💡 Policy updates & analysis on EU sustainable finance

🌱 Sustainable Finance new from Europe and beyond

👥 Expert interviews

⚠️ This decision is likely to 𝘀𝗲𝘃𝗲𝗿𝗲𝗹𝘆 𝗹𝗶𝗺𝗶𝘁 𝘁𝗵𝗲 𝘀𝗰𝗮𝗹𝗶𝗻𝗴 𝘂𝗽 𝗼𝗳 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 for the #JustTransition and Europe's #competitiveness.

Read our analysis and reaction here: www.linkedin.com/feed/update/...

⚠️ This decision is likely to 𝘀𝗲𝘃𝗲𝗿𝗲𝗹𝘆 𝗹𝗶𝗺𝗶𝘁 𝘁𝗵𝗲 𝘀𝗰𝗮𝗹𝗶𝗻𝗴 𝘂𝗽 𝗼𝗳 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁 for the #JustTransition and Europe's #competitiveness.

Read our analysis and reaction here: www.linkedin.com/feed/update/...

📄 More information & how to apply: shorturl.at/FjkQo

📄 More information & how to apply: shorturl.at/FjkQo

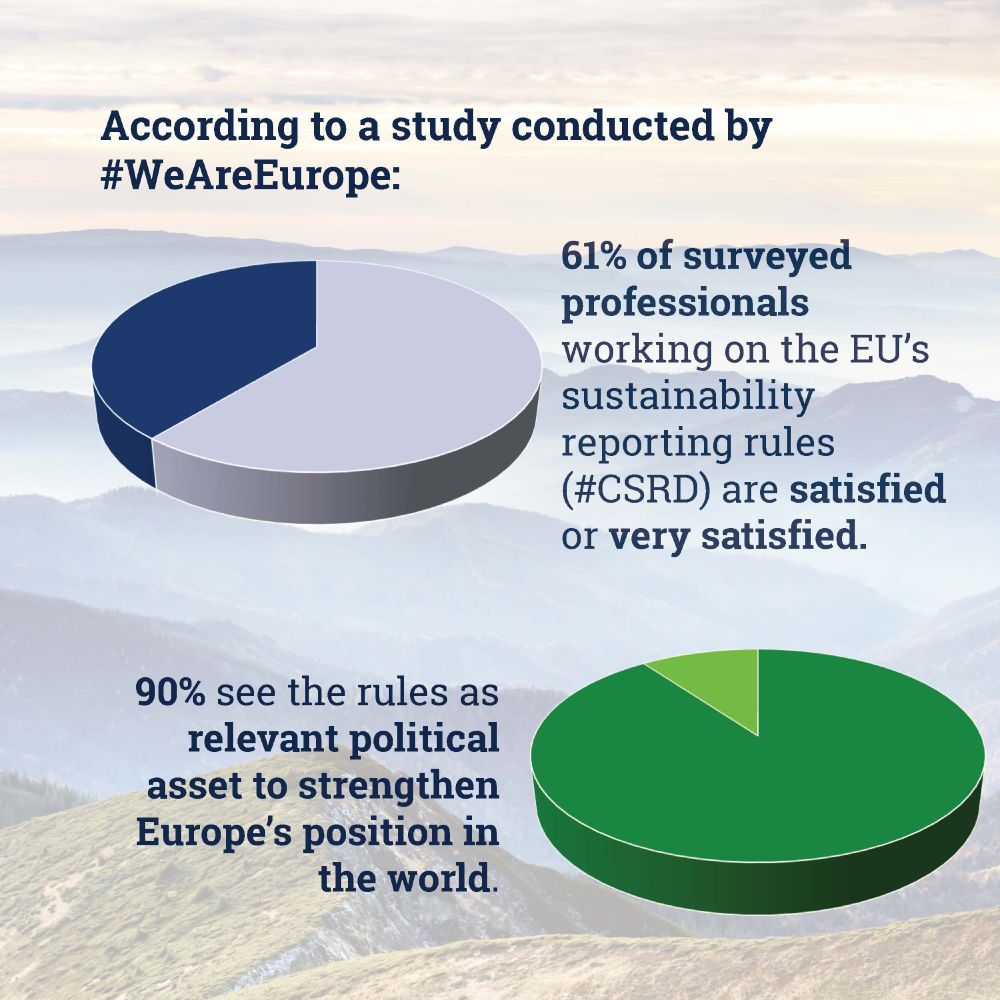

The association #WeAreEurope launched a survey among EU companies: The majority want to preserve the original Corporate Sustainability Due Diligence Directive and avoid diluting its provisions.

For more: www.linkedin.com/feed/update/...

The association #WeAreEurope launched a survey among EU companies: The majority want to preserve the original Corporate Sustainability Due Diligence Directive and avoid diluting its provisions.

For more: www.linkedin.com/feed/update/...

We welcome this step as there is currently no common EU standard defining “social investments”.

Access the paper here: shorturl.at/ypu1Q

We welcome this step as there is currently no common EU standard defining “social investments”.

Access the paper here: shorturl.at/ypu1Q

📄 More info & apply: lnkd.in/eqbAt986

📩 Send CV + cover letter to [email protected] (subject: Senior Policy Adviser – [First Name, Last Name])

📄 More info & apply: lnkd.in/eqbAt986

📩 Send CV + cover letter to [email protected] (subject: Senior Policy Adviser – [First Name, Last Name])

In the next days, Eurosif will take part in two key international gatherings in São Paulo, bringing together global leaders and experts committed to driving sustainable investment forward

For more info: www.linkedin.com/feed/update/...

In the next days, Eurosif will take part in two key international gatherings in São Paulo, bringing together global leaders and experts committed to driving sustainable investment forward

For more info: www.linkedin.com/feed/update/...

In this issue:

• The latest #Omnibus developments and ESMA publications

• News from Eurosif and our network across Europe

• Upcoming events

• Recommended reads & podcasts

Read the October edition here: mailchi.mp/eurosif/euro...

In this issue:

• The latest #Omnibus developments and ESMA publications

• News from Eurosif and our network across Europe

• Upcoming events

• Recommended reads & podcasts

Read the October edition here: mailchi.mp/eurosif/euro...

🌱 While progress is clear, climate neutrality requires urgent and coordinated action.

Full report: eea.europa.eu/en/europe-environment-2025

🌱 While progress is clear, climate neutrality requires urgent and coordinated action.

Full report: eea.europa.eu/en/europe-environment-2025

📄 The report explores what makes transition funds distinct from other environmental and ESG funds.

Our key takeaways: www.linkedin.com/feed/update/...

📄 The report explores what makes transition funds distinct from other environmental and ESG funds.

Our key takeaways: www.linkedin.com/feed/update/...

• "Transition" products can deliver competitive returns

• Most retail investors show preferences for #ESG investing

For more: www.linkedin.com/feed/update/...

• "Transition" products can deliver competitive returns

• Most retail investors show preferences for #ESG investing

For more: www.linkedin.com/feed/update/...

On 16 October, we hosted the first Eurosif Club annual event. Here, financial market participants, businesses, and policymakers explored the latest and upcoming developments of the EU’s sustainable finance framework.

👉 For more: www.linkedin.com/feed/update/...

On 16 October, we hosted the first Eurosif Club annual event. Here, financial market participants, businesses, and policymakers explored the latest and upcoming developments of the EU’s sustainable finance framework.

👉 For more: www.linkedin.com/feed/update/...

Today, the Plenary voted against starting trilogue negotiations - meaning more changes to the text are possible.

📢 𝐖𝐞 𝐮𝐫𝐠𝐞 𝐌𝐄𝐏𝐬 𝐭𝐨 𝐬𝐚𝐯𝐞𝐠𝐮𝐚𝐫𝐝 𝐤𝐞𝐲 𝐬𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐥𝐞 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐫𝐮𝐥𝐞𝐬.

💡 More on the business case for the framework: lnkd.in/ew8wM2-F

Today, the Plenary voted against starting trilogue negotiations - meaning more changes to the text are possible.

📢 𝐖𝐞 𝐮𝐫𝐠𝐞 𝐌𝐄𝐏𝐬 𝐭𝐨 𝐬𝐚𝐯𝐞𝐠𝐮𝐚𝐫𝐝 𝐤𝐞𝐲 𝐬𝐮𝐬𝐭𝐚𝐢𝐧𝐚𝐛𝐥𝐞 𝐟𝐢𝐧𝐚𝐧𝐜𝐞 𝐫𝐮𝐥𝐞𝐬.

💡 More on the business case for the framework: lnkd.in/ew8wM2-F

🌍 As the regulatory landscape evolves with the #Omnibus package, ESMA gives guidance to companies by setting expectations for what it will focus on in companies’ sustainability statements

🔗 Read the full statement here: lnkd.in/dUGm8AqE

🌍 As the regulatory landscape evolves with the #Omnibus package, ESMA gives guidance to companies by setting expectations for what it will focus on in companies’ sustainability statements

🔗 Read the full statement here: lnkd.in/dUGm8AqE

🔎 Their analysis includes:

- Insights on transparency, completeness and usability

- Recommendations for reporting companies & the ongoing ESRS review

🔗Our summary: www.linkedin.com/feed/update/...

🔗 Full report: lnkd.in/dDnsG_Zm

🔎 Their analysis includes:

- Insights on transparency, completeness and usability

- Recommendations for reporting companies & the ongoing ESRS review

🔗Our summary: www.linkedin.com/feed/update/...

🔗 Full report: lnkd.in/dDnsG_Zm

Last week, the European Securities and Markets Authority issued their final report on technical standards specifying provisions under the European Green Bonds (#EuGB) Regulation.

👉Read more here: lnkd.in/df6dY8AA

Last week, the European Securities and Markets Authority issued their final report on technical standards specifying provisions under the European Green Bonds (#EuGB) Regulation.

👉Read more here: lnkd.in/df6dY8AA

💬 Eurosif Executive Director Aleksandra Palinska had the pleasure of exploring this question during a panel at EFFAS’ CESG conference yesterday.

Read our key insights: www.linkedin.com/feed/update/...

💬 Eurosif Executive Director Aleksandra Palinska had the pleasure of exploring this question during a panel at EFFAS’ CESG conference yesterday.

Read our key insights: www.linkedin.com/feed/update/...

📍 Brussels & online

🗓️ 16/10

🌍 Aleksandra Palinska, Executive Director of Eurosif, will join experts from the European Commission, EFRAG, and PRI to discuss the 𝗘𝗨 𝗢𝗺𝗻𝗶𝗯𝘂𝘀 𝗣𝗿𝗼𝗰𝗲𝗱𝘂𝗿𝗲 𝗮𝗻𝗱 𝗪𝗵𝗮𝘁’𝘀 𝗡𝗲𝘅𝘁 𝗶𝗻 𝗘𝗦𝗚 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻.

lnkd.in/d2XE7Mhy

📍 Brussels & online

🗓️ 16/10

🌍 Aleksandra Palinska, Executive Director of Eurosif, will join experts from the European Commission, EFRAG, and PRI to discuss the 𝗘𝗨 𝗢𝗺𝗻𝗶𝗯𝘂𝘀 𝗣𝗿𝗼𝗰𝗲𝗱𝘂𝗿𝗲 𝗮𝗻𝗱 𝗪𝗵𝗮𝘁’𝘀 𝗡𝗲𝘅𝘁 𝗶𝗻 𝗘𝗦𝗚 𝗥𝗲𝗴𝘂𝗹𝗮𝘁𝗶𝗼𝗻.

lnkd.in/d2XE7Mhy

Frank Bold’s new analysis shows the 𝗖𝗦𝗥𝗗 𝗶𝘀 𝗮𝗹𝗿𝗲𝗮𝗱𝘆 𝐢𝐦𝐩𝐫𝐨𝐯𝐢𝐧𝐠 𝗰𝗹𝗶𝗺𝗮𝘁𝗲 𝘁𝗿𝗮𝗻𝘀𝗶𝘁𝗶𝗼𝗻 𝗽𝗹𝗮𝗻𝗻𝗶𝗻𝗴 & 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗿𝗲𝘀𝗶𝗹𝗶𝗲𝗻𝗰𝗲.

👉 Something to consider as the EU negotiates the “simplification package”: bit.ly/46ZqoS5

Frank Bold’s new analysis shows the 𝗖𝗦𝗥𝗗 𝗶𝘀 𝗮𝗹𝗿𝗲𝗮𝗱𝘆 𝐢𝐦𝐩𝐫𝐨𝐯𝐢𝐧𝐠 𝗰𝗹𝗶𝗺𝗮𝘁𝗲 𝘁𝗿𝗮𝗻𝘀𝗶𝘁𝗶𝗼𝗻 𝗽𝗹𝗮𝗻𝗻𝗶𝗻𝗴 & 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝗿𝗲𝘀𝗶𝗹𝗶𝗲𝗻𝗰𝗲.

👉 Something to consider as the EU negotiates the “simplification package”: bit.ly/46ZqoS5

👉 Find Eurosif's take and a breakdown of the main issues for investors here: www.eurosif.org/wp-content/u...

#CSRD #CSDDD

👉 Find Eurosif's take and a breakdown of the main issues for investors here: www.eurosif.org/wp-content/u...

#CSRD #CSDDD

📅 4-6 November 2025

Organised by Impact Finance Belgium, part of our network, this event will 𝗳𝗲𝗮𝘁𝘂𝗿𝗲 𝗶𝗻𝘀𝗽𝗶𝗿𝗶𝗻𝗴 𝗸𝗲𝘆𝗻𝗼𝘁𝗲𝘀, 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗮𝗹 𝗲𝘅𝗰𝗵𝗮𝗻𝗴𝗲𝘀, 𝗮𝗻𝗱 𝗽𝗼𝘄𝗲𝗿𝗳𝘂𝗹 𝗽𝗮𝗿𝘁𝗻𝗲𝗿𝘀𝗵𝗶𝗽𝘀.

👉 For more information: www.belgianimpactweek.be/bru25/home

📅 4-6 November 2025

Organised by Impact Finance Belgium, part of our network, this event will 𝗳𝗲𝗮𝘁𝘂𝗿𝗲 𝗶𝗻𝘀𝗽𝗶𝗿𝗶𝗻𝗴 𝗸𝗲𝘆𝗻𝗼𝘁𝗲𝘀, 𝗽𝗿𝗮𝗰𝘁𝗶𝗰𝗮𝗹 𝗲𝘅𝗰𝗵𝗮𝗻𝗴𝗲𝘀, 𝗮𝗻𝗱 𝗽𝗼𝘄𝗲𝗿𝗳𝘂𝗹 𝗽𝗮𝗿𝘁𝗻𝗲𝗿𝘀𝗵𝗶𝗽𝘀.

👉 For more information: www.belgianimpactweek.be/bru25/home

In our newest episode of SustainabilityBridges, Eric Pedersen shared Nordea's perspectives on the 𝗘𝗨’𝘀 𝘀𝘂𝘀𝘁𝗮𝗶𝗻𝗮𝗯𝗹𝗲 𝗳𝗶𝗻𝗮𝗻𝗰𝗲 𝗳𝗿𝗮𝗺𝗲𝘄𝗼𝗿𝗸 𝗮𝗻𝗱 𝘁𝗵𝗲 𝗢𝗺𝗻𝗶𝗯𝘂𝘀 𝗶𝗻𝗶𝘁𝗶𝗮𝘁𝗶𝘃𝗲.

🎧 Listen here: www.eurosif.org/press-room/c...

In our newest episode of SustainabilityBridges, Eric Pedersen shared Nordea's perspectives on the 𝗘𝗨’𝘀 𝘀𝘂𝘀𝘁𝗮𝗶𝗻𝗮𝗯𝗹𝗲 𝗳𝗶𝗻𝗮𝗻𝗰𝗲 𝗳𝗿𝗮𝗺𝗲𝘄𝗼𝗿𝗸 𝗮𝗻𝗱 𝘁𝗵𝗲 𝗢𝗺𝗻𝗶𝗯𝘂𝘀 𝗶𝗻𝗶𝘁𝗶𝗮𝘁𝗶𝘃𝗲.

🎧 Listen here: www.eurosif.org/press-room/c...

1️⃣ 𝗚𝗼𝗼𝗱 𝗳𝗼𝗿 𝗰𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 𝗮𝗻𝗱 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀

2️⃣ 𝗕𝗼𝗼𝘀𝘁𝘀 𝘁𝗵𝗲 𝘄𝗵𝗼𝗹𝗲 𝗲𝗰𝗼𝗻𝗼𝗺𝘆

3️⃣ 𝗕𝗮𝗰𝗸𝗲𝗱 𝗯𝘆 𝗰𝗶𝘁𝗶𝘇𝗲𝗻𝘀

For more: www.linkedin.com/feed/update/...

1️⃣ 𝗚𝗼𝗼𝗱 𝗳𝗼𝗿 𝗰𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 𝗮𝗻𝗱 𝗶𝗻𝘃𝗲𝘀𝘁𝗼𝗿𝘀

2️⃣ 𝗕𝗼𝗼𝘀𝘁𝘀 𝘁𝗵𝗲 𝘄𝗵𝗼𝗹𝗲 𝗲𝗰𝗼𝗻𝗼𝗺𝘆

3️⃣ 𝗕𝗮𝗰𝗸𝗲𝗱 𝗯𝘆 𝗰𝗶𝘁𝗶𝘇𝗲𝗻𝘀

For more: www.linkedin.com/feed/update/...

🖋️Their workplan includes:

• Streamlining rules

• Fighting #greenwashing

• #TransitionFinance

• New supervision tasks for EU Green Bonds & ESG ratings

Read our summary: www.linkedin.com/feed/update/...

🖋️Their workplan includes:

• Streamlining rules

• Fighting #greenwashing

• #TransitionFinance

• New supervision tasks for EU Green Bonds & ESG ratings

Read our summary: www.linkedin.com/feed/update/...

🌱 Explore Japan’s latest sustainable investment trends from JSIF’s new White Paper.

👉 Don’t miss insights on ESG, transition finance & impact investing in Japan: shorturl.at/Ub9PK

🌱 Explore Japan’s latest sustainable investment trends from JSIF’s new White Paper.

👉 Don’t miss insights on ESG, transition finance & impact investing in Japan: shorturl.at/Ub9PK

🔎 Economists find 𝘀𝘁𝗿𝗼𝗻𝗴 𝗯𝗲𝗻𝗲𝗳𝗶𝘁𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗖𝗦𝗗𝗗𝗗 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗘𝗨, and warn that diluting it, as suggested by the #Omnibus initiative, would “significantly weaken” its effectiveness

For more: www.linkedin.com/posts/eurosi...

🔎 Economists find 𝘀𝘁𝗿𝗼𝗻𝗴 𝗯𝗲𝗻𝗲𝗳𝗶𝘁𝘀 𝗼𝗳 𝘁𝗵𝗲 𝗖𝗦𝗗𝗗𝗗 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗘𝗨, and warn that diluting it, as suggested by the #Omnibus initiative, would “significantly weaken” its effectiveness

For more: www.linkedin.com/posts/eurosi...