#Sentiment has recovered by readings are neutral

#Sentiment has recovered by readings are neutral

...but the yield curve is steepening

...but the yield curve is steepening

Risk appetite indicators are confirming the $SPX advance

Risk appetite indicators are confirming the $SPX advance

Breadth is healing. $SPX A-D Line made an ATH, NYSE A-D Line is knocking at the door.

% bullish and % above 50 dma have recovered

Net 52w highs-lows are back to positive

Breadth is healing. $SPX A-D Line made an ATH, NYSE A-D Line is knocking at the door.

% bullish and % above 50 dma have recovered

Net 52w highs-lows are back to positive

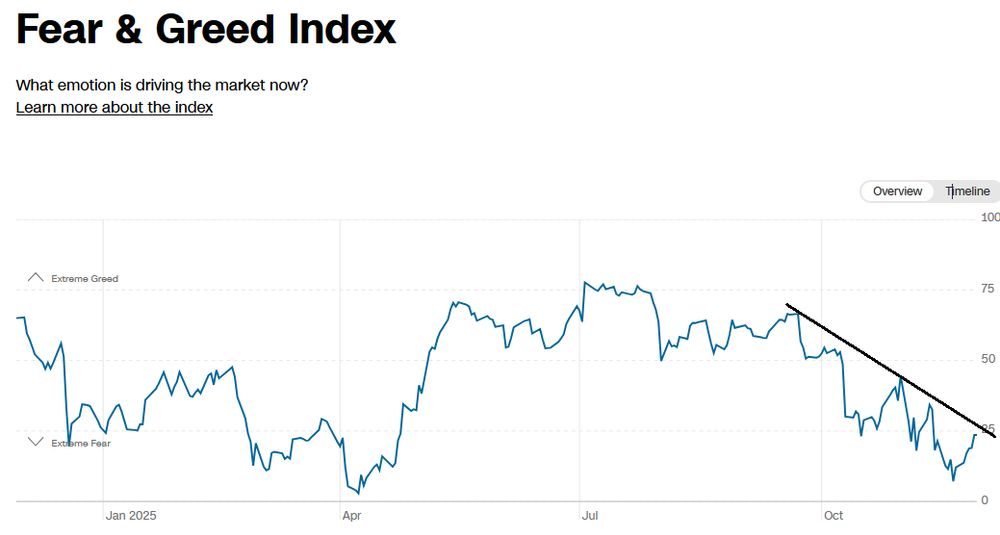

Can the Fear & Greed Index break up through the trend line, indicating that the bulls are taking full control of the tape?

#sentiment

Can the Fear & Greed Index break up through the trend line, indicating that the bulls are taking full control of the tape?

#sentiment

I'm not counting my chickens before they're hatched, but here is the out-of-sample record of ZBT buy signals. They fizzle in the ST when the Fed is raising rates, which isn't the case today.

I'm not counting my chickens before they're hatched, but here is the out-of-sample record of ZBT buy signals. They fizzle in the ST when the Fed is raising rates, which isn't the case today.

The market is getting close to a Zweig Breadth Thrust buy signal - still have another week to go

The market is getting close to a Zweig Breadth Thrust buy signal - still have another week to go

Sometimes it's useful to turn charts upside for a different perspective. Would you buy these charts?

$SPX $SPXEW

Sometimes it's useful to turn charts upside for a different perspective. Would you buy these charts?

$SPX $SPXEW

$QQQ testing overhead trend line resistance

$QQQ testing overhead trend line resistance

www.marketwatch.com/story/is-it-...

www.marketwatch.com/story/is-it-...

buff.ly/rF3FNMK

buff.ly/rF3FNMK

"As the market adopted a risk-off tone, market leadership showed a clear growth to value rotation across the board on all market cap bands and internationally"

buff.ly/8P2jPdm

"As the market adopted a risk-off tone, market leadership showed a clear growth to value rotation across the board on all market cap bands and internationally"

buff.ly/8P2jPdm

humblestudentofthemarkets.blogspot.com/2025/11/how-...

humblestudentofthemarkets.blogspot.com/2025/11/how-...

buff.ly/ws4n3sb

buff.ly/ws4n3sb

"As the market adopted a risk-off tone, market leadership showed a clear growth to value rotation across the board on all market cap bands and internationally"

humblestudentofthemarkets.blogspot.com/2025/11/is-i...

"As the market adopted a risk-off tone, market leadership showed a clear growth to value rotation across the board on all market cap bands and internationally"

humblestudentofthemarkets.blogspot.com/2025/11/is-i...

Even as $SPX fell, forward 12m EPS rose strongly, indicating positive fundamental momentum

Even as $SPX fell, forward 12m EPS rose strongly, indicating positive fundamental momentum

$SPX forward P/E valuations have come off the boil as stock prices retreated

(cont...)

$SPX forward P/E valuations have come off the boil as stock prices retreated

(cont...)

How worried should we be about negative breadth divergences?

How worried should we be about negative breadth divergences?

The Zweig Breadth Thrust Indicator reached an oversold condition on Thursday. The history of the signal in the last two years speaks for itself.

The Zweig Breadth Thrust Indicator reached an oversold condition on Thursday. The history of the signal in the last two years speaks for itself.

Inversions of the $VIX term structure have tended to resolve in market bounces

Inversions of the $VIX term structure have tended to resolve in market bounces

An oldie but goodie: A fragile bull

humblestudentofthemarkets.com/2025/10/18/a...

An oldie but goodie: A fragile bull

humblestudentofthemarkets.com/2025/10/18/a...

Greed and Fear back at extreme fear

Greed and Fear back at extreme fear