Looking at:

decarbonisation; energy;

Russia's war in Ukraine.

Blog on Wordpress: https://lightbucket.wordpress.com/

But the longer term problem is that Germany's coal generation is falling far too slowly.

• The 2038 phase out reneges on Germany's Paris commitment, which requires a 2030 phase out;

• Germany's coal reduction is even slower than the US, over the period which includes the first Trump term.

But the longer term problem is that Germany's coal generation is falling far too slowly.

• The 2038 phase out reneges on Germany's Paris commitment, which requires a 2030 phase out;

• Germany's coal reduction is even slower than the US, over the period which includes the first Trump term.

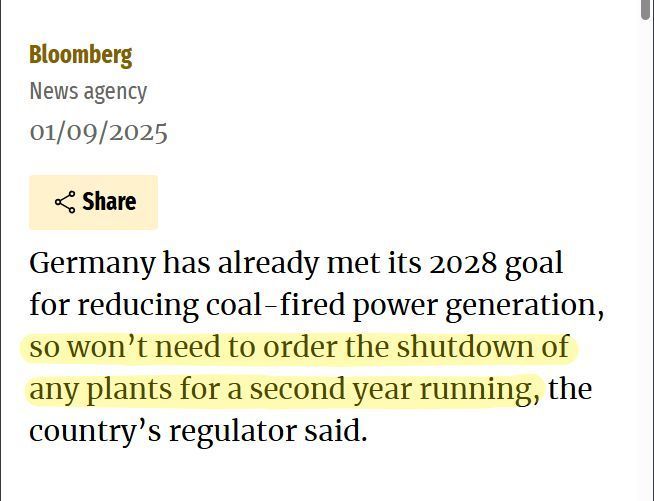

Germany is certainly not accelerating its coal phase out.

It is standing still. Germany won’t be closing any coal plants for a second year running.

Its 2038 coal phaseout target is so lax it can afford to do absolutely nothing for two years running.

⸻

Ref: www.luxtimes.lu/europeanunio...

Germany is certainly not accelerating its coal phase out.

It is standing still. Germany won’t be closing any coal plants for a second year running.

Its 2038 coal phaseout target is so lax it can afford to do absolutely nothing for two years running.

⸻

Ref: www.luxtimes.lu/europeanunio...

For 2000–2024, Germany has underperformed even the U.S. is reducing electricity generation from coal.

In 2000 both Germany and the U.S. had a 52% coal share,

but by 2024 U.S. coal share had fallen far faster than Germany's, despite the U.S. being actively pro-coal during the first Trump term.

For 2000–2024, Germany has underperformed even the U.S. is reducing electricity generation from coal.

In 2000 both Germany and the U.S. had a 52% coal share,

but by 2024 U.S. coal share had fallen far faster than Germany's, despite the U.S. being actively pro-coal during the first Trump term.

You mention two dates, "2030/2038":

2030 is the deadline by which EU countries need to be coal power free to align with the UN Paris Climate Agreement.

But Germany has chosen to renege on its Paris commitment, and has set 2038 as its coal phaseout year.

You mention two dates, "2030/2038":

2030 is the deadline by which EU countries need to be coal power free to align with the UN Paris Climate Agreement.

But Germany has chosen to renege on its Paris commitment, and has set 2038 as its coal phaseout year.

Germany also has the highest share of EU coal power.

39% of the EU's coal generation is Germany's.

Germany hasn't replaced coal, Germany is the dominant coal generator in the EU, with the highest coal share of the top 6 European economies.

⸻

Ref: Ember 2025 ember-energy.org/latest-insig...

Germany also has the highest share of EU coal power.

39% of the EU's coal generation is Germany's.

Germany hasn't replaced coal, Germany is the dominant coal generator in the EU, with the highest coal share of the top 6 European economies.

⸻

Ref: Ember 2025 ember-energy.org/latest-insig...

Germany hasn't replaced coal.

In fact it has the highest coal share of the six largest European economies (20.9% coal in 2024).

⸻

Ref: Ember: ember-energy.org/data/electri...

Germany hasn't replaced coal.

In fact it has the highest coal share of the six largest European economies (20.9% coal in 2024).

⸻

Ref: Ember: ember-energy.org/data/electri...

The cost breakdown for 2026–2028 (in 2026 money) is:

TOTAL cost: €60.3/MWh

of which:

Return on capital (at 9.1% WACC): €13.8/MWh

Depreciation: €11.7/MWh

Fuel (incl. reprocessing and waste disposal): €8.1/MWh

Staff: €10.4/MWh

The cost breakdown for 2026–2028 (in 2026 money) is:

TOTAL cost: €60.3/MWh

of which:

Return on capital (at 9.1% WACC): €13.8/MWh

Depreciation: €11.7/MWh

Fuel (incl. reprocessing and waste disposal): €8.1/MWh

Staff: €10.4/MWh

The CfD contract allows unrestricted merchant generation above the CfD generation cap:

The CfD contract allows unrestricted merchant generation above the CfD generation cap:

By way of comparison, here's the electricity mix and the carbon intensity of electricity generation of the six largest European economies in 2024, with the EU added for context.

France is the only one of the six largest European economies with sub-50g electricity emissions.

By way of comparison, here's the electricity mix and the carbon intensity of electricity generation of the six largest European economies in 2024, with the EU added for context.

France is the only one of the six largest European economies with sub-50g electricity emissions.

Here's the aggregate electricity mix of all eight of the sub-100g countries combined.

Nuclear and hydro still dominate the mix, with a 78% share between them,

but wind is growing fast, with 10.7%.

(Coal barely shows up with a 0.26% share).

⸻

Ref: Ember ember-energy.org/data/electri...

Here's the aggregate electricity mix of all eight of the sub-100g countries combined.

Nuclear and hydro still dominate the mix, with a 78% share between them,

but wind is growing fast, with 10.7%.

(Coal barely shows up with a 0.26% share).

⸻

Ref: Ember ember-energy.org/data/electri...

Here's the carbon intensity of electricity generation for all six sub-50g countries, and the two sub-100g countries, along with the electricity mix that gets them there:

⸻

Refs:

Ember: ember-energy.org/data/electri...

Our World in Data: ourworldindata.org/grapher/carb...

Here's the carbon intensity of electricity generation for all six sub-50g countries, and the two sub-100g countries, along with the electricity mix that gets them there:

⸻

Refs:

Ember: ember-energy.org/data/electri...

Our World in Data: ourworldindata.org/grapher/carb...

Britain's Clean Power 2030 Action Plan sets an emissions target for electricity generation of under 50 g CO₂e/kWh by 2030.

There are six European countries already below this target.

Who are they, and how did they get there?

🧵

⸻

Ref: Clean Power 2030 Action Plan

www.gov.uk/government/p...

Britain's Clean Power 2030 Action Plan sets an emissions target for electricity generation of under 50 g CO₂e/kWh by 2030.

There are six European countries already below this target.

Who are they, and how did they get there?

🧵

⸻

Ref: Clean Power 2030 Action Plan

www.gov.uk/government/p...

Here's the Offshore Wind subsidy per MWh by year.

It was negative in 2022, during the gas price crisis, but otherwise the subsidy has been positive.

Looking ahead, DESNZ forecasts that market prices will fall, but offshore wind from AR3/AR4 will come online to reduce average CfD strike prices.

Here's the Offshore Wind subsidy per MWh by year.

It was negative in 2022, during the gas price crisis, but otherwise the subsidy has been positive.

Looking ahead, DESNZ forecasts that market prices will fall, but offshore wind from AR3/AR4 will come online to reduce average CfD strike prices.

The 5.5GW of Offshore Wind capacity awarded in AR3 at lower strike prices is just starting to come online.

Almost all the Offshore Wind capacity now generating is from AR2 and earlier, when strike prices were higher.

Here's the Q1 2026 forecast subsidy for Offshore Wind from pre-AR1 to AR3:

The 5.5GW of Offshore Wind capacity awarded in AR3 at lower strike prices is just starting to come online.

Almost all the Offshore Wind capacity now generating is from AR2 and earlier, when strike prices were higher.

Here's the Q1 2026 forecast subsidy for Offshore Wind from pre-AR1 to AR3:

Here are the UK CfD strike prices for Offshore Wind for all Allocation Rounds.

The chart show the ASP, i.e. each auction's price cap, and the strike prices awarded. The strike prices are inflation linked, and are shown in 2024 prices, as used for AR7.

Strike prices fell sharply in AR3 and AR4.

Here are the UK CfD strike prices for Offshore Wind for all Allocation Rounds.

The chart show the ASP, i.e. each auction's price cap, and the strike prices awarded. The strike prices are inflation linked, and are shown in 2024 prices, as used for AR7.

Strike prices fell sharply in AR3 and AR4.

In Q4 2025, the technology-averaged strike price of Offshore Wind is £146.18/MWh,

and the CfD strike price averaged over all CfD generation is £147/MWh.

Why so high?

In Q4 2025, the technology-averaged strike price of Offshore Wind is £146.18/MWh,

and the CfD strike price averaged over all CfD generation is £147/MWh.

Why so high?

A 🧵 on offshore wind CfDs.

In Q4 2025, Offshore Wind accounts for 71% of UK CfD generation,

and 72% of CfD payments,

ie over twice as much as everything else put together.

Offshore Wind dominates Britain's renewable electricity.

⸻

Ref: LCCC Dashboard www.lowcarboncontracts.uk/resources/sc...

A 🧵 on offshore wind CfDs.

In Q4 2025, Offshore Wind accounts for 71% of UK CfD generation,

and 72% of CfD payments,

ie over twice as much as everything else put together.

Offshore Wind dominates Britain's renewable electricity.

⸻

Ref: LCCC Dashboard www.lowcarboncontracts.uk/resources/sc...

And here's the National Audit Office's report on Hinkley Point C, from June 2017:

www.nao.org.uk/wp-content/u...

The CfD strike price depends very heavily on investors' return:

👇

And here's the National Audit Office's report on Hinkley Point C, from June 2017:

www.nao.org.uk/wp-content/u...

The CfD strike price depends very heavily on investors' return:

👇

Here's a history of the Interim Levy Rate.

It hit zero from Q3 2021 to Q4 2022, during the gas price crisis (when the ILR had a price floor of £0/MWh and couldn't go negative),

but has otherwise ranged between £5/MWh and £12/MWh.

⸻

Ref: EMR Settlement www.emrsettlement.co.uk/document/set...

Here's a history of the Interim Levy Rate.

It hit zero from Q3 2021 to Q4 2022, during the gas price crisis (when the ILR had a price floor of £0/MWh and couldn't go negative),

but has otherwise ranged between £5/MWh and £12/MWh.

⸻

Ref: EMR Settlement www.emrsettlement.co.uk/document/set...

Here's the LCCC's forecast Interim Levy Rate for the next 2 years.

It stays in the £10-£12/MWh range, it's not expected to fall significantly.

The new Nuclear RAB Interim Levy Rate (paying for Sizewell C) is shown for comparison.

⸻

Ref: LCCC dp.lowcarboncontracts.uk/dataset/adva...

Here's the LCCC's forecast Interim Levy Rate for the next 2 years.

It stays in the £10-£12/MWh range, it's not expected to fall significantly.

The new Nuclear RAB Interim Levy Rate (paying for Sizewell C) is shown for comparison.

⸻

Ref: LCCC dp.lowcarboncontracts.uk/dataset/adva...

Here's a breakdown, by generating technology, of what the CfD strike prices are.

The average strike price of Offshore Wind is £146/MWh,

it accounts for 71% of CfD generation,

so it dominates the average strike price.

Solar PV pays a negative CfD subsidy, but it's 0.9% of CfD generation.

Here's a breakdown, by generating technology, of what the CfD strike prices are.

The average strike price of Offshore Wind is £146/MWh,

it accounts for 71% of CfD generation,

so it dominates the average strike price.

Solar PV pays a negative CfD subsidy, but it's 0.9% of CfD generation.

Here, as an example, is Q4 2025.

The Market Reference Prices are set at ~£85/MWh;

12.1 TWh of CfD generation is expected,

at an average CfD strike price of £147/MWh,

so net CfD payments of £748m must be brought in,

from 73 TWh of total generation,

so the Interim Levy Rate becomes £10.298/MWh.

Here, as an example, is Q4 2025.

The Market Reference Prices are set at ~£85/MWh;

12.1 TWh of CfD generation is expected,

at an average CfD strike price of £147/MWh,

so net CfD payments of £748m must be brought in,

from 73 TWh of total generation,

so the Interim Levy Rate becomes £10.298/MWh.

HPC's CfD is cheaper than current CfDs.

The average CfD strike price

for Q4 2025 is £147/MWh

The Hinkley Point C (CPI-linked) strike price is £127/MWh

(Market Reference Prices are ~£85/MWh).

⸻

Ref: LCCC Dashboard www.lowcarboncontracts.uk/resources/sc...

HPC's CfD is cheaper than current CfDs.

The average CfD strike price

for Q4 2025 is £147/MWh

The Hinkley Point C (CPI-linked) strike price is £127/MWh

(Market Reference Prices are ~£85/MWh).

⸻

Ref: LCCC Dashboard www.lowcarboncontracts.uk/resources/sc...

It had been at 21% for over 7 months from 25th October 2024 to 6th June 2025.

#Russianeconomy

10 years of interest rates, for context 👇:

⸻

Ref: tradingeconomics.com/russia/inter...

It had been at 21% for over 7 months from 25th October 2024 to 6th June 2025.

#Russianeconomy

10 years of interest rates, for context 👇:

⸻

Ref: tradingeconomics.com/russia/inter...

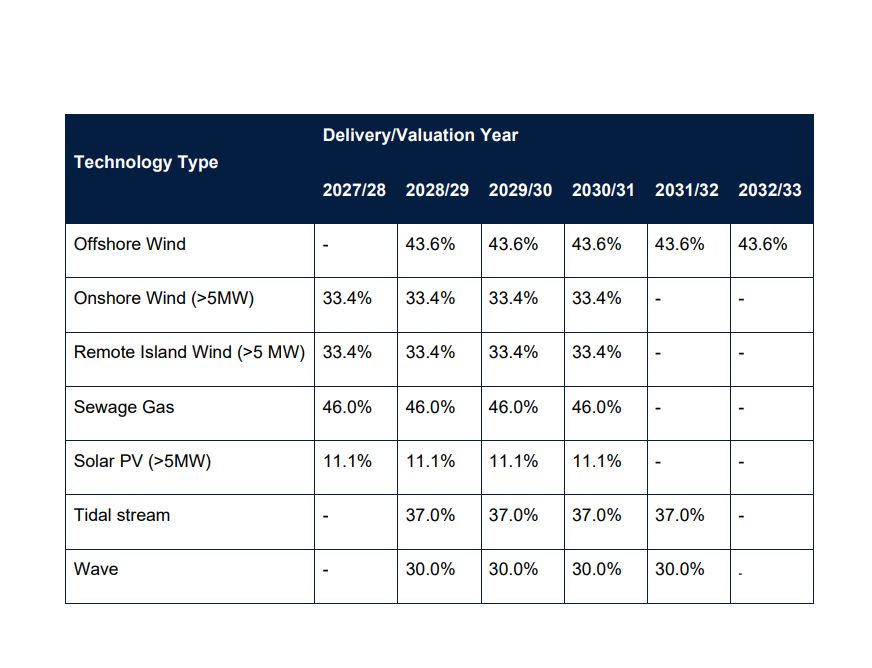

(page 2 of 2 of the load factors)👇

⸻

Ref: Contracts for Difference (CfD) Allocation Round 7: Allocation Framework assets.publishing.service.gov.uk/media/6880ff...

(page 2 of 2 of the load factors)👇

⸻

Ref: Contracts for Difference (CfD) Allocation Round 7: Allocation Framework assets.publishing.service.gov.uk/media/6880ff...