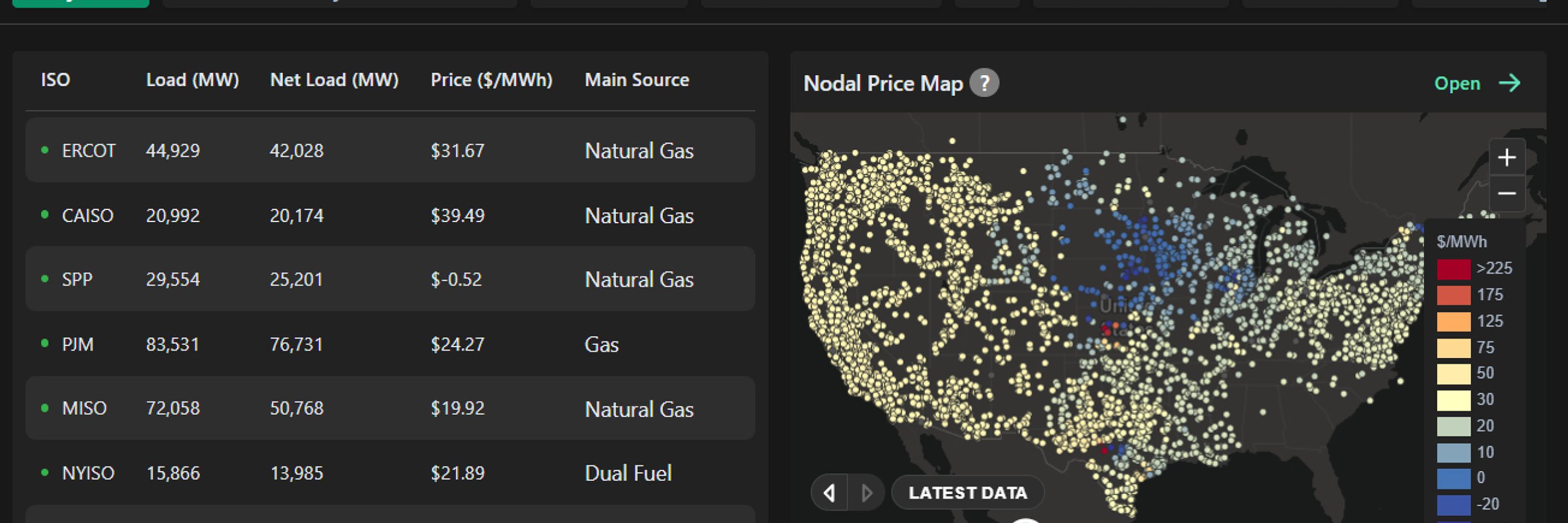

check it out and track live outcomes on www.gridstatus.io/live

check it out and track live outcomes on www.gridstatus.io/live

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

part 2 will cover the fulsome western expansion of SPP's market, the Canada of it all, wider western challenges, and pondering the implications to Mid-C of split market participation among its constituent parts

blog.gridstatus.io/western-mark...

www.gridstatus.io/live/isone

www.gridstatus.io/live/isone

This rapid expansion will strain an already tense environment.

This rapid expansion will strain an already tense environment.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

While large, this is a far more gradual increase compared to DAY or PPL, whose forecasts have ballooned in just the last year.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

AEP-Ohio alone accounts for over 5 GW of this reduction, largely driven by tariff changes requiring large loads to prepay for a portion of expected usage.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.

PPL reports more than 15 GW of large loads by 2035 in comparison to 248 MW today, almost 5 GW more than COMED, a zone that today serves 2-3x the total demand.