Harvir Dhillon

@harvirdhillon.bsky.social

310 followers

130 following

440 posts

Economist at the British Retail Consortium 🛍️

UK macro, retail and #costofliving 📈👨🏽💻🇬🇧

Opinions my own etc

Formerly Experian

Leicestershire, United Kingdom 🦊

Posts

Media

Videos

Starter Packs

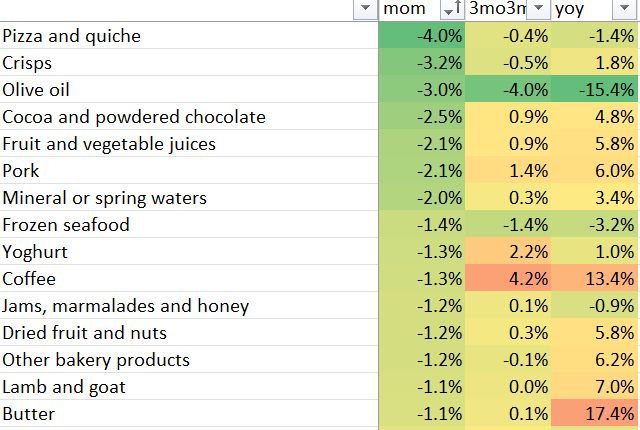

Surprise drop in food prices means that the CPI remains unchanged at 3.8%. This is the first monthly decrease in food prices since May 2024.