The IMF says Ghana will reach moderate risk by 2028. But external debt payments are right on the threshold - any shock will keep Ghana at high risk:

The IMF says Ghana will reach moderate risk by 2028. But external debt payments are right on the threshold - any shock will keep Ghana at high risk:

And that assumes continued GDP growth and no major economic shocks.

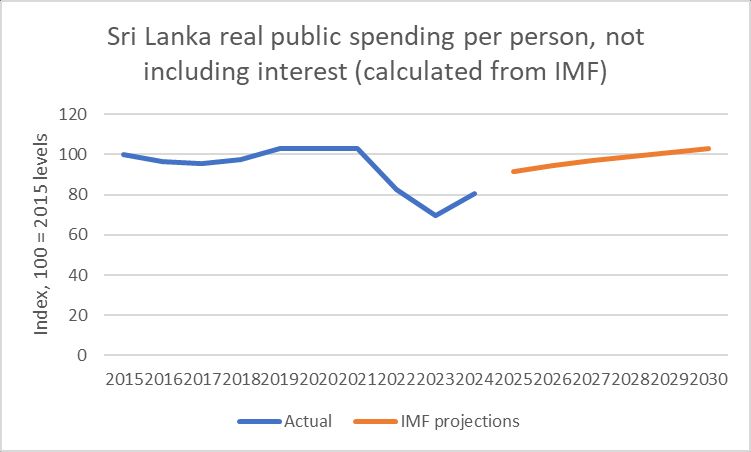

In 2025 public spending is expected to be 9% less than a decade ago.

And that assumes continued GDP growth and no major economic shocks.

In 2025 public spending is expected to be 9% less than a decade ago.

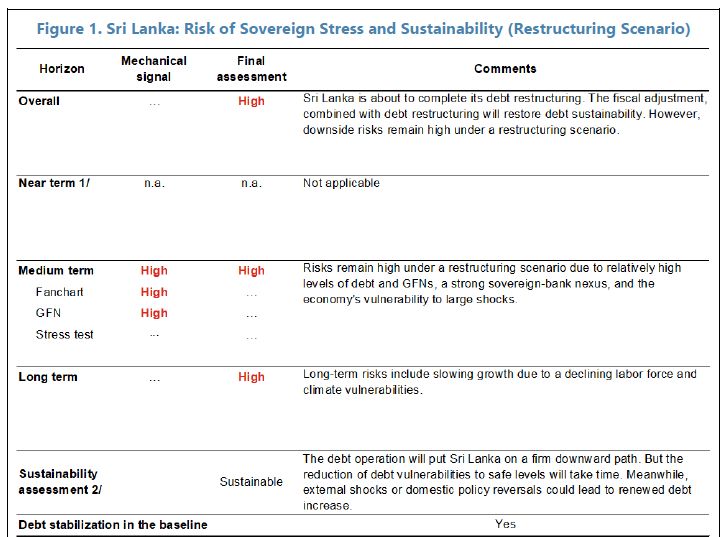

[The original restructuring was based on there being a 50:50 chance of another restructuring being needed]

[The original restructuring was based on there being a 50:50 chance of another restructuring being needed]

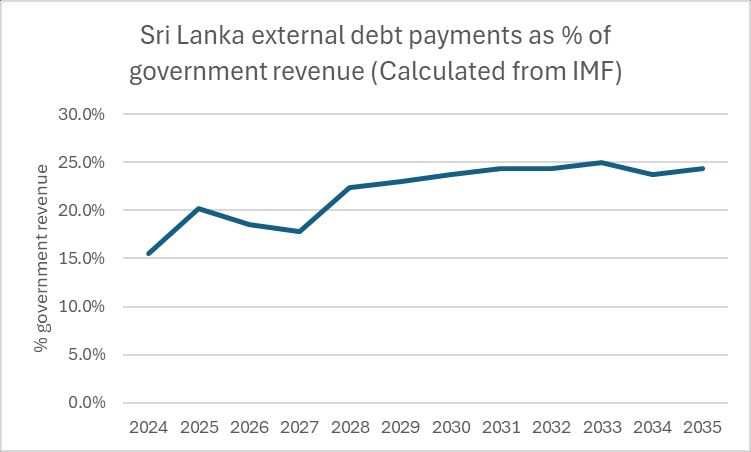

That keeps Sri Lanka in the highest 20 countries for government external debt service, even AFTER 'debt relief'

That keeps Sri Lanka in the highest 20 countries for government external debt service, even AFTER 'debt relief'

IMF: Bad news, food insecurity and poverty have risen

IMF don't say: Nigeria's public spending per person has fallen over 25% since 2015, and is projected to fall 50% by 2030

IMF: Bad news, food insecurity and poverty have risen

IMF don't say: Nigeria's public spending per person has fallen over 25% since 2015, and is projected to fall 50% by 2030

www.lowyinstitute.org/publications...

www.lowyinstitute.org/publications...

This is exactly why we need laws to ensure private lenders take part in debt restructuring

erlassjahr.de/en/news/sri-...

This is exactly why we need laws to ensure private lenders take part in debt restructuring

erlassjahr.de/en/news/sri-...

www.imf.org/en/Publicati...

www.imf.org/en/Publicati...

The answer is 0

But the UK still claims it is a 'strong advocate' for transparency because it supports the useless principles

The answer is 0

But the UK still claims it is a 'strong advocate' for transparency because it supports the useless principles

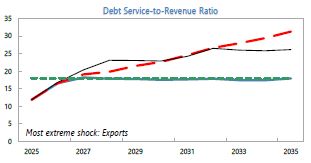

Debt relief is meant to reduce debt risk to 'moderate' with 'space to absorb shocks'.

But in Ghana, any shock at all will move Ghana back to high risk.

Debt relief is meant to reduce debt risk to 'moderate' with 'space to absorb shocks'.

But in Ghana, any shock at all will move Ghana back to high risk.

He concludes:

He concludes:

Yes, yes, yes to this - and it's not as hard as vested interests try to make out:

#CancelTheDebt

Yes, yes, yes to this - and it's not as hard as vested interests try to make out:

#CancelTheDebt