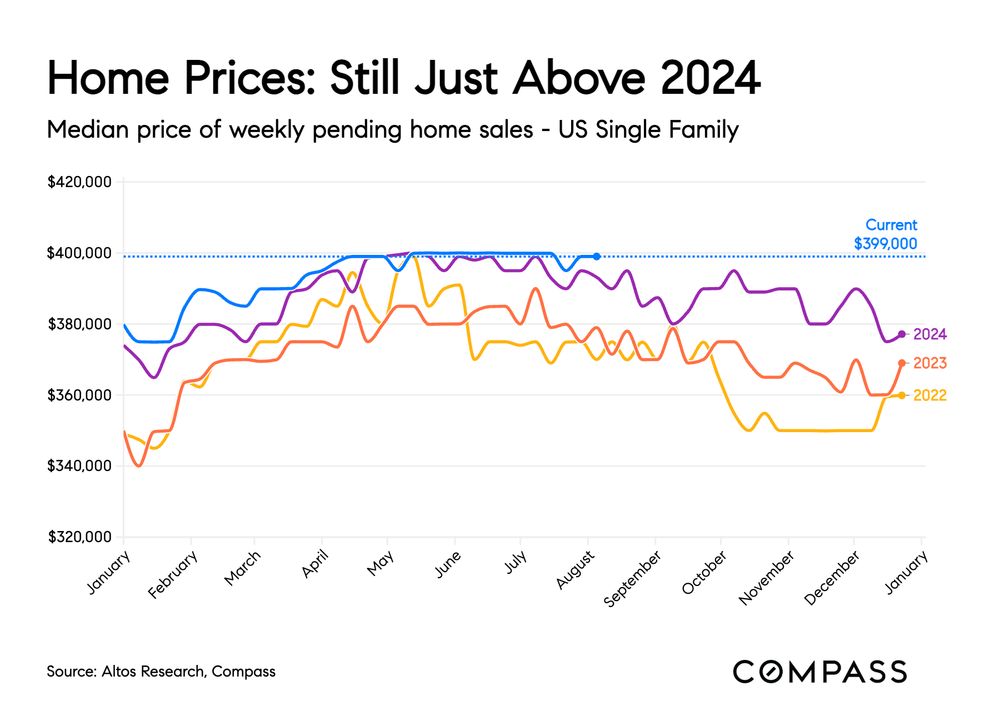

In our weekly pending contracts, the slight growth over 2024 continues.

Last year the brief mortgage rate dip to 6.1% in September lifted the sales rate for Q4. Will be interesting if we can beat that this year.

In our weekly pending contracts, the slight growth over 2024 continues.

Last year the brief mortgage rate dip to 6.1% in September lifted the sales rate for Q4. Will be interesting if we can beat that this year.

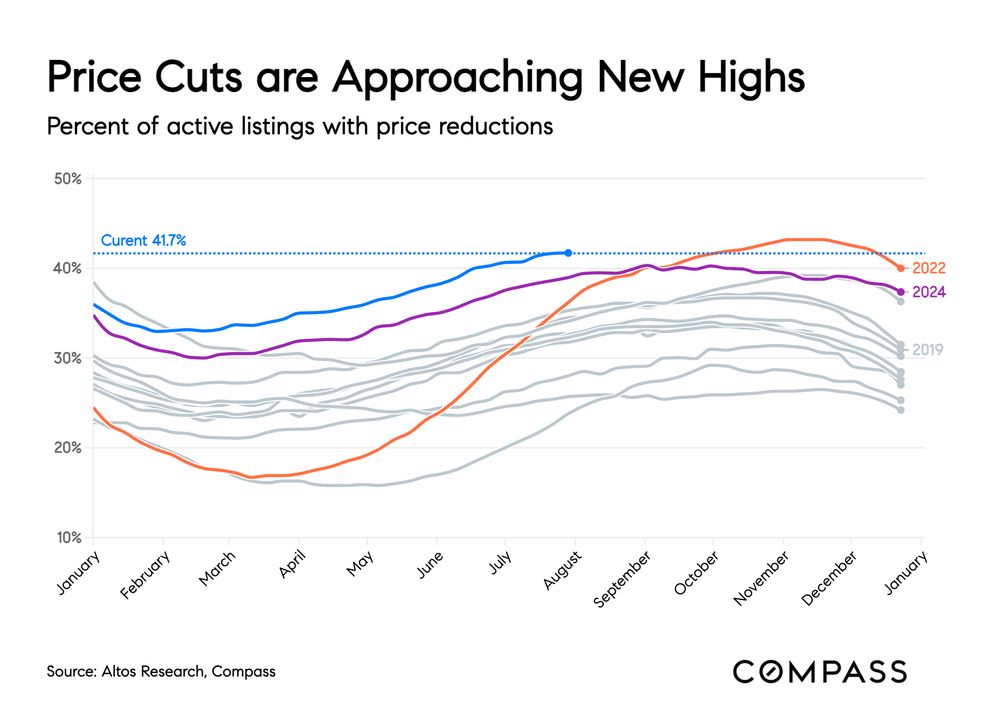

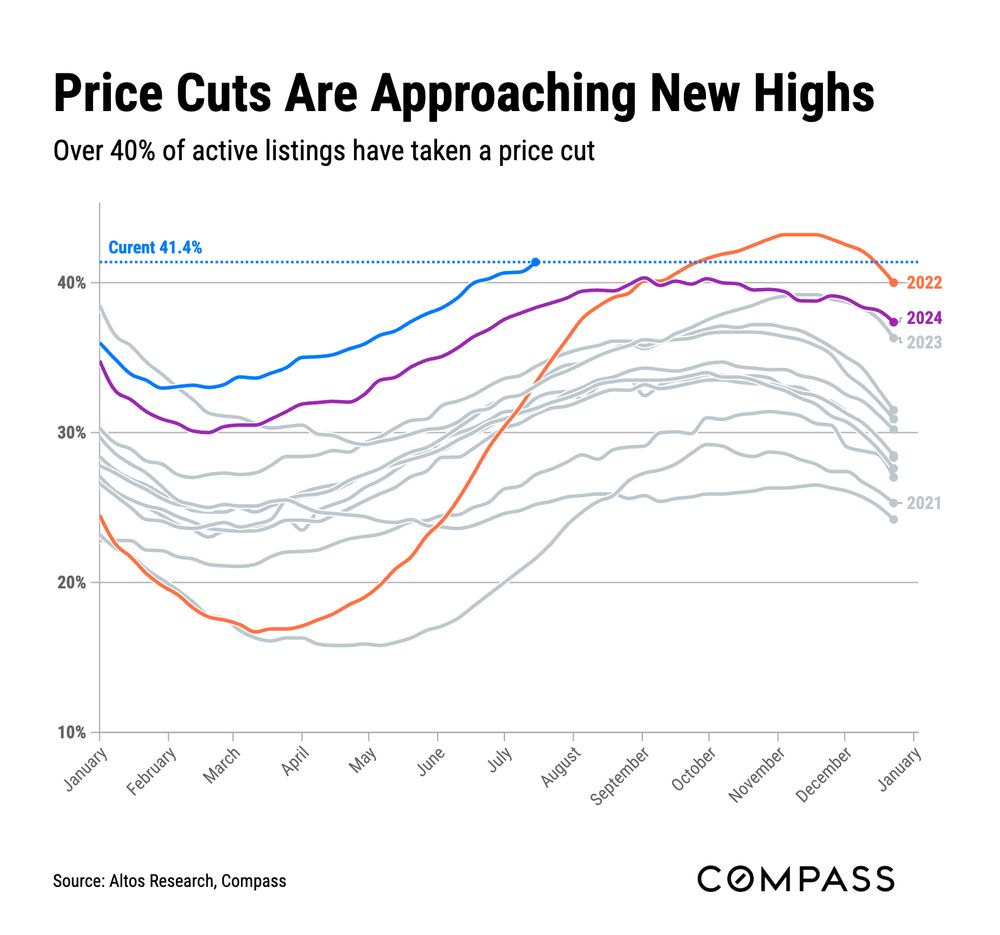

41.5% of the homes have taken a price cut from the original list price. That level isn't increasing.

41.5% of the homes have taken a price cut from the original list price. That level isn't increasing.

This week, the median price of new pending contracts ticked up to $397,500, coming in almost 2% above the same week last year.

This week, the median price of new pending contracts ticked up to $397,500, coming in almost 2% above the same week last year.

Even with limited supply, newly pending sales were up almost 5% from last year this week. We counted 77,000 sales contracts started this week.

More transactions are getting done in states with more available inventory.

Even with limited supply, newly pending sales were up almost 5% from last year this week. We counted 77,000 sales contracts started this week.

More transactions are getting done in states with more available inventory.

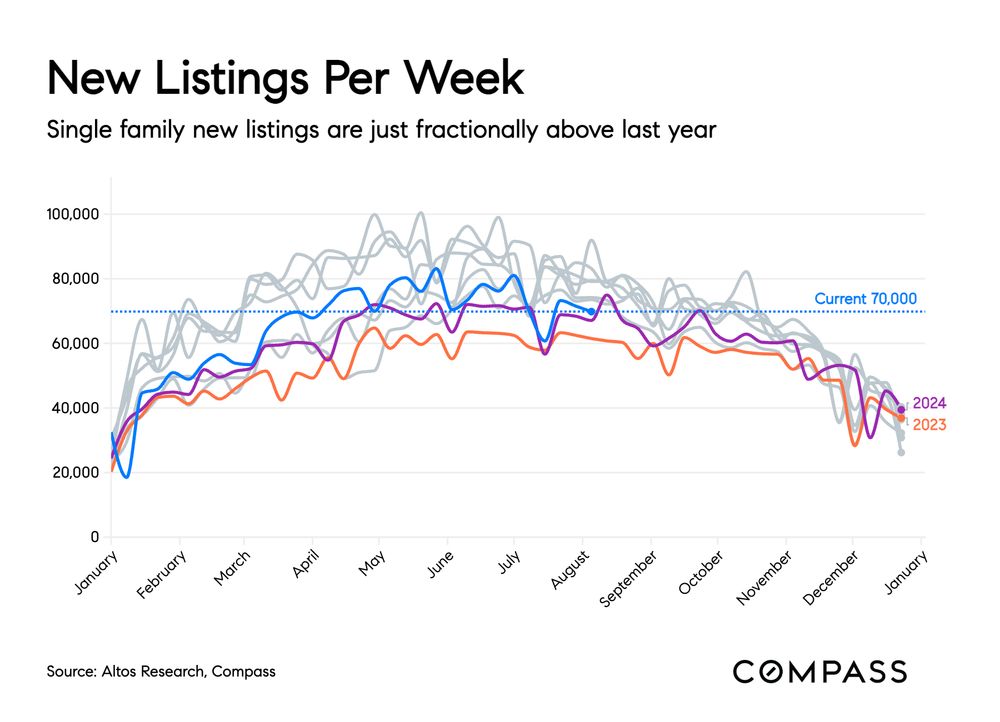

This week we counted just over 66,000 newly listed single-family homes, 5% fewer than a year ago.

This 90-day rolling average shows the trend clearly.

This week we counted just over 66,000 newly listed single-family homes, 5% fewer than a year ago.

This 90-day rolling average shows the trend clearly.

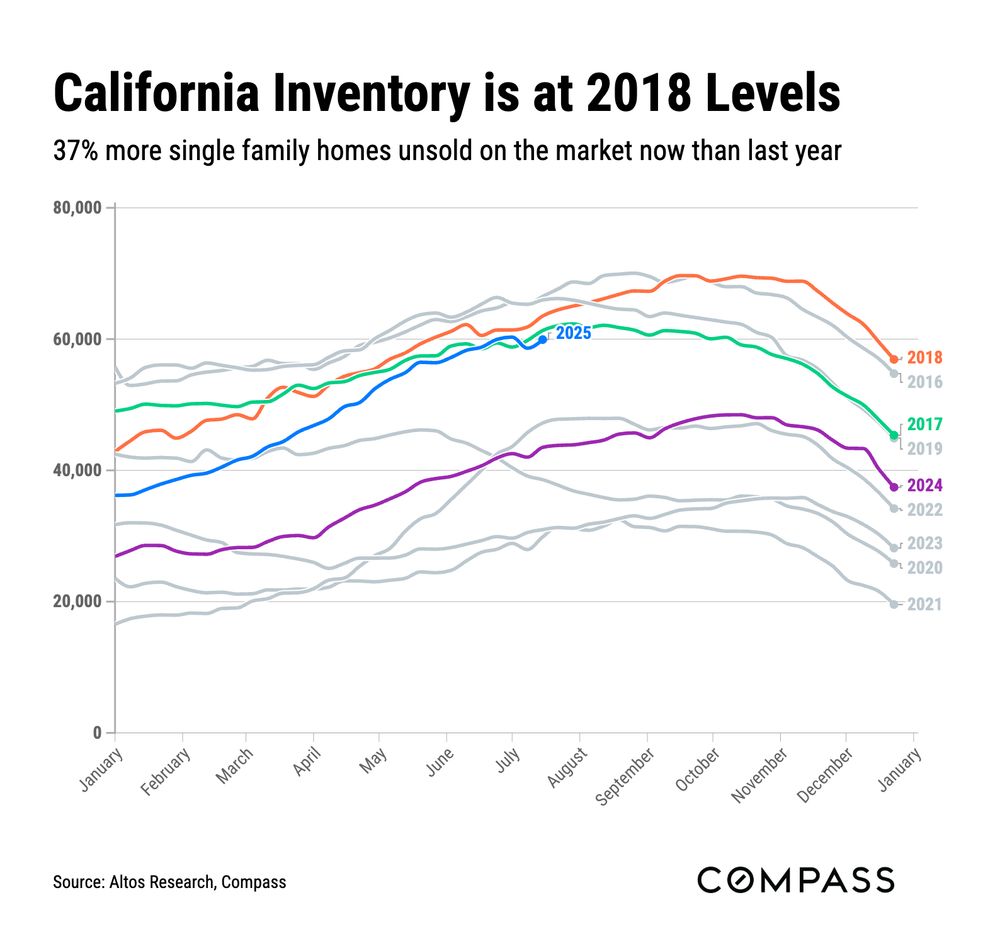

National inventory has been unchanged at ~860,000 single-family homes since July. Last year it was rising quickly.

National inventory has been unchanged at ~860,000 single-family homes since July. Last year it was rising quickly.

We count 66,000 newly pending single family home sales this week, plus 13,000 condos. 4% more than a year ago.

In fact, year-to-date the cumulative pending home sales are finally ahead of 2024. 2.759MM sales vs. 2.75MM last year.

We count 66,000 newly pending single family home sales this week, plus 13,000 condos. 4% more than a year ago.

In fact, year-to-date the cumulative pending home sales are finally ahead of 2024. 2.759MM sales vs. 2.75MM last year.

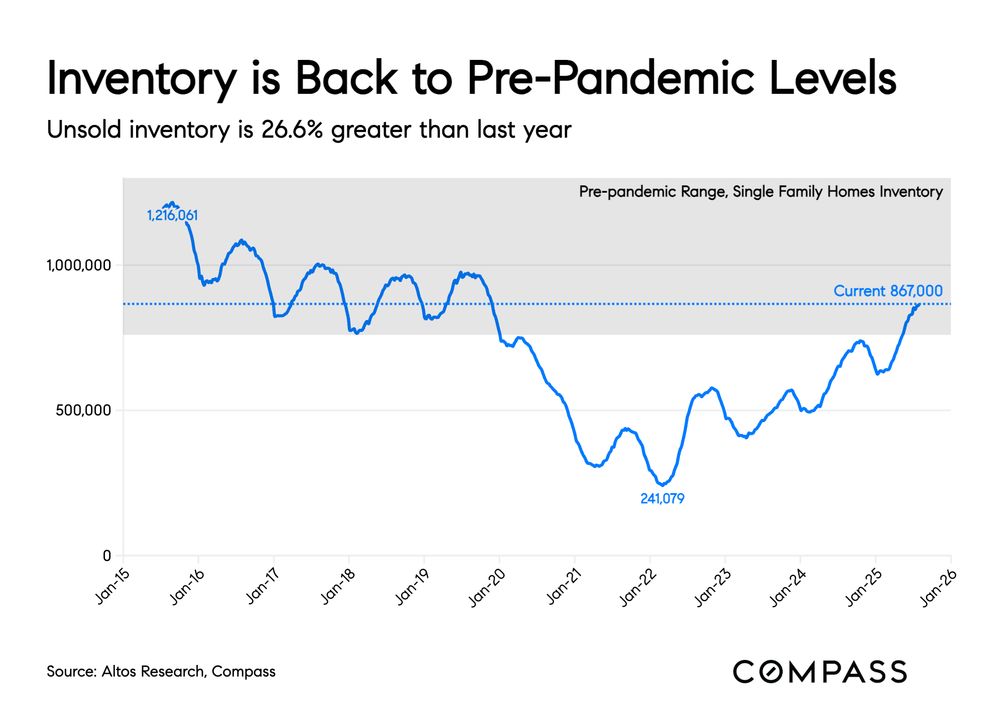

861,000 single family homes unsold on the market. That's unchanged for 6 weeks.

Limited supply has implications of a floor on future prices. There are just not that many sellers out there.

861,000 single family homes unsold on the market. That's unchanged for 6 weeks.

Limited supply has implications of a floor on future prices. There are just not that many sellers out there.

I expect it to be negative by October.

In this chart I've highlighted three recent pricing moments to pay attention to for repeats later in 2025, depending on mortgage rate moves.

I expect it to be negative by October.

In this chart I've highlighted three recent pricing moments to pay attention to for repeats later in 2025, depending on mortgage rate moves.

Expect EOY "Home prices are down for 2025" headlines.

Expect EOY "Home prices are down for 2025" headlines.

The slope of the asking price of homes for sale continues to be pretty steep. This is the first negative reading since 2023 and looks like it's aiming for full year 2025 to finish lower than 2024. (national, single fam)

The slope of the asking price of homes for sale continues to be pretty steep. This is the first negative reading since 2023 and looks like it's aiming for full year 2025 to finish lower than 2024. (national, single fam)

Here's an illustration of what's under way.

Here's an illustration of what's under way.

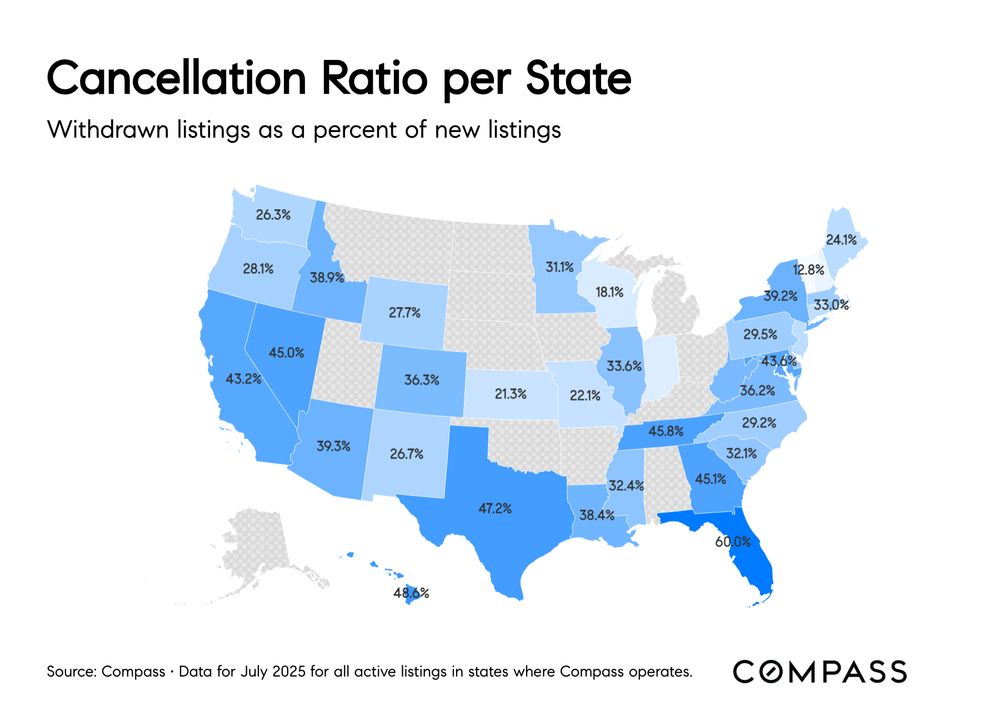

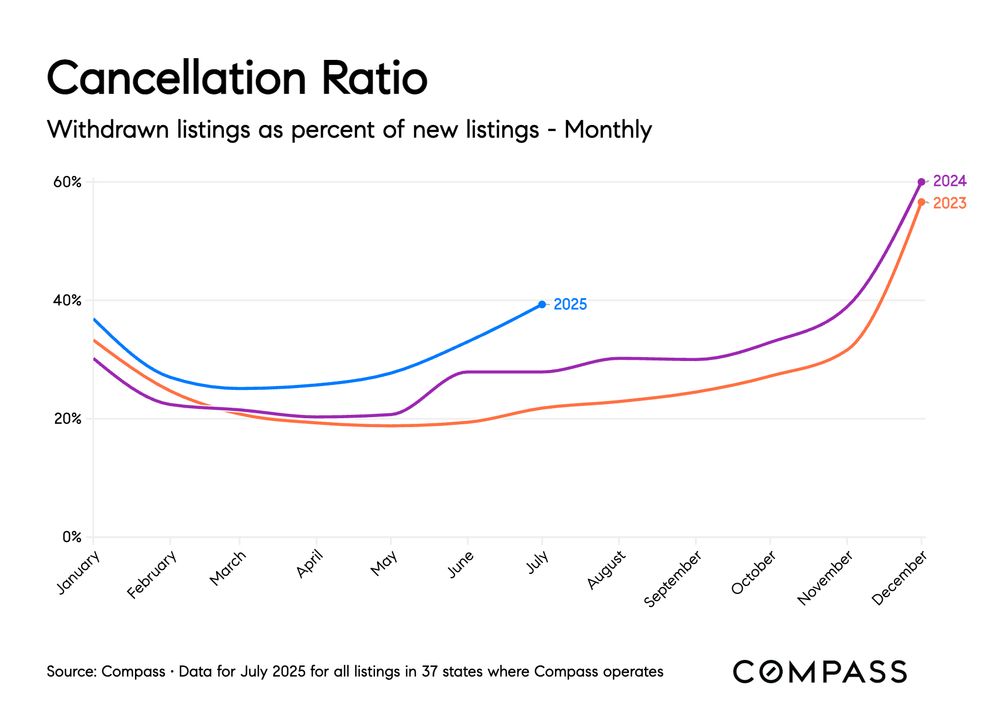

How much are cancellations effecting the market right now?

Lots of people asking that question. Here's how I look at it. As a percentage of new listings - how many cancel?

Some data:

How much are cancellations effecting the market right now?

Lots of people asking that question. Here's how I look at it. As a percentage of new listings - how many cancel?

Some data:

➡️ At 41.7% of the active listings, price reductions were unchanged from last week but still significantly more than a year ago.

While pricing is obviously soft in most of the country, it's notable that it's not deteriorating.

➡️ At 41.7% of the active listings, price reductions were unchanged from last week but still significantly more than a year ago.

While pricing is obviously soft in most of the country, it's notable that it's not deteriorating.

➡️At $399,000 home prices are just 1.5% above last year at this time.

Even as sale inch upwards, it sure looks like there are lots of opportunities for home prices to finish 2025 in negative territory.

➡️At $399,000 home prices are just 1.5% above last year at this time.

Even as sale inch upwards, it sure looks like there are lots of opportunities for home prices to finish 2025 in negative territory.

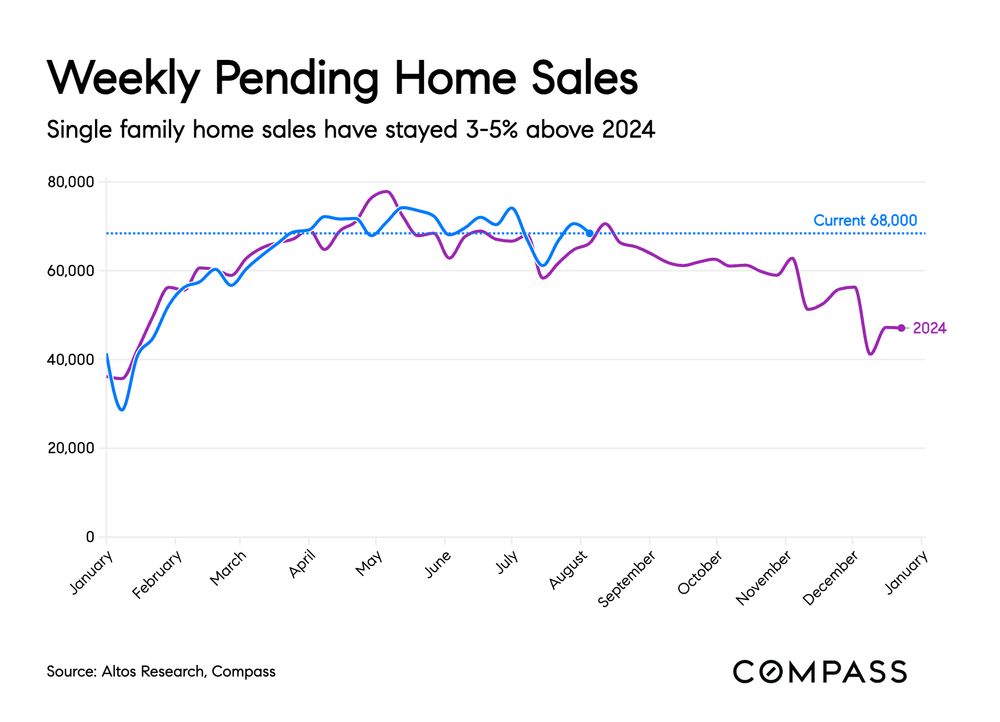

➡️68,000 new contracts for single family homes.

That dipped 3% for the week but is still 3.5% greater than last year. Slowly that'll turn into transaction growth headlines.

➡️68,000 new contracts for single family homes.

That dipped 3% for the week but is still 3.5% greater than last year. Slowly that'll turn into transaction growth headlines.

➡️There are 867,000 single family homes on the market.

That's 26.6% more than last year. Lots more unsold homes, but inventory was growing faster then.

➡️There are 867,000 single family homes on the market.

That's 26.6% more than last year. Lots more unsold homes, but inventory was growing faster then.

Everyone knows that the price pressure is on. Did you know that have been gradually FEWER new listings each week?

Sellers are staying away.

That implies a cap on inventory growth for the rest of the year.

1/6

Everyone knows that the price pressure is on. Did you know that have been gradually FEWER new listings each week?

Sellers are staying away.

That implies a cap on inventory growth for the rest of the year.

1/6

Help me answer: Why now?

Help me answer: Why now?

For the leading indicators of future sales prices, we look at the price reductions now. Currently 41.4% of the homes on the market have taken a price cut. Up 70bp for the week.

That signals continued price pressures through the rest of the year at least.

For the leading indicators of future sales prices, we look at the price reductions now. Currently 41.4% of the homes on the market have taken a price cut. Up 70bp for the week.

That signals continued price pressures through the rest of the year at least.