Share Price $12.08

Snatched a holding today. Why?

I'm seeking a few dull and uninspiring stocks, out of favour but selling very cheaply.

Watched, listened and read what I could research. Nomad Foods fit the bill!

In 2026

Pricing up on food products

Efficiency program starts.

Share Price $12.08

Snatched a holding today. Why?

I'm seeking a few dull and uninspiring stocks, out of favour but selling very cheaply.

Watched, listened and read what I could research. Nomad Foods fit the bill!

In 2026

Pricing up on food products

Efficiency program starts.

Share Price: 215p

Analysts been less enthusiastic. Profit forecasts lowered.

May explain recent SP drop.

FY26 Adj PBT Mgmtbguidance £39m-£43m is today's real story!

Margin expansion + £25m buyback reinforces upward SP path.

In time upgrades?

Upside bigger than the Downside!

Share Price: 215p

Analysts been less enthusiastic. Profit forecasts lowered.

May explain recent SP drop.

FY26 Adj PBT Mgmtbguidance £39m-£43m is today's real story!

Margin expansion + £25m buyback reinforces upward SP path.

In time upgrades?

Upside bigger than the Downside!

Share Price 217p (+12.6%)

FY Margin Magic!

Adj PBT rose 20% on a modest 6% revenue increase and 11% TTV growth, confirms successful margin expansion. Hmm..

Forward bookings are up, strong cash flow, dividend and a large share buyback programme.

Paying Up to Buy Now.

Humbug!...

Share Price 217p (+12.6%)

FY Margin Magic!

Adj PBT rose 20% on a modest 6% revenue increase and 11% TTV growth, confirms successful margin expansion. Hmm..

Forward bookings are up, strong cash flow, dividend and a large share buyback programme.

Paying Up to Buy Now.

Humbug!...

Share Price: 2,490p

Did SP overreact post-Budget?

No, if consumer spending slows, cost inflation bites and Germany adds risk.

The £40m rates hit is only ~£1 per guest across ~40m stays. Hardly a major deterrent.

Doubled my Holding! Smart?

Not overly cheap, but I’ll sleep easy!

Share Price: 2,490p

Did SP overreact post-Budget?

No, if consumer spending slows, cost inflation bites and Germany adds risk.

The £40m rates hit is only ~£1 per guest across ~40m stays. Hardly a major deterrent.

Doubled my Holding! Smart?

Not overly cheap, but I’ll sleep easy!

Share Price 2490p (-11.45%)

If the £50m extra Rateable Valuation is spread across their 68K (on average) rooms let for 365 nights

Then...

~£735 is the extra yearly cost per let room

Implies ~£2 extra cost for each let room per night

Has Market Overreacted?

Yes, if sums correct.

Share Price 2490p (-11.45%)

If the £50m extra Rateable Valuation is spread across their 68K (on average) rooms let for 365 nights

Then...

~£735 is the extra yearly cost per let room

Implies ~£2 extra cost for each let room per night

Has Market Overreacted?

Yes, if sums correct.

Share Price 2530p (-10%)

Bernstein, downgraded its rating for Whitbread, calling the business rate changes a "hammer blow."

Another firm, Citi, estimated the cost impact to be ~£43m

Whitbread would look to offset it through cost-cutting

Was cheaper SP for good reasons.

Ouch!

Share Price 2530p (-10%)

Bernstein, downgraded its rating for Whitbread, calling the business rate changes a "hammer blow."

Another firm, Citi, estimated the cost impact to be ~£43m

Whitbread would look to offset it through cost-cutting

Was cheaper SP for good reasons.

Ouch!

Share Price 59.29p

Issue isn't the profitable core business or the £95m cash pile!

It's the unquantifiable Litigation Risk Premium with The High Court battle (with £320m asset freeze + forgery claims).

Awful sentiment.

SP overdiscounting risks?

Added 15% more!

Pity Me!

Share Price 59.29p

Issue isn't the profitable core business or the £95m cash pile!

It's the unquantifiable Litigation Risk Premium with The High Court battle (with £320m asset freeze + forgery claims).

Awful sentiment.

SP overdiscounting risks?

Added 15% more!

Pity Me!

Share Price: 2,630p (-6.4%)

Heavy drop this morning with no clear news. Looks like insiders have been trimming,

A likely mix of wage pressures, Germany softening, and possibly a fully valued SP.

Bought the dip <2,600p, adding 25% to my holding.

Still a Buy-and-Hold for me.

Share Price: 2,630p (-6.4%)

Heavy drop this morning with no clear news. Looks like insiders have been trimming,

A likely mix of wage pressures, Germany softening, and possibly a fully valued SP.

Bought the dip <2,600p, adding 25% to my holding.

Still a Buy-and-Hold for me.

Share Price 107p (-9.78%)

Remote Gaming Duty (RGD) to spike to 40% is an Omega Disaster for profitability.

The £46m cost wipes out the £25m UK Digital profit,

Duty hike must urgently be reviewed before it pushes users to the black market.

No position but think

Quietly Exit Fast.

Share Price 107p (-9.78%)

Remote Gaming Duty (RGD) to spike to 40% is an Omega Disaster for profitability.

The £46m cost wipes out the £25m UK Digital profit,

Duty hike must urgently be reviewed before it pushes users to the black market.

No position but think

Quietly Exit Fast.

Share Price: 140p (-2.5%)

H1 today and broadly solid, but the real story for me is my renewed confidence in mgmt.

Taken the opportunity to buy-in big!

Not expecting instant fireworks,

Can see the makings of future good dividends and capital gains.

Getting towards a core holding!

Share Price: 140p (-2.5%)

H1 today and broadly solid, but the real story for me is my renewed confidence in mgmt.

Taken the opportunity to buy-in big!

Not expecting instant fireworks,

Can see the makings of future good dividends and capital gains.

Getting towards a core holding!

Share Price: 21.58p (-0.55%)

Q3 trading update and mgmt webcast disappointing.

Mgmt seem reactive, cost cuts urgent, leverage high, contracts restrictive.

Risk/reward profile unclear—appealing mainly to investors who thrive on risk.

Recovery looks distant

No return ticket up as yet!

Share Price: 21.58p (-0.55%)

Q3 trading update and mgmt webcast disappointing.

Mgmt seem reactive, cost cuts urgent, leverage high, contracts restrictive.

Risk/reward profile unclear—appealing mainly to investors who thrive on risk.

Recovery looks distant

No return ticket up as yet!

Share Price 52.4p

H1 FY26 in image below!

Consensus market expectations for FY26 of revenue of £650m and adjusted EBITDA before SBP of £52.25m

Spreading risk into slow mover near bottom of a cycle.

Buillt my Core Holding here, cheaply brick by brick

Adding today 10% more!

Share Price 52.4p

H1 FY26 in image below!

Consensus market expectations for FY26 of revenue of £650m and adjusted EBITDA before SBP of £52.25m

Spreading risk into slow mover near bottom of a cycle.

Buillt my Core Holding here, cheaply brick by brick

Adding today 10% more!

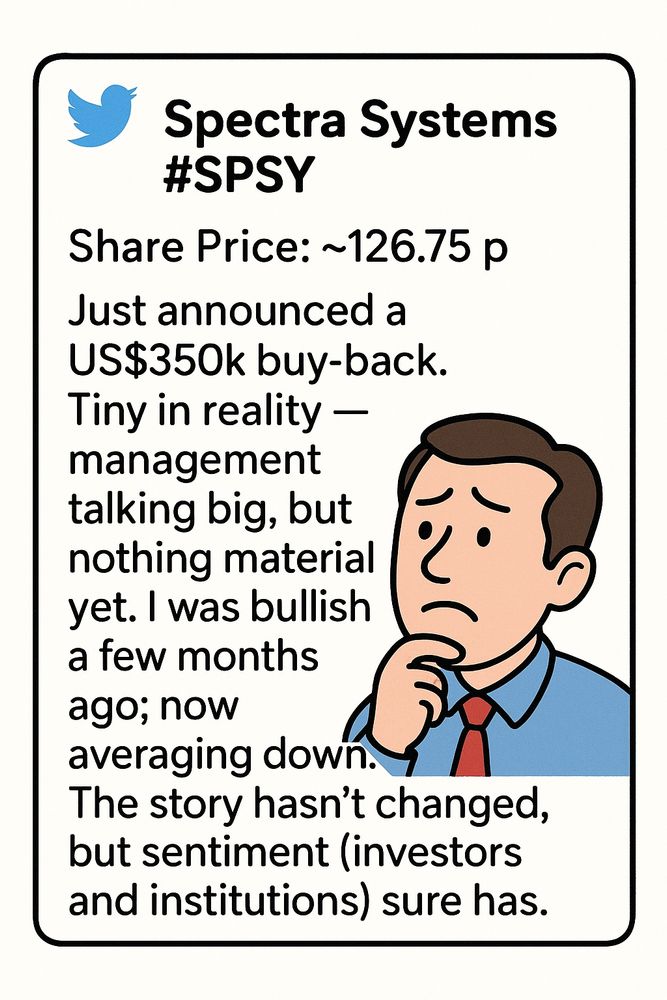

Share Price 126.75p (-1.36%)

The story hasn’t changed lately, but the sentiment has!

Do institutions have any concerns on mgmt's ability to deliver on existing contracts on time and on budget?

Enough time remains to win new contracts.

Thinking risk/reward on my side.

A Buy

Share Price 126.75p (-1.36%)

The story hasn’t changed lately, but the sentiment has!

Do institutions have any concerns on mgmt's ability to deliver on existing contracts on time and on budget?

Enough time remains to win new contracts.

Thinking risk/reward on my side.

A Buy

Share Price 59.45p (-5.03%)

Not trading weakness. Hmm...

It’s the drawn-out legal fight with the founder. A £320m claim, plus a likely Buddi settlement, weighs heavily.

Others selling at these lows, suggests they know something I don't.

Bought when <80p

Now averaging down

Share Price 59.45p (-5.03%)

Not trading weakness. Hmm...

It’s the drawn-out legal fight with the founder. A £320m claim, plus a likely Buddi settlement, weighs heavily.

Others selling at these lows, suggests they know something I don't.

Bought when <80p

Now averaging down

Share Price 132.25p (+4.18%) 📈

New Q3 contract wins & renewals totalling $4.2 m+.

Has disappointed as Retail Investors bought into the hype and held.

Any growth still feels more “small business potential” than breakout scale.

Mgmt haven't delivered as hoped!

Not4Me

Share Price 132.25p (+4.18%) 📈

New Q3 contract wins & renewals totalling $4.2 m+.

Has disappointed as Retail Investors bought into the hype and held.

Any growth still feels more “small business potential” than breakout scale.

Mgmt haven't delivered as hoped!

Not4Me

Share Price (pre-open): 292p

Q3 results out this morning. Trading steady in core categories, but big-ticket remains soft.

Positive outlook commentary is the key focus now as the market gauges the full-year path.

Yes, a bit boring but I will add on open.

A Core Holding!

Share Price (pre-open): 292p

Q3 results out this morning. Trading steady in core categories, but big-ticket remains soft.

Positive outlook commentary is the key focus now as the market gauges the full-year path.

Yes, a bit boring but I will add on open.

A Core Holding!

Share price $16.60(+23%)

Surge is driven by a Politico report on the potential 2-year extension of Obamacare subsidies.

Huge plus for ACA marketplace insurers like Oscar Health. Analysts forecast strong future revenue & earnings growth,

On FOMO, I've bought a new position!

Share price $16.60(+23%)

Surge is driven by a Politico report on the potential 2-year extension of Obamacare subsidies.

Huge plus for ACA marketplace insurers like Oscar Health. Analysts forecast strong future revenue & earnings growth,

On FOMO, I've bought a new position!

Share Price $44.37 (-6.84%)

I added here today on a falling share price knife. Hmm... Maybe too quick.

Poor or bad news for $NVO hitting the market with regularity.

Upside on earnings growth seems complicated and further away.

A cheaper SP as Risk/Reward Price being reset.

Share Price $44.37 (-6.84%)

I added here today on a falling share price knife. Hmm... Maybe too quick.

Poor or bad news for $NVO hitting the market with regularity.

Upside on earnings growth seems complicated and further away.

A cheaper SP as Risk/Reward Price being reset.

Share Price: $44.22 (-7.2%)

A sharp fall today as the Alzheimer’s trial for oral semaglutide failed to show real clinical benefit.

Investors had hoped for a major new use-case beyond diabetes and obesity.

Miss has knocked confidence hard!

Average Down Slowly.

Let market guide!

Share Price: $44.22 (-7.2%)

A sharp fall today as the Alzheimer’s trial for oral semaglutide failed to show real clinical benefit.

Investors had hoped for a major new use-case beyond diabetes and obesity.

Miss has knocked confidence hard!

Average Down Slowly.

Let market guide!

Share Price: $83.87

SP wobble after EU AI pay case (WIE) raises concerns.

Mobility margins may be peaking

AV investments remain long-term bets

Q3 growth is strong, but caution weighs on sentiment

A challenge due to increased costs and uncertainty

Risk profile is up, but I've Added.

Share Price: $83.87

SP wobble after EU AI pay case (WIE) raises concerns.

Mobility margins may be peaking

AV investments remain long-term bets

Q3 growth is strong, but caution weighs on sentiment

A challenge due to increased costs and uncertainty

Risk profile is up, but I've Added.

Share Price $14.92 (-90c) -5.6%

Feeling the chill from a softening South American backdrop

SP under pressure as Brazil’s outlook cools. Investors reassess the risk

Weak growth, stubborn rates, and a wary market — not the mix the bulls wanted

Market overreacting?

I've bought here!

Share Price $14.92 (-90c) -5.6%

Feeling the chill from a softening South American backdrop

SP under pressure as Brazil’s outlook cools. Investors reassess the risk

Weak growth, stubborn rates, and a wary market — not the mix the bulls wanted

Market overreacting?

I've bought here!

Share Price: 265p (up ~27%)

I've already exited!

Became suspicious of SP falling and staying lower. Oops!

Mgmt always talked big, and I began to doubt it — so today could be a change as investors see the outlook more positive.

I'm left behind.

Had bought IG Group #IGG instead.

Share Price: 599p (–1.6%)

Finally a chance to clean up the mess in both the UK and US operations.

“one-offs” dragged on far too long. Averaging down hasn’t been ideal

Fresh leadership and cleaner books might steady things.

Let’s hope nothing worse turns up.

Stubbornly adding!

Share Price: 599p (–1.6%)

Finally a chance to clean up the mess in both the UK and US operations.

“one-offs” dragged on far too long. Averaging down hasn’t been ideal

Fresh leadership and cleaner books might steady things.

Let’s hope nothing worse turns up.

Stubbornly adding!

Share Price 3725p (-1.59%)

Over 5 years...

Lion Finance #BEO rose +671%

whereas TBC Group #TBCG only rose 235%.

I've added #TBCG again, expecting management to improve returns to match those of Lion Finance (formerly Bank of Georgia).

A Core Holding in both.

Little diversification!