𝙄𝙣𝙛𝙡𝙖𝙩𝙞𝙤𝙣: We follow two measures of inflation:

1/4

𝙄𝙣𝙛𝙡𝙖𝙩𝙞𝙤𝙣: We follow two measures of inflation:

1/4

* Deliveries month to date: 4.5

* Not in ANS service: 1 (HIL maint.)

* Asia: 0

* USWC: 9 (5 CP, 2 HIL, 2 XOM) in runs

* Deliveries month to date: 4.5

* Not in ANS service: 1 (HIL maint.)

* Asia: 0

* USWC: 9 (5 CP, 2 HIL, 2 XOM) in runs

Also, Permanent Fund Corp: 60+ days after the close of 1Q 2026, and they STILL haven't reported the Management Fees paid for that quarter. ( 🤫 ... maybe they'll forget.) 🙄🙄

#akleg

Also, Permanent Fund Corp: 60+ days after the close of 1Q 2026, and they STILL haven't reported the Management Fees paid for that quarter. ( 🤫 ... maybe they'll forget.) 🙄🙄

#akleg

1/2

1/2

* 5-yr: S&P 13.18% v PFC 9.59%

* 3-yr: S&P 19.77% v PFC 9.76%

* 1-yr: S&P 13.09% v PFC 11.51%

1/6

1/6

* 5-yr: S&P 13.14% v PFC 9.59%

* 3-yr: S&P 18.97% v PFC 9.76%

* 1-yr: S&P 12.66% v PFC 11.51%

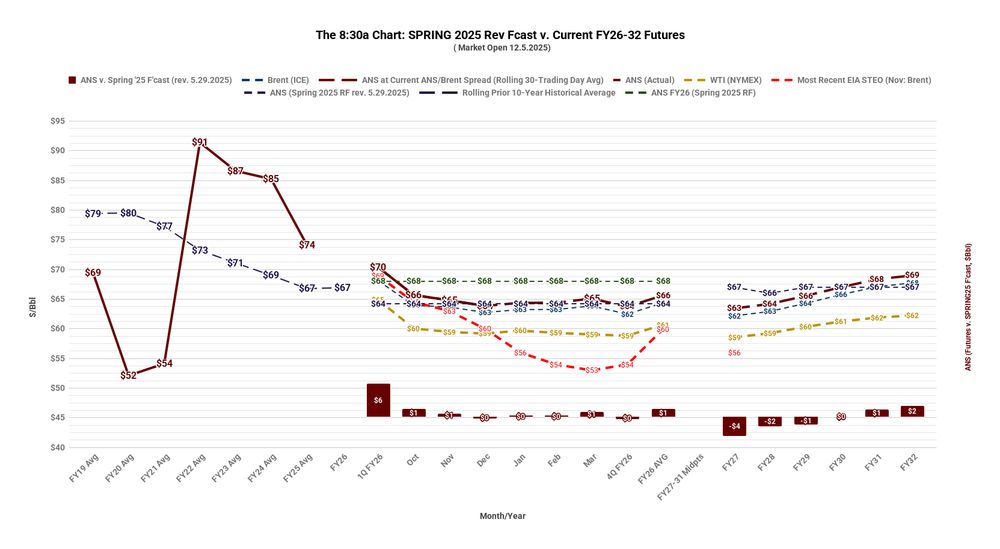

> FY26 ⬆️ $1 (+$83mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg

> FY26 ⬆️ $1 (+$83mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg

First, we chart YTD $$oil + the outlook from the current futures mkt v. DOR's most recent 10-year rev f'cast. Futures: near (⬇️ $2), mid (even) & long-term (⬇️ $1) v. SPRING25 F'cast (rev).

1/2

First, we chart YTD $$oil + the outlook from the current futures mkt v. DOR's most recent 10-year rev f'cast. Futures: near (⬇️ $2), mid (even) & long-term (⬇️ $1) v. SPRING25 F'cast (rev).

1/2

* 5-yr: S&P 13.31% v PFC 9.59%

* 3-yr: S&P 18.93% v PFC 9.76%

* 1-yr: S&P 13.22% v PFC 11.51%

> FY26 ⬆️ $1 (+$66mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg

> FY26 ⬆️ $1 (+$66mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg

Using the prior yr's production profile as a baseline, the first charts YTD production levels compared w/the most recent F'cast (now SPRING25). W/42% of FY26 done, YTD avg (red) running -14kbd (-3%) v. F'cast.

1/2

Using the prior yr's production profile as a baseline, the first charts YTD production levels compared w/the most recent F'cast (now SPRING25). W/42% of FY26 done, YTD avg (red) running -14kbd (-3%) v. F'cast.

1/2

YTD 2025 avg USWC (approx % of pre (2019)- and post (2022)-COVID levels):

> Crude demand: 85% & 94%;

> Domestic share: 76% & 88%.

#akleg

YTD 2025 avg USWC (approx % of pre (2019)- and post (2022)-COVID levels):

> Crude demand: 85% & 94%;

> Domestic share: 76% & 88%.

#akleg

* 5-yr: S&P 13.23% v PFC 9.59%

* 3-yr: S&P 18.81% v PFC 9.76%

* 1-yr: S&P 12.94% v PFC 11.51%

> FY26 ⬆️ $1 (+$58mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg

> FY26 ⬆️ $1 (+$58mil UGF)

> FY27 ⬇️ $4 (-$133mil)

> FY28-32 even (avg annual $0mil)

#akleg