If the OECD folds, then maybe OECD should move out of way for UN tax effort. 1/2

taxnotes.co/4obqq04

If the OECD folds, then maybe OECD should move out of way for UN tax effort. 1/2

taxnotes.co/4obqq04

But note that US, even with (only) a 10% income tax rate on billionaires, has head start⬇️(G20, 2024). So any lift would be easier for US. 1/2

But note that US, even with (only) a 10% income tax rate on billionaires, has head start⬇️(G20, 2024). So any lift would be easier for US. 1/2

[Reminder this econ focus isn't meant to diminish important moral issues with targeting at-risk immigrants.]

bsky.app/profile/wash...

[Reminder this econ focus isn't meant to diminish important moral issues with targeting at-risk immigrants.]

bsky.app/profile/wash...

Evidence shows Tylenol doesn't cause autism (& vaccines don't, either).

People have blamed autism on moms' choices for nearly 100 yrs, making their challenges even harder.

www.npr.org/2016/09/09/4...

Evidence shows Tylenol doesn't cause autism (& vaccines don't, either).

People have blamed autism on moms' choices for nearly 100 yrs, making their challenges even harder.

www.npr.org/2016/09/09/4...

If assertion is correct, it means income inequality is much worse. 1/2

www.nytimes.com/2025/08/01/h...

If assertion is correct, it means income inequality is much worse. 1/2

www.nytimes.com/2025/08/01/h...

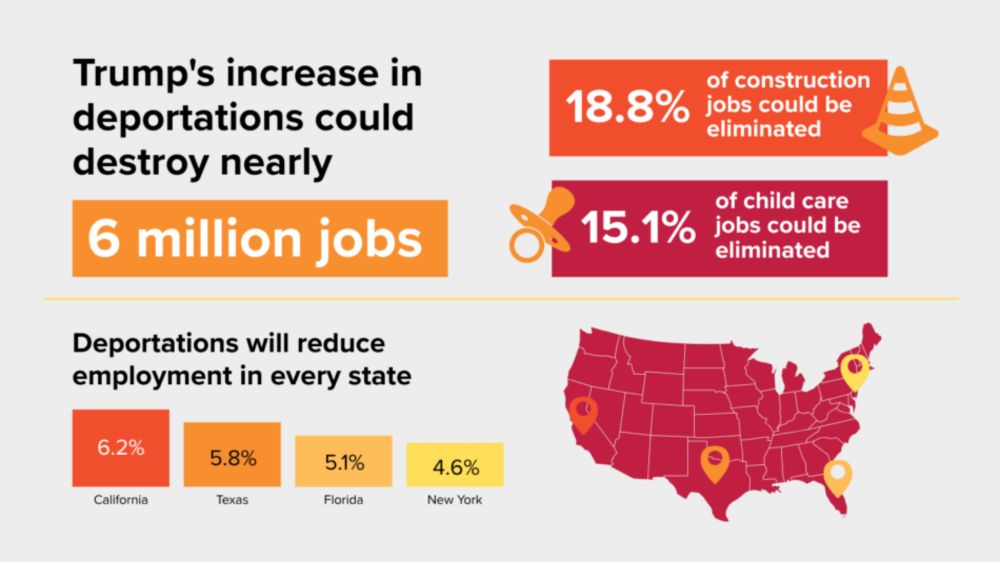

I remain puzzled that we didn't hear more about econ effects of OBBBA's targeting of at-risk immigrants, esp. from govt groups that had models equipped for that. For sure, part of story seems OBBBA sponsors didn't wait for these results.

bsky.app/profile/benz...

New report from me @epi.org

I remain puzzled that we didn't hear more about econ effects of OBBBA's targeting of at-risk immigrants, esp. from govt groups that had models equipped for that. For sure, part of story seems OBBBA sponsors didn't wait for these results.

bsky.app/profile/benz...

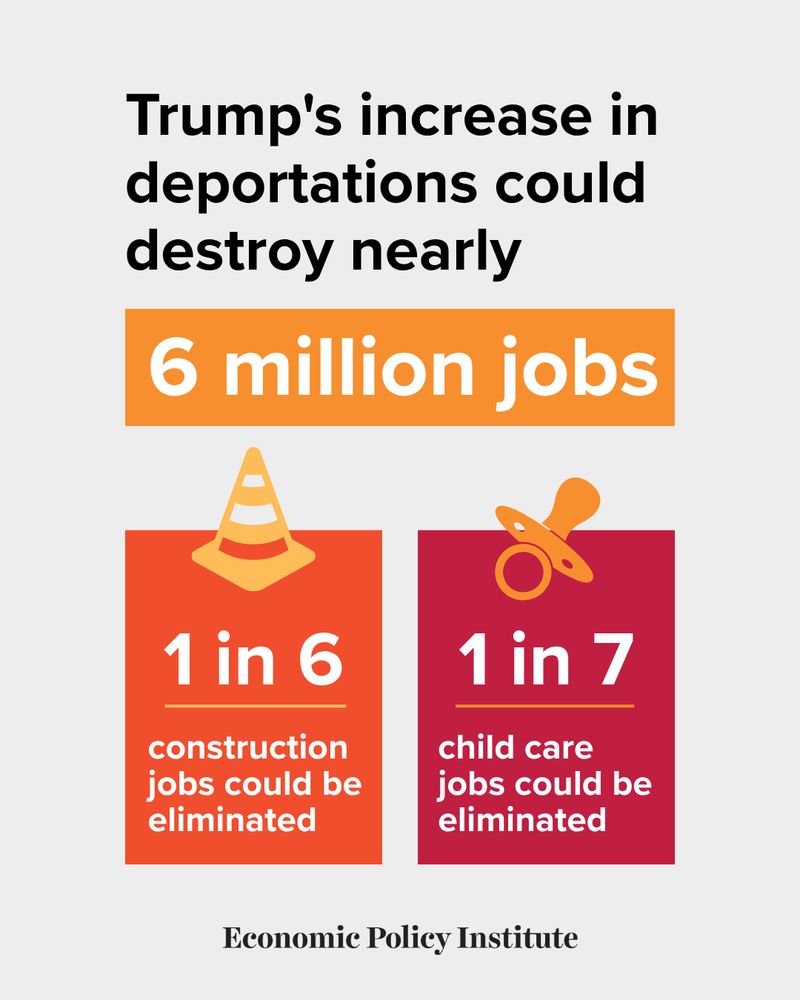

Immigrants are a crucial part of the US economy, and Trump's radical deportation agenda will hurt us all.

Trump’s increase in deportations will destroy 6 million jobs—for both immigrants AND US-born workers: www.epi.org/publication/...

Immigrants are a crucial part of the US economy, and Trump's radical deportation agenda will hurt us all.

Trump’s increase in deportations will destroy 6 million jobs—for both immigrants AND US-born workers: www.epi.org/publication/...

Caveat is Pillar 2's tax rate test is very diluted. So P2 mostly (tho where's shipping, etc?) identifies BEPS, but actual tax collected seems low & getting lower.

@gabrielzucman.bsky.social

bsky.app/profile/taxo...

Caveat is Pillar 2's tax rate test is very diluted. So P2 mostly (tho where's shipping, etc?) identifies BEPS, but actual tax collected seems low & getting lower.

@gabrielzucman.bsky.social

bsky.app/profile/taxo...

doi.org/10.1111/1758...

doi.org/10.1111/1758...

Now only discipline is (fgn-investor-influenced) bond market. 1/2

bsky.app/profile/bbko...

Now only discipline is (fgn-investor-influenced) bond market. 1/2

bsky.app/profile/bbko...

(1) Big OBBBA targeting of at-risk immigrants;

(2) Tariffs, incl. imposed on intermediate inputs used by US-based companies; 1/2

(1) Big OBBBA targeting of at-risk immigrants;

(2) Tariffs, incl. imposed on intermediate inputs used by US-based companies; 1/2

Not faulting any analysts (this stuff is hard), but rather people who didn't want to know.

Not faulting any analysts (this stuff is hard), but rather people who didn't want to know.

The international provisions of this bill, which have been marketed as America-first reforms, actually put big corporations and tax havens first. Congress is betraying promises made to American workers to bring back domestic jobs.

The international provisions of this bill, which have been marketed as America-first reforms, actually put big corporations and tax havens first. Congress is betraying promises made to American workers to bring back domestic jobs.

Do Canada et al know this? 1/4

Do Canada et al know this? 1/4

OBBBA benefits top groups more than original TCJA did, but both feast on lower income groups. Original TCJA's regressivity has been overlooked.

OBBBA benefits top groups more than original TCJA did, but both feast on lower income groups. Original TCJA's regressivity has been overlooked.

www.wsj.com/politics/pol...

www.wsj.com/politics/pol...

@dsmitch28.bsky.social and I concur with @wyden.senate.gov's skepticism of this progressivity.

equitablegrowth.org/the-funny-ma...

@dsmitch28.bsky.social and I concur with @wyden.senate.gov's skepticism of this progressivity.

equitablegrowth.org/the-funny-ma...

But that pales next to radical* credit for private school donors costing $26B.

(*So sweet it's a tax shelter. Also, compare it to bill's denial of public-school-supporting prop tax ded.)

h/t @itep.org @amyhanauer.bsky.social

But that pales next to radical* credit for private school donors costing $26B.

(*So sweet it's a tax shelter. Also, compare it to bill's denial of public-school-supporting prop tax ded.)

h/t @itep.org @amyhanauer.bsky.social

But my dry language isn't intended to minimize full (incl. moral) scope of targeting at-risk immigrants as well as safetynet users. I am guessing CBO staff (⬇️) feel same.

But my dry language isn't intended to minimize full (incl. moral) scope of targeting at-risk immigrants as well as safetynet users. I am guessing CBO staff (⬇️) feel same.

Research reveals how systemic barriers continue to restrict economic mobility for Black Americans — from dissipated generational gains to disparities in unemployment insurance access.

Learn more ➡️ equitablegrowth.org/on-juneteent...

Research reveals how systemic barriers continue to restrict economic mobility for Black Americans — from dissipated generational gains to disparities in unemployment insurance access.

Learn more ➡️ equitablegrowth.org/on-juneteent...