2 2025, beating consensus estimates of 0.1%. Nonetheless, this marked a slowdown from the 0.7% growth seen over Q1 2025.

The Bank of England’s MPC voted 5-4 to cut Bank Rate by 25bp to 4.00%. The majority bloc voted for an interest rate reduction due to signs of disinflationary pressures stemming from weak activity and cooling labour market conditions

Reposted by Martin Sartorius

Reposted by Martin Sartorius

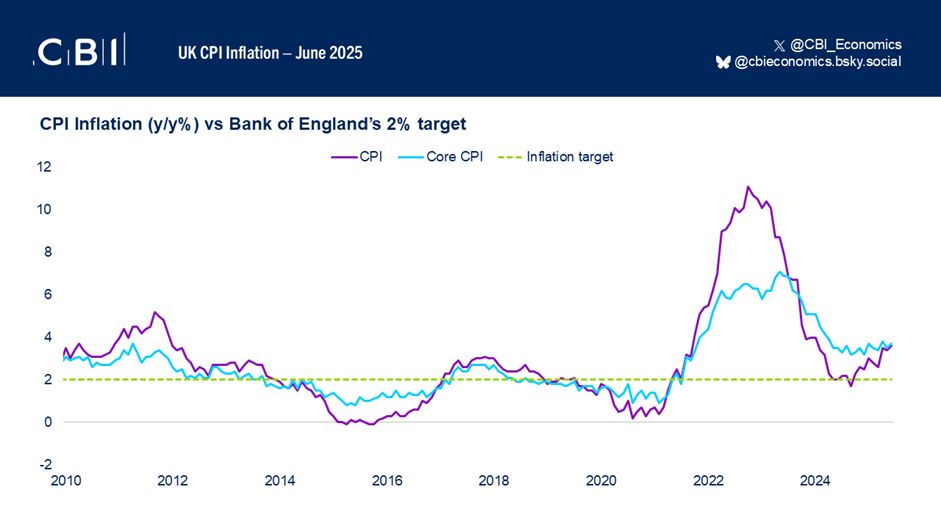

UK CPI inflation rose by a stronger-than-expected 3.6% in June (from 3.4% in May), marking the highest rate since January 2024. Core CPI inflation also increased to 3.7%, from 3.5% in the previous month

Reposted by Martin Sartorius

#Retail sales volumes fell at a sharp rate in the year to June, according to the latest CBI Distributive Trades Survey. Retailers expect sales to decline rapidly again next month.

Reposted by Martin Sartorius

🚨 New UK economic forecast is out! 🚨

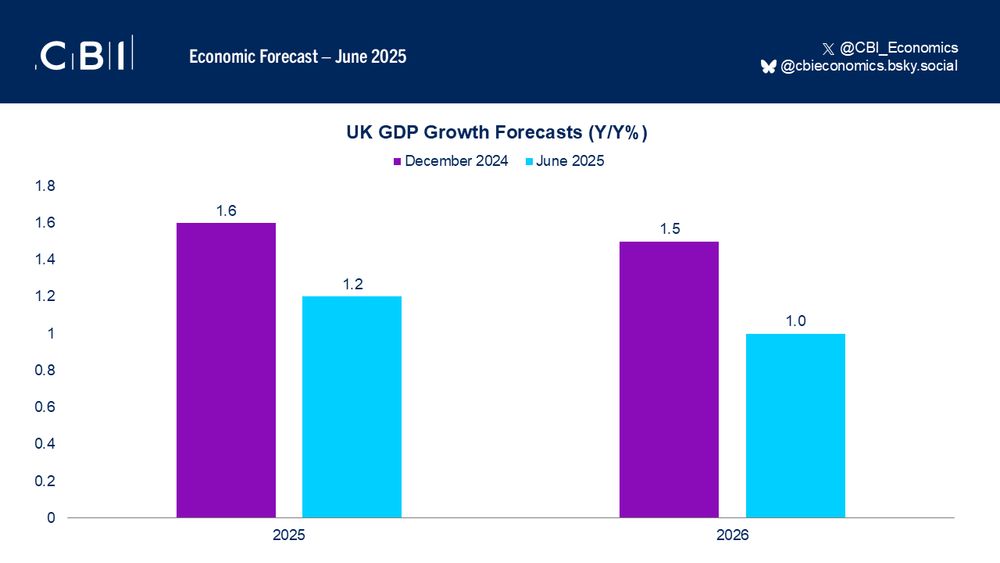

We project that the UK will see modest GDP growth of 1.2% in 2025 and 1.0% in 2026. The economy is facing stiff domestic & international headwinds that will weigh on activity.

Here’s what you need to know 👇🧵

#UKeconomy #Econsky #Econ

We project that the UK will see modest GDP growth of 1.2% in 2025 and 1.0% in 2026. The economy is facing stiff domestic & international headwinds that will weigh on activity.

Here’s what you need to know 👇🧵

#UKeconomy #Econsky #Econ