Alpesh Paleja

@alpeshpaleja.bsky.social

43 followers

74 following

50 posts

Deputy Chief Economist at the CBI. All views my own. 🌈

Posts

Media

Videos

Starter Packs

Pinned

Alpesh Paleja

@alpeshpaleja.bsky.social

· May 14

Hello! We’re the economics team at the Confederation of British Industry (CBI). Follow us for posts on UK macroeconomics, our business surveys, tax & fiscal policy, and updates on our consulting work.

Reposted by Alpesh Paleja

Reposted by Alpesh Paleja

This Thursday, we're pleased to be hosting Jon Hall, External Member of the Bank of England's Financial Policy Committee, for a discussion on safeguarding UK financial stability while supporting long-term growth.

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

🔒 Members only - register here: events.cbi.org.uk/event/2b056a....

Home - CBI Member Discussion with Jon Hall, External Member of the Bank of England's Financial Policy Committee (FPC)

events.cbi.org.uk

Reposted by Alpesh Paleja

Reposted by Alpesh Paleja

Kien Tan

@kientan74.bsky.social

· Sep 5

Correcting the record on retail sales, improving quality across economic statistics

Under new senior leadership the ONS is urgently focusing its resources on core economic statistics as part of a wider strategic recovery plan. In this post, incoming Director General for economic soci

blog.ons.gov.uk

Reposted by Alpesh Paleja

Alpesh Paleja

@alpeshpaleja.bsky.social

· Aug 21

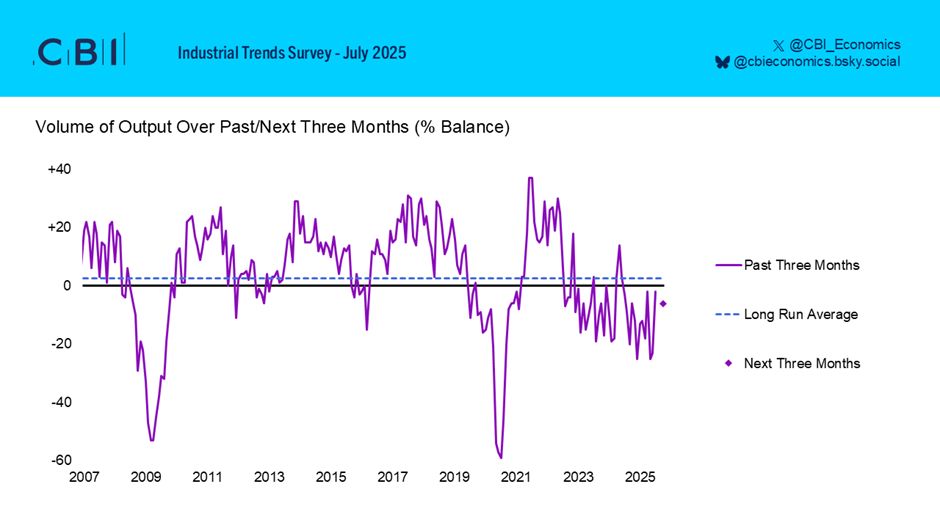

The latest CBI Industrial Trends Survey found that manufacturing output volumes fell in the three months to August, after being broadly unchanged in the three months to July. Manufacturers expect output volumes to decline again in the next three months.

Alpesh Paleja

@alpeshpaleja.bsky.social

· Aug 20

Alpesh Paleja

@alpeshpaleja.bsky.social

· Aug 20

Reposted by Alpesh Paleja

Reposted by Alpesh Paleja

Reposted by Alpesh Paleja

Alpesh Paleja

@alpeshpaleja.bsky.social

· Jul 30

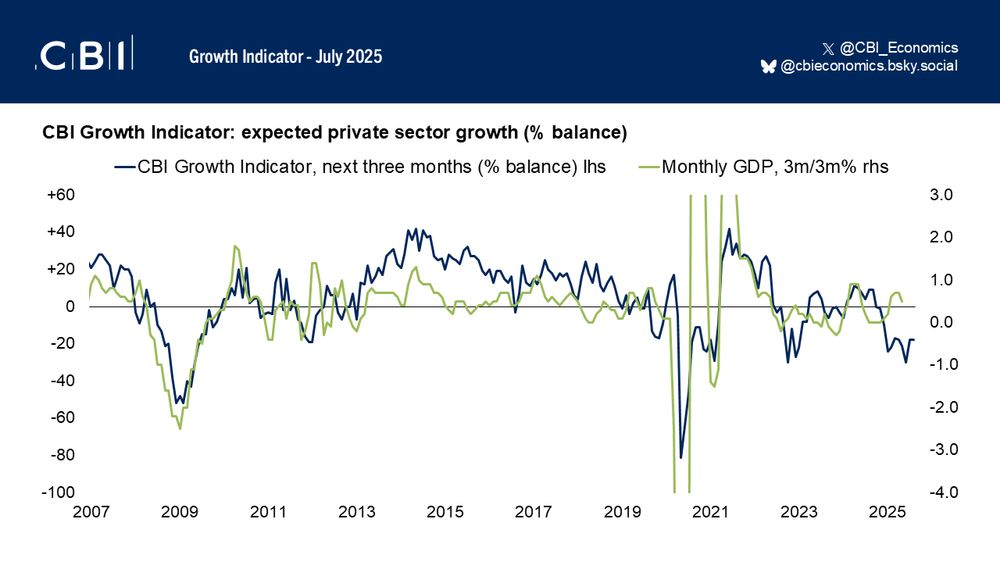

📉 Private sector firms expect activity to fall again through October.

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

The latest CBI Growth Indicator shows continued weakness across the economy, extending a run of negative sentiment that began in late 2024

Reposted by Alpesh Paleja