@nytopinion.nytimes.com. Was Chair of President Obama's CEA.

1. AI substitutes for labor, market-clearing wage falls below zero, people not hired.

2. AI complements labor, wages rise, income effects so people don't work as much.

1. AI substitutes for labor, market-clearing wage falls below zero, people not hired.

2. AI complements labor, wages rise, income effects so people don't work as much.

Impossible? It wasn’t.

Inevitable? It’s wasn’t that either.

It was a choice.

Vote Burhan #1 on Nov 4th and keep choosing housing.

Impossible? It wasn’t.

Inevitable? It’s wasn’t that either.

It was a choice.

Vote Burhan #1 on Nov 4th and keep choosing housing.

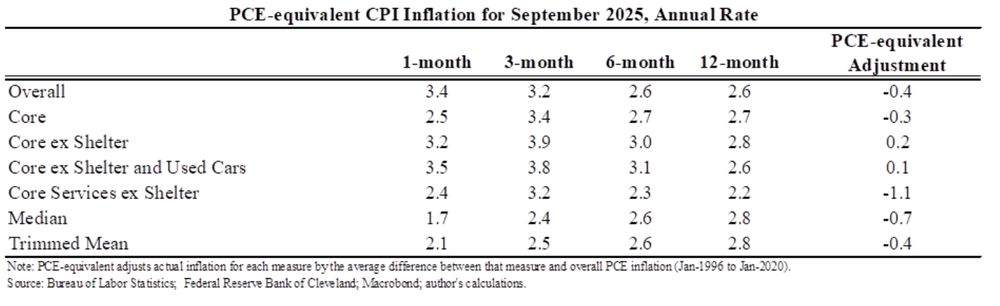

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

This is the median 7 concepts over 3, 6 and 12 months.

My own judgment is closer to 2.5%, maybe a tiny bit below.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

It was in effect for about 85 years.

It has now, for better or worse, been effectively abolished.

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

If you bought the stock market on the day Alan Greenspan announced "irrational exuberance" you would have made money no matter what day you ended up selling.

(Don't @ me about inflation adjustment.)

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

Quick summary, core CPI annual rate:

1 month: 2.8%

3 months: 3.6%

6 months: 3.0%

12 months: 3.0%

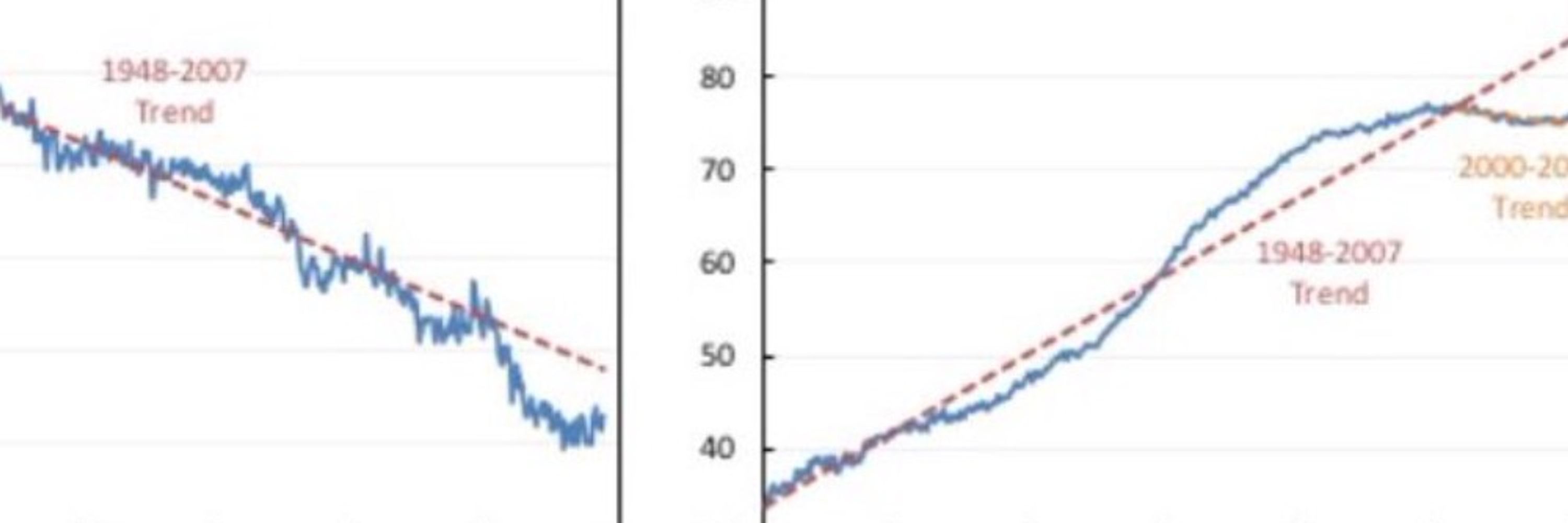

Productivity growth is often lagged, Part 129

Productivity growth before and after the dot.com bust

Productivity growth is often lagged, Part 129

Productivity growth before and after the dot.com bust

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

Large deficits (albeit smaller than expected), capital demand, Fed independence risk, persistent inflation, uncertainty, all go the other way.

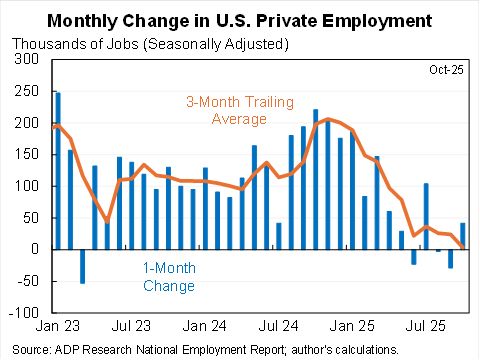

Now with additional data and revisions I'm wondering the opposite.

As always would place more weight on data messiness than any structural explanation (e.g., productivity, frozen labor market, etc)

Now with additional data and revisions I'm wondering the opposite.

As always would place more weight on data messiness than any structural explanation (e.g., productivity, frozen labor market, etc)

In Canada.

In Canada.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

But core PCE inflation ex portfolio services slowing lately, running just above 2% (when remeaned to reflect it usually runs low).

Some of the reinflation we've seen is rising stock prices counting as higher inflation.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.

Just chance the opposite hasn't happened. Eg 2004: Kerry came closer in the EC than the popular vote.

This is the pop vote vote margin Dems would have needed in past elections to win EC.

My review of the excellent Breakneck. www.goodreads.com/review/show/...

My review of the excellent Breakneck. www.goodreads.com/review/show/...

That is likely 99.9% of GDP, up from 98.2% last year.

Note CBO's January forecast was 99.9% of GDP.

In June CEA projected that if OBBBA passed it would fall to 96.2% of GDP this year.

That is likely 99.9% of GDP, up from 98.2% last year.

Note CBO's January forecast was 99.9% of GDP.

In June CEA projected that if OBBBA passed it would fall to 96.2% of GDP this year.