I like making things. Interested in energy & data

@gridstatus.io, and I’m looking for users to test it.

Not only does it make pretty visualizations, it helps you understand how forecast vintages evolve over time, compare their historical accuracy, and more.

DM or reply for link!

@gridstatus.io, and I’m looking for users to test it.

Not only does it make pretty visualizations, it helps you understand how forecast vintages evolve over time, compare their historical accuracy, and more.

DM or reply for link!

@gridstatus.io

So far, LMPs have ranged from $-100/MWh to $367/MWh across the nearly 1000 new nodes in IESO

See the pretty map and more here: www.gridstatus.io/live/ieso

@gridstatus.io

So far, LMPs have ranged from $-100/MWh to $367/MWh across the nearly 1000 new nodes in IESO

See the pretty map and more here: www.gridstatus.io/live/ieso

We walked through how to use Grid Status to monitor, track, and review these situations 🔌💡

blog.gridstatus.io/exploring-ex...

We walked through how to use Grid Status to monitor, track, and review these situations 🔌💡

blog.gridstatus.io/exploring-ex...

this time we dove into the data around an event in PJM last summer where ~1.5 GW of datacenters suddenly dropped off the grid in northern Virginia, PJM's limited tools to deal with these kinds of events, and the sad state of batteries in the RTO 🔌💡

blog.gridstatus.io/byte-blackou...

this time we dove into the data around an event in PJM last summer where ~1.5 GW of datacenters suddenly dropped off the grid in northern Virginia, PJM's limited tools to deal with these kinds of events, and the sad state of batteries in the RTO 🔌💡

blog.gridstatus.io/byte-blackou...

We're in the depths of outage season with many thermal assets out for maintenance. In those conditions, even a modest morning load forecast beat can lead to a quick run up the supply stack. 🔌💡

We're in the depths of outage season with many thermal assets out for maintenance. In those conditions, even a modest morning load forecast beat can lead to a quick run up the supply stack. 🔌💡

little 🧵 with some IESO background, check the blog for more figures and explanation of the MRP

blog.gridstatus.io/market-renew...

little 🧵 with some IESO background, check the blog for more figures and explanation of the MRP

blog.gridstatus.io/market-renew...

Basically saying "we need to do something right now, please approve, even if it's not perfect" (snipping ISO-NE)

www.iso-ne.com/static-asset...

nyisoviewer.etariff.biz/ViewerDocLib...

Basically saying "we need to do something right now, please approve, even if it's not perfect" (snipping ISO-NE)

www.iso-ne.com/static-asset...

nyisoviewer.etariff.biz/ViewerDocLib...

1. Record winter load peak

2. Record net load

3. Record battery discharge

4. Record solar generation

5. Record 5-minute LMPs at a specific node

🧵

1. Record winter load peak

2. Record net load

3. Record battery discharge

4. Record solar generation

5. Record 5-minute LMPs at a specific node

Prior to the new record, only a single day had cracked the winter top ten in the last decade. Impressively, the RTO accomplished this while exporting ~8 GW to neighbors.

💡🔌

Prior to the new record, only a single day had cracked the winter top ten in the last decade. Impressively, the RTO accomplished this while exporting ~8 GW to neighbors.

💡🔌

The previous record was ~34.5 GW on January 17th, just last year.

You can track this here: www.gridstatus.io/eia/TVA

A note of caution though, this EIA data can change as it gets updated, consider it preliminary in the moment.

💡🔌

The previous record was ~34.5 GW on January 17th, just last year.

You can track this here: www.gridstatus.io/eia/TVA

A note of caution though, this EIA data can change as it gets updated, consider it preliminary in the moment.

💡🔌

Same goes for out east, where DA prices have been rising in NYISO and ISO-NE over the weekend as the system braces for cold and snow. 🔌💡

Same goes for out east, where DA prices have been rising in NYISO and ISO-NE over the weekend as the system braces for cold and snow. 🔌💡

As snow settled in over the Mid-Atlantic, Dominion’s demand exceeded AEP’s, a result of both storm placement and a greater reliance on electric heating 🔌💡

Expansion and electrification of oil and gas operations has driven load growth in ERCOT’s Far West weather zone. Likely the fastest load growth in the country over the past few years.

Expansion and electrification of oil and gas operations has driven load growth in ERCOT’s Far West weather zone. Likely the fastest load growth in the country over the past few years.

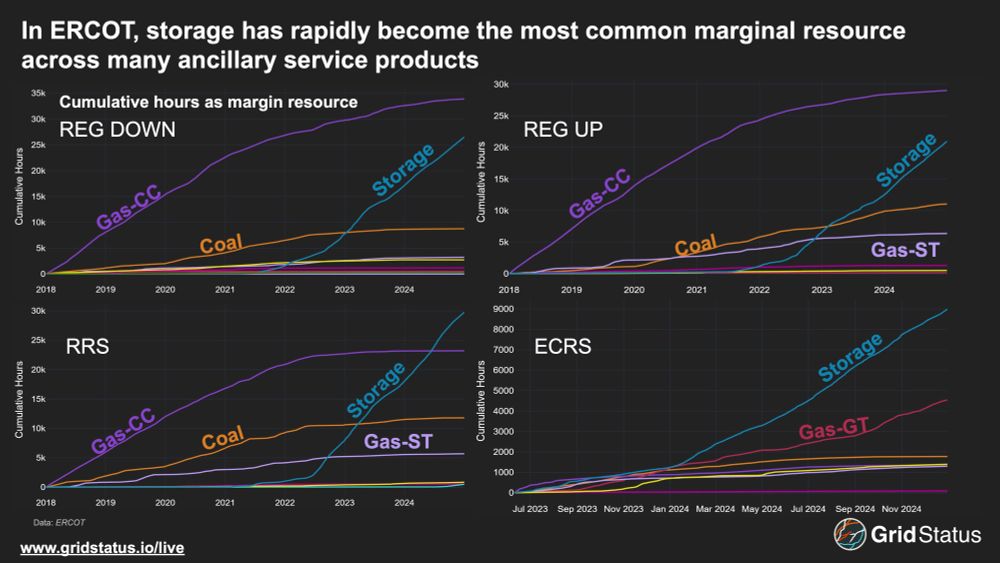

Battery generation capacity has made up 50%+ of awards for reg up and responsive reserves since 2022. In these, coal and gas regularly account for <20% of capacity.

#energysky 🔌💡

Battery generation capacity has made up 50%+ of awards for reg up and responsive reserves since 2022. In these, coal and gas regularly account for <20% of capacity.

#energysky 🔌💡

As @waldoch.bsky.social pointed out, I forgot to mention communicating/writing about the insights, which is a big part of what we do at @gridstatus.io

As @waldoch.bsky.social pointed out, I forgot to mention communicating/writing about the insights, which is a big part of what we do at @gridstatus.io

Peak solar production in MISO shot up 144% during the past year, reaching over 8GW in October.

Lots of good insights in this thread!

MISO and PJM are the two largest markets in the US, with solar capacity growing faster than many may realize. MISO’s solar record increased dramatically over the year, surpassing 8GW in October, while contribution to peak load exceeded 5% on more than 50 days.

Peak solar production in MISO shot up 144% during the past year, reaching over 8GW in October.

Lots of good insights in this thread!

Use Sync Tooltips to compare across charts

We have our list of improvements for this in the new year, but what do you want to see? 🔌💡

www.gridstatus.io/live/ercot#p...

Use Sync Tooltips to compare across charts

We have our list of improvements for this in the new year, but what do you want to see? 🔌💡

www.gridstatus.io/live/ercot#p...

short 🧵

#energysky

short 🧵

#energysky

However, divergence occurred as wind began to recover. A negative congestion signal was sent to windy areas due to now-ramped thermal gen closer to load

However, divergence occurred as wind began to recover. A negative congestion signal was sent to windy areas due to now-ramped thermal gen closer to load