Left leaning centrist

- which income groups see the biggest increase in income?

- which income groups see the biggest decrease in income?

- which income groups see the biggest increase in income?

- which income groups see the biggest decrease in income?

You’re the one trying to pick at one item in isolation.

However the overall impact is clear, and it’s positive, and it’s progressive

You’re the one trying to pick at one item in isolation.

However the overall impact is clear, and it’s positive, and it’s progressive

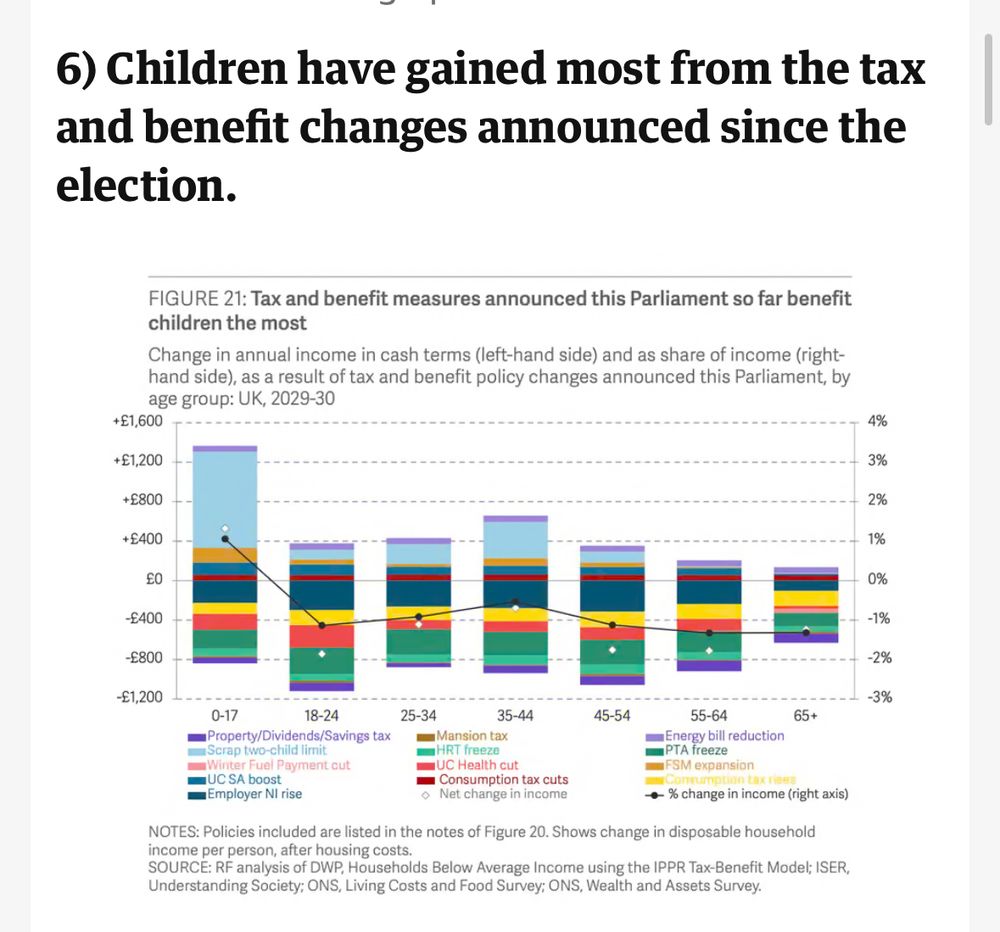

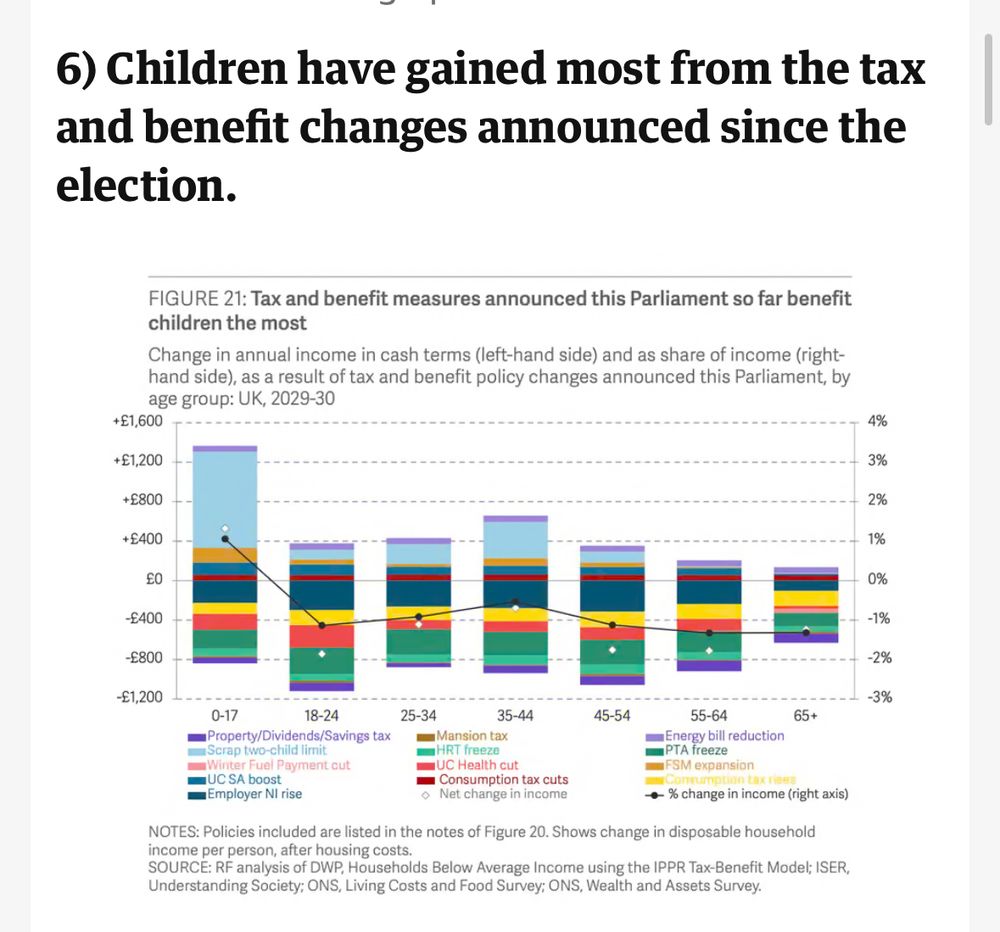

Labour have delivered two budgets which benefit the poorest, and the youngest, the most.

This seems to be what both of us want to see…

I’m more than comfortable with that.

Labour have delivered two budgets which benefit the poorest, and the youngest, the most.

This seems to be what both of us want to see…

Multiple things need to happen to improve the economy and living standards.

So yes, a simplistic framing

Multiple things need to happen to improve the economy and living standards.

So yes, a simplistic framing

Just raise the minimum wage and everything will ok?

But that won’t solve the housing crisis if supply of housing isn’t increased.

It will just bid up rents/house prices which won’t address inequality.

Just raise the minimum wage and everything will ok?

But that won’t solve the housing crisis if supply of housing isn’t increased.

It will just bid up rents/house prices which won’t address inequality.

Hard to see these people as impartial arbiters of truth when they behave like this.

They don’t want to talk about the substance, which is the rich paying more and the poor receiving more.

So they manufacture this nonsense

Hard to see these people as impartial arbiters of truth when they behave like this.

They don’t want to talk about the substance, which is the rich paying more and the poor receiving more.

So they manufacture this nonsense

The facts are, Labour’s budgets have been progressive helping the poorest & the young the most.

I’m more than comfortable with that.

The facts are, Labour’s budgets have been progressive helping the poorest & the young the most.

- Mansion tax on £2mil+ properties

- 2% extra tax for landlords, savings, and property

- VAT on private school fees

- Higher capital gains tax

- Higher inheritance tax for wealthy landowners.

- Higher private jet levies

Have you missed all this?

Increasing real wages is one part of the story (that is happening)

Reducing inflation is one part of the story (that is happening)

Increasing housing supply is one part of the story (planning reforms are happening, but will take a lot longer)

Etc.

Increasing real wages is one part of the story (that is happening)

Reducing inflation is one part of the story (that is happening)

Increasing housing supply is one part of the story (planning reforms are happening, but will take a lot longer)

Etc.

Could also say it’s a subsidy to banks & landlords as housing is expensive.

Could also say it’s a subsidy to farmers and food producers as food is expensive

Could also say it’s a subsidy to energy companies as electricity & gas is expensive

Etc.

Could also say it’s a subsidy to banks & landlords as housing is expensive.

Could also say it’s a subsidy to farmers and food producers as food is expensive

Could also say it’s a subsidy to energy companies as electricity & gas is expensive

Etc.

About 7% send their kids to private schools - definitely not ‘middle’

Only 145,000 houses in the UK worth £2mil+ - definitely not ‘middle’

48% of gains for CGT-liable individuals came from 14% of individuals with taxable incomes > £150,000 - definitely not ‘middle’

About 7% send their kids to private schools - definitely not ‘middle’

Only 145,000 houses in the UK worth £2mil+ - definitely not ‘middle’

48% of gains for CGT-liable individuals came from 14% of individuals with taxable incomes > £150,000 - definitely not ‘middle’

A sign that the last budget improved the UK’s position despite all the nose to the contrary

A sign that the last budget improved the UK’s position despite all the nose to the contrary

Laura K trying to pretend the OBR predicting headroom has reduced from £9bn to £4n meant that no action needed to be taken

Laura K trying to pretend the OBR predicting headroom has reduced from £9bn to £4n meant that no action needed to be taken

The middle generally aren’t sending their kids private schools

The middle generally aren’t flying in private jets.

The middle generally aren’t making large taxable capital gains

The middle generally aren’t sending their kids private schools

The middle generally aren’t flying in private jets.

The middle generally aren’t making large taxable capital gains

- Mansion tax on £2mil+ properties

- 2% extra tax for landlords, savings, and property

- VAT on private school fees

- Higher capital gains tax

- Higher inheritance tax for wealthy landowners.

- Higher private jet levies

Have you missed all this?