Made it through nicely today.

Made it through nicely today.

investor.crowncastle.com/news-release...

investor.crowncastle.com/news-release...

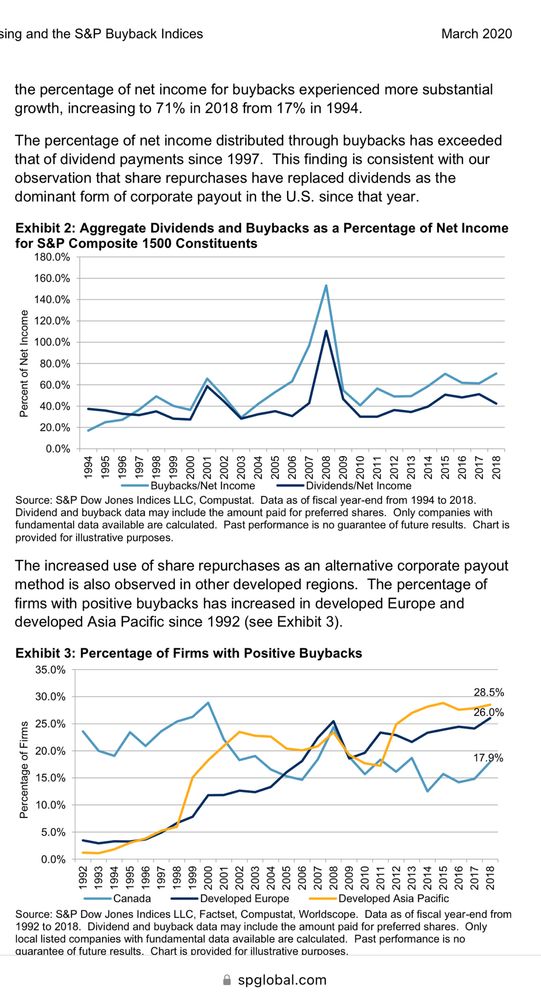

Kalecki-Levy is too simple to avoid and the S&P captures corp profits enough now:

Kalecki-Levy is too simple to avoid and the S&P captures corp profits enough now: