- When gov't engineers retire, highway projects cost more: the engineers pay for themselves 6 times over

- Improving gov’t engineer quality from the 25th to 75th percentile reduces costs by 14%, equal to 3x avg. engineer pay

Paper: papers.ssrn.com/sol3/papers....

- When gov't engineers retire, highway projects cost more: the engineers pay for themselves 6 times over

- Improving gov’t engineer quality from the 25th to 75th percentile reduces costs by 14%, equal to 3x avg. engineer pay

Paper: papers.ssrn.com/sol3/papers....

www.wsj.com/economy/cpi-...

www.wsj.com/economy/cpi-...

- Growth-enhancing policies almost certainly cannot stabilize federal debt on their own

- But such policies can reduce the tax hikes/spending cuts needed to stabilize debt

- We need more research here

Paper: papers.ssrn.com/sol3/papers....

- Growth-enhancing policies almost certainly cannot stabilize federal debt on their own

- But such policies can reduce the tax hikes/spending cuts needed to stabilize debt

- We need more research here

Paper: papers.ssrn.com/sol3/papers....

Paper: tinyurl.com/yvy2jt93

Paper: tinyurl.com/yvy2jt93

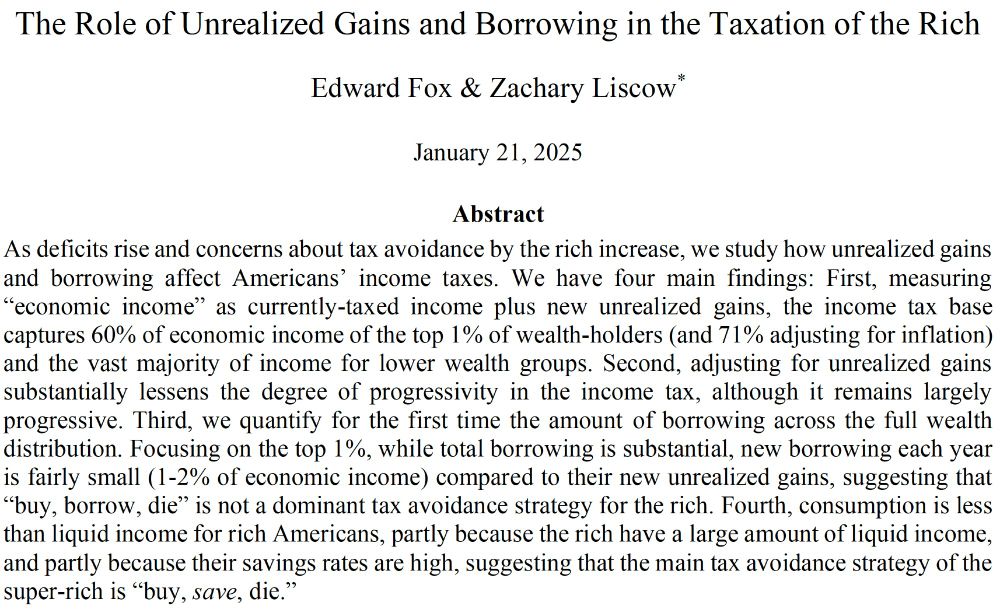

The rich avoid tax primarily through “buy-save-die,” not “buy-borrow-die.”

The rich avoid tax primarily through “buy-save-die,” not “buy-borrow-die.”

🧵 w/ findings ⬇️

Paper is here: ssrn.com/abstract=510...

🧵 w/ findings ⬇️

Paper is here: ssrn.com/abstract=510...

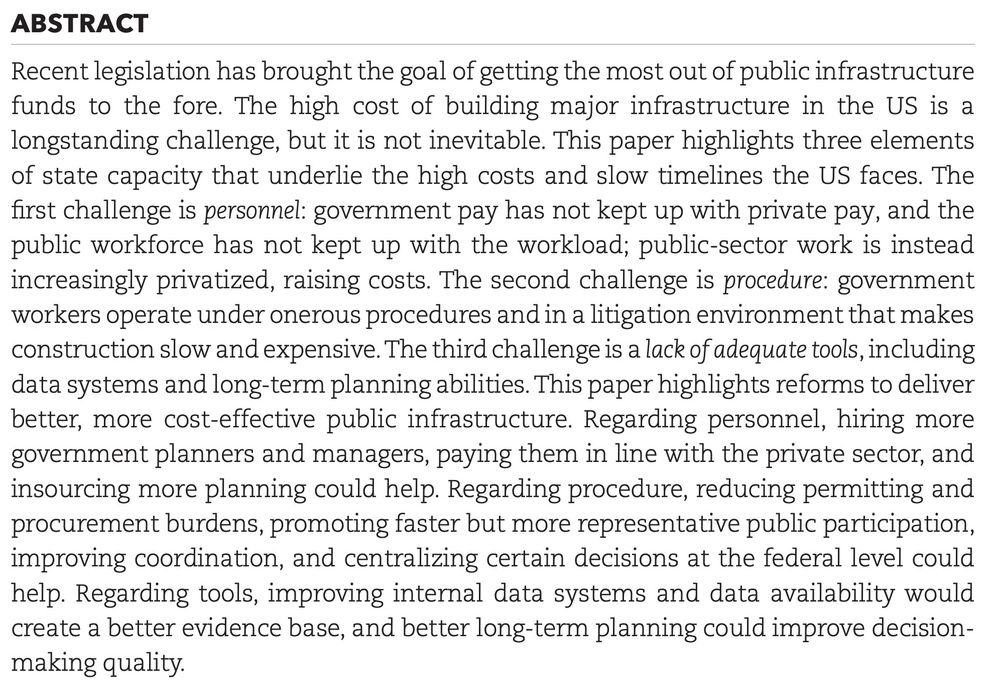

• Hire more government infrastructure experts as employees

• Bring public workers’ pay in line with that of their private-sector counterparts

• Insource more planning

• Hire more government infrastructure experts as employees

• Bring public workers’ pay in line with that of their private-sector counterparts

• Insource more planning

More in my paper on permitting: papers.ssrn.com/sol3/papers....

More in my paper on permitting: papers.ssrn.com/sol3/papers....

More here: tinyurl.com/y5sbfdux

More here: tinyurl.com/y5sbfdux

US infrastructure construction (transportation, energy, etc.) is often costly & slow.

I discuss the data & propose reforms. 🧵

Here is the paper: papers.ssrn.com/sol3/papers....

US infrastructure construction (transportation, energy, etc.) is often costly & slow.

I discuss the data & propose reforms. 🧵

Here is the paper: papers.ssrn.com/sol3/papers....

tobin.yale.edu/programs/pre...

tobin.yale.edu/programs/pre...