But note that US, even with (only) a 10% income tax rate on billionaires, has head start⬇️(G20, 2024). So any lift would be easier for US. 1/2

But note that US, even with (only) a 10% income tax rate on billionaires, has head start⬇️(G20, 2024). So any lift would be easier for US. 1/2

In any case, hope the optimism expressed below is borne out.

In any case, hope the optimism expressed below is borne out.

Perhaps one reason the idea has circulated that OBBBA is tough on GILTI is there's a US obsession with QBAI.

Perhaps one reason the idea has circulated that OBBBA is tough on GILTI is there's a US obsession with QBAI.

GILTI QBAI carveout is gone, but that's backstopped by GILTI deduction, plus frees up FTCs. FTCs for GILTI no longer are reduced by apportioned expenses, and GILTI haircut halved. Some of rev loss is FDII ded, but GILTI stuff is pro-MNE.

GILTI QBAI carveout is gone, but that's backstopped by GILTI deduction, plus frees up FTCs. FTCs for GILTI no longer are reduced by apportioned expenses, and GILTI haircut halved. Some of rev loss is FDII ded, but GILTI stuff is pro-MNE.

OBBBA benefits top groups more than original TCJA did, but both feast on lower income groups. Original TCJA's regressivity has been overlooked.

OBBBA benefits top groups more than original TCJA did, but both feast on lower income groups. Original TCJA's regressivity has been overlooked.

But that pales next to radical* credit for private school donors costing $26B.

(*So sweet it's a tax shelter. Also, compare it to bill's denial of public-school-supporting prop tax ded.)

h/t @itep.org @amyhanauer.bsky.social

But that pales next to radical* credit for private school donors costing $26B.

(*So sweet it's a tax shelter. Also, compare it to bill's denial of public-school-supporting prop tax ded.)

h/t @itep.org @amyhanauer.bsky.social

But my dry language isn't intended to minimize full (incl. moral) scope of targeting at-risk immigrants as well as safetynet users. I am guessing CBO staff (⬇️) feel same.

But my dry language isn't intended to minimize full (incl. moral) scope of targeting at-risk immigrants as well as safetynet users. I am guessing CBO staff (⬇️) feel same.

CRS⬇️ in right column shows mostly (-) METRs for debt-financing under current law, and non-res structures will go (-) with OBBBA.

CRS⬇️ in right column shows mostly (-) METRs for debt-financing under current law, and non-res structures will go (-) with OBBBA.

In looking at this, note that OBBBA reverses sign of the deficit effect of CBO's surge exercise, and OBBBA's effects likely are both smaller and bigger than $0.9T. 1/2

In looking at this, note that OBBBA reverses sign of the deficit effect of CBO's surge exercise, and OBBBA's effects likely are both smaller and bigger than $0.9T. 1/2

Yet the policy "immigration of high-skilled workers" seems narrow as OBBBA & Admin's policies attack all immigration (students, H1-Bs, others). It's not the authors' fault, but what we really need now is the coming labor shock scored.

Yet the policy "immigration of high-skilled workers" seems narrow as OBBBA & Admin's policies attack all immigration (students, H1-Bs, others). It's not the authors' fault, but what we really need now is the coming labor shock scored.

CBO & JCT say they look at this type of thing, so we should see numbers or at least a reason below doesn't apply.

CBO & JCT say they look at this type of thing, so we should see numbers or at least a reason below doesn't apply.

(The revenue estimate suggests initial US penalty pickup later overwhelmed by FDI flight).

(The revenue estimate suggests initial US penalty pickup later overwhelmed by FDI flight).

Left 4/29/25, CBO & JCT seem to say that as an exception they would include population changes in conventional estimates.

Right is CBO's director's 4/28/25 blog, saying population changes will not be in conventional recon estimates because of "timing." 1/2

Left 4/29/25, CBO & JCT seem to say that as an exception they would include population changes in conventional estimates.

Right is CBO's director's 4/28/25 blog, saying population changes will not be in conventional recon estimates because of "timing." 1/2

CBO/JCT have been busy and are still cranking, so maybe tbd. This call will matter.2/2

CBO/JCT have been busy and are still cranking, so maybe tbd. This call will matter.2/2

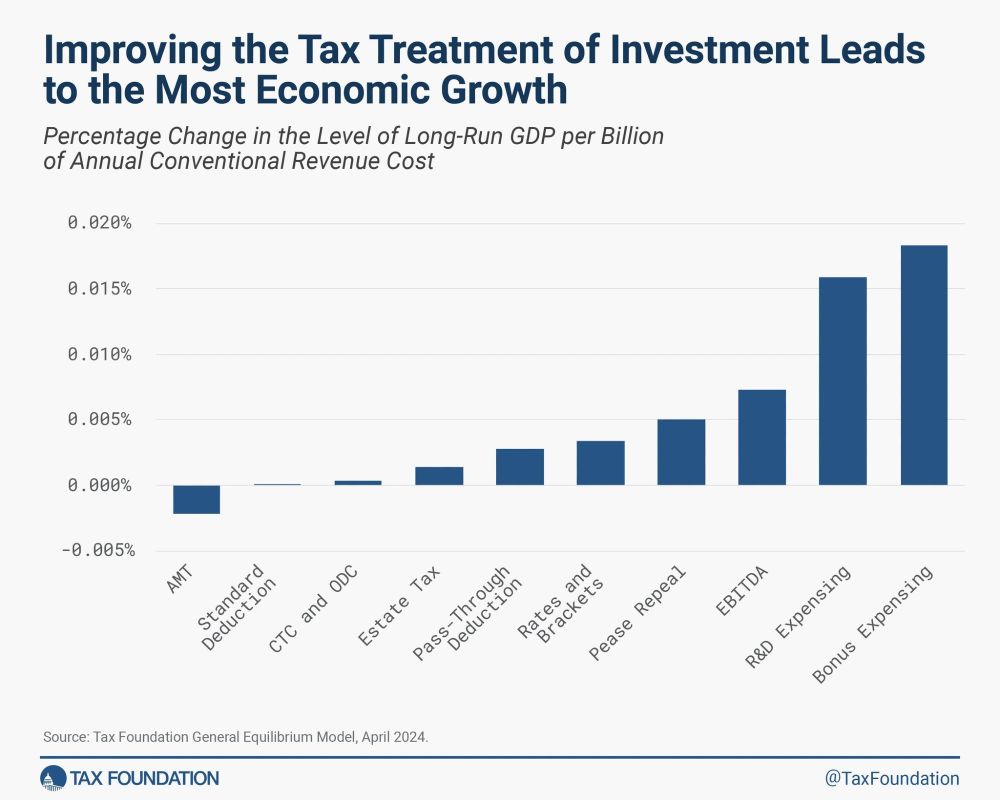

Tax expensing and debt-financing for L-T stuff invites big-time arbitrage.

Tax expensing and debt-financing for L-T stuff invites big-time arbitrage.

(1) CBO/JCT have done this for 20 years: it didn't just pop up in 2025.

(2) CBO/JCT's precise language is that the conventional estimate incorporates effects of population change. Technically that suggests this isn't same as adding dynamic score to conventional estimate.

(1) CBO/JCT have done this for 20 years: it didn't just pop up in 2025.

(2) CBO/JCT's precise language is that the conventional estimate incorporates effects of population change. Technically that suggests this isn't same as adding dynamic score to conventional estimate.

E.g., below shows big increase at pyramid top, raising Federal health/Social Security/etc. costs, in relatively short time between 2000 and 2020. 1/2

E.g., below shows big increase at pyramid top, raising Federal health/Social Security/etc. costs, in relatively short time between 2000 and 2020. 1/2

Figure from @taxnotes.bsky.social article that advocates combo of national income plus net nominal holding gains of produced assets (both are national accounts concepts) to show comprehensive capital income. 1/2

Figure from @taxnotes.bsky.social article that advocates combo of national income plus net nominal holding gains of produced assets (both are national accounts concepts) to show comprehensive capital income. 1/2

My novice read is that those losses are in the OECD data, and if taken out, U.S. looks much better. This also implicates the design of the state-local gvt pandemic aid.

My novice read is that those losses are in the OECD data, and if taken out, U.S. looks much better. This also implicates the design of the state-local gvt pandemic aid.

There's clamor to adopt elsewhere some of US tax infrastructure noted above. It would be a shame if the US dismantles that infrastructure just when it is most needed. 3/3

There's clamor to adopt elsewhere some of US tax infrastructure noted above. It would be a shame if the US dismantles that infrastructure just when it is most needed. 3/3

The last section is important procedurally. IMO, CBO is right to model foreign govt retaliation in a point estimate even though that's a bit tricky to quantify.

t.co/82sQE7Fn9V

The last section is important procedurally. IMO, CBO is right to model foreign govt retaliation in a point estimate even though that's a bit tricky to quantify.

t.co/82sQE7Fn9V

It shows net +46B from well-off to fund pre-K & other safety-net things. 3/3

It shows net +46B from well-off to fund pre-K & other safety-net things. 3/3

Accommodate legit small biz/farms/ranches, but after that this is a simple test of fiscal seriousness.

Accommodate legit small biz/farms/ranches, but after that this is a simple test of fiscal seriousness.

Instead of telling the ticket collector "the guy behind me caused what I'm about to do," a current policy baseline is saying "the guy ahead of me caused what I'm about to do."

Instead of telling the ticket collector "the guy behind me caused what I'm about to do," a current policy baseline is saying "the guy ahead of me caused what I'm about to do."